KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Tuesday suggested three key points for tax reforms in the country.

(more…)Tag: FPCCI

-

Raising interest rate will not help in curtailing inflation: FPCCI

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) has lambasted the central bank for raising interest rate to 17 per cent and said it will not help in curtailing inflation.

(more…) -

Documentation must to bridge fiscal deficit: FPCCI

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Wednesday said that documentation of economy is a must to bridge fiscal deficit.

(more…) -

FPCCI warns black economy to boost on high interest rate

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) has warned the government that industry will opt black economy as formal banking channels are out of reach due to high interest rate.

(more…) -

Dollar crisis: SBP striving to clear 11,000 import payment pending cases

KARACHI: Facing acute shortage of US dollar, the State Bank of Pakistan (SBP) is striving to clear 11,000 import payment pending cases, said SBP governor Jameel Ahmad on Wednesday.

(more…) -

Pakistan Customs to launch module to link international prices for updated valuations

KARACHI: Pakistan Customs is set to launch a module which will link with the international markets to reflect updated prices for making accurate customs valuations.

(more…) -

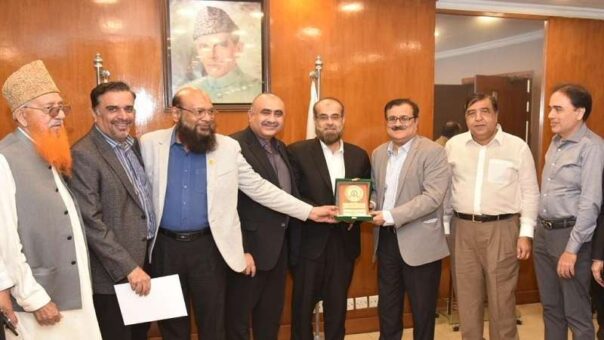

FPCCI, BoI to launch Invest Pakistan initiative

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) and Board of Investment (BoI) have agreed to form a Joint Consultative Working Group to help constitute and effectively operationalize an independent body called Invest Pakistan under the leadership of Prime Minister through Prime Minister’s Office (PMO).

READ MORE: Over 400 vegetable containers stuck up at ports due to dollar shortage

According to a statement issued on Monday, FPCCI President Irfan Iqbal Sheikh apprised that Invest Pakistan will ensure the policy advocacy initiatives with the support and full-backing of private-sector to promote and facilitate FDI in Pakistan. We have decided to lend a helping hand to make this initiative a success story in the broader national interest, he added.

READ MORE: FPCCI demands release of soybean, canola cargoes

FPCCI Chief added that he has liked the initiative as its concept note entails giving up to 80 percent representation to private-sector on Invest Pakistan board and 51 percent equity or shareholding to private-sector. However, the exact modalities and ToRs will be worked out when the meetings of the working group take place, he added.

Suleman Chawla, SVP FPCCI, who co-chaired the meeting with Ms. Ambreen Iftikhar, Additional Secretary BoI, at the FPCCI Head Office, explained the Public-Private Partnership (PPP) frameworks have proven to be most successful the world over – be it promoting FDI or enticing private-sector investments. He added that PPP mechanism ensures first-hand knowledge and expertise on a sectorial-level from the business, industry and trade community.

READ MORE: KATI urges removal of regulatory duty on yarn

Ms. Ambreen Iftikhar outlined the objectives of Invest Pakistan intuitive as: (i) develop a new and innovative private partnership to facilitate, promote and convert FDI (ii) possibility of joint equity of Invest Pakistan between public and private sectors (iii) seat on the policy negotiation and decision-making forums to avoid disconnect between government institutions and the business community (iv) joint targeting of investment and customized resolution of binding constraints (v) Brand Pakistan through actual investment successes rather through verbose material.

READ MORE: Pakistan slaps 5pc regulatory duty on yarn import

It is pertinent to note that apart from its President and SVP, FPCCI has nominated three other of its prominent members to Joint Consultative Working Group; namely, Mian Nasser Hyatt Maggo, immediate past President FPCCI; Mr. Amjad Rafi, Chairman of Pakistan-Turkiye Joint Business Council of FPCCI and Mr. Jawaid Ilyas, Chairman of Pakistan-China Business Council of FPCCI.

-

SRB says cases worth Rs 80 billion stuck in litigation

KARACHI: Sindh Revenue Board (SRB) Friday said that cases worth Rs80 billion were stuck in litigation and it is willing to resolve amicably.

SRB chairman Dr. Wasif Ali Memon highlighted that Rs80 billion worth of cases are stuck in litigation and the provincial revenue board is all-willing to resolve as many cases amicably as possible.

READ MORE: Customs appraising officer awarded major penalty for inefficiency

“We want to be the facilitators and partners to the business community and no highhandedness is ever desired by SRB,” he added during his visit to Federation of Pakistan Chambers of Commerce and Industry (FPCCI).

On the demand of FPCCI, Dr. Wasif Ali Memon announced that an effective and inclusive Alternative Dispute Resolution Committee (ADRC) would be formulated by SRB in few weeks and we will include 5 – 6 nominees of FPCCI into the committee.

READ MORE: Further tax collection on pharmaceutical products unlawful: KTBA

Chairman SRB also proposed that FPCCI nominees should come from varied sectors to address issues of all the sectors. Additionally, he requested the business community to exhaust the ADRC and other SRB procedures before going into litigation as it only delays the dispute resolution.

On the occasion, Irfan Iqbal Sheikh, President FPCCI, has stressed upon the need to strengthen and broaden the scope of ADRC to save the precious time, resources and hassle of both the sides, i.e. business community and the SRB.

Co-chairing the high-profile meeting with SRB Chairman, Suleman Chawla, SVP FPCCI, offered to nominate technical and expert members of the business, industry and trade community from the platform of FPCCI to facilitate SRB’s efforts to strengthen ADRC.

READ MORE: Non-filers will not be included in ATL 2022

FPCCI nominees will come with the first-hand knowledge of real issues and with deep understanding of the taxation matters, he added.

Shabbir Mansha, VP FPCCI, demanded that as Karachi contributes the lion’s share of taxes in federal & provincial authorities, there should be an enhanced focus on the infrastructural development of Karachi – specifically in industrial& commercial areas and port infrastructure. This will only increase the revenue generation from Karachi, he added.

READ MORE: FBR directs BS-21 officers to submit declaration of assets

Shuakat Omerson, VP FPCCI, apprised the top management of SRB that many members of FPCCI are qualified in alternative dispute resolution mechanism; including the incumbent and former office bearers of FPCCI; and, they can offer great support to SRB’s ADRC initiatives.

Khurram Ejaz, Advisor to the President of FPCCI on FBR & revenue matters, said that FPCCI considers SRB as their partners and not as adversaries; because objectives of both the institutions are same – economic development of the province and resolution of all disputes & anomalies pertaining to provincial tax collection.

-

FPCCI demands release of soybean, canola cargoes

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Monday demanded the government to release the consignments of soybean and canola cargoes at the earliest.

In different communications sent to the Prime Minister, the finance minister and the commerce minister, the apex trade body informed that soybean seed was a major raw material for the different industries in Pakistan.

READ MORE: KATI urges removal of regulatory duty on yarn

Initially it has been used for oil extracting industry for the production of oil purpose then its residual is used in the feed of animals because it is protein rich substance. In poultry industry it has been used as feed.

If the supply of this raw material is stopped or delayed then the industries which are directly attached with the poultry industry like hatching industry and feed mills may also suffer and as a result of this millions of people will lose their jobs.

READ MORE: Pakistan slaps 5pc regulatory duty on yarn import

“It is also used in the feed of cows, goats and buffalos in this connection the Halal industry of Pakistan will also be hurt by this decision,” the FPCCI added.

The soybean and canola cargoes are stuck up at port area Karachi due to restriction of PPRO organization which comes under the ministry of food security. The ministry has stopped the consignments on the arguments that the goods are GMO Seeds with the apprehension which may cause cancer to humans.

“Whereas the industry has a point of view that it only happens when it is used in sowing purpose and in Pakistan it is only used in oil extracting and feed industry,” the FPCCI informed.

READ MORE: Industries threaten mass protest against gas supply shutdown

The cargoes are under heavy demurrage and detention since their arrival and adding cost to the miseries of stakeholders. It is pointed out that soybean meal is an ingredient which contributes 15-20 per cent of used in the industry.

Soybean is termed as to contain the highest crude protein content to the extent of 44 per cent which contributes to reasonable yield in milk production.

It is to record that soybean is being imported in the country since last many years and widely traded commodity. However, its clearance is at halt for the reasons best known to the hierarchy. “The situation is causing cancellation of market commitment and contracts escalating the cost of doing business,” it added.

READ MORE: Member Customs assures swift clearance of export consignments

On the other hand its substitute i.e. canola meal is also being treated on the same line and consignments are pending clearance at the port.

The FPCCI of the view that if such practices are carried on and the consignments are stuck up at the port, the situation will result in shortage of poultry, meat and dairy items are the basic commodities which has a routine use in daily life,

FPCCI is analyzing the situation seriously, and strongly recommended that immediate relief to the stakeholders may be granted before the situation gets out of control.

-

No tax amnesty, no tax rate cut under IMF program: FBR chief

KARACHI: The chairman of Federal Board of Revenue (FBR) Asim Ahmad on Saturday said that under ongoing program of the International Monetary Fund (IMF) the government committed for not granting any tax amnesty scheme and no tax rate cut.

FBR chief was talking to business community at the Federation of Chamber of Commerce and Industry (FPCCI) during his visit to the Federation House.

READ MORE: FBR may withdraw condition of invoice, packing list in containers

He said that the government had agreed with the IMF for neither allow any tax amnesty nor allow tax rate cut under the loan program. “Therefore, all the stakeholders have to work together on the policy,” he added.

The chairman admitted that under imports under Chapter 84 and 85 of Customs Act, 1990 was problem not only for the business community but it was also for the tax authorities as well. “Hopefully this issue will be resolved very soon,” he assured the business community.

READ MORE: Customs Enforcement announces auction of vehicles on Nov 09, 2022

Asim Ahmed said that FBR never wanted to stop the clearance of parts and machinery. “Because industrial activity ensures revenue collection for the country,” he added.

The chairman said that tax officials were in touch with the business community to resolve the issues.

He said that tax reform commission had started its work soon after Ishaq Dar assumed as the finance minister. The chairman also informed that the tax audit would be conducted once in four year.

READ MORE: FBR auctions confiscated immovable properties on Nov 15, 2022

The chairman said that the retailer and wholesaler sectors were not filing income tax returns, which was main hindrance in identifying true income. He said by enforcing the relevant tax laws on retail sector there was revenue potential of Rs20 billion. In contrast the tax authorities were able to collect only Rs6 billion from this sector.

READ MORE: FBR issues circular to relax income tax return filing deadline

On the occasion, Suleman Chawla, senior Vice President of the FPCCI said that business community was uncomfortable on the issues of return filing and selection of audit. These issues should be resolved on priority.