KARACHI: Housing and construction finance outstanding increased by Rs111 billion or 75 per cent during fiscal year 2020/2021 over the preceding fiscal year, reaching Rs259 billion by end of June 2021.

An increase of this quantum in housing and construction finance in one year is unprecedented in Pakistan’s history. As a result, 97 per cent of the overall target set by State Bank of Pakistan (SBP) for June 30, 2021 was met.

Governor SBP Dr. Reza Baqir presented this information on unprecedented growth in housing and construction finance to the Prime Minister a day earlier in a meeting of the National Coordination Committee on Housing, Construction and Development (NCCHCD) chaired by the Prime Minister.

The meeting was attended by the Federal Ministers for Finance, Information, Aviation, and Climate Change, Chairman NAPHDA, State Minister for Information & Broadcasting, SAPM on Political Communication, Presidents/CEOs of banks and senior SBP officials.

The Prime Minister appreciated that efforts of SBP have been successful in stimulating the housing and construction finance in the country, which was hitherto a neglected area within commercial banks.

The Prime Minister expressed the strong resolve of the government to accelerate activity in this area and encouraged banks to continue to support this area of economic activity and especially to facilitate customers interested in availing the government’s mark-up subsidy scheme for housing.

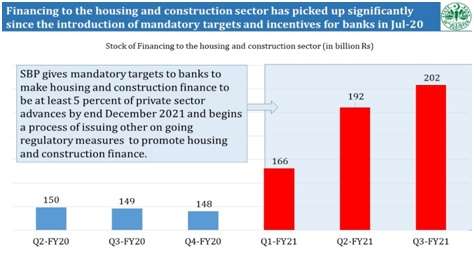

In July, 2020, the State Bank, in line with Government’s vision to promote the housing & construction sector activities and improve home ownership in the country, mandated banks to increase their housing and construction finance portfolio to at least 5 percent of their private sector advances by December 2021. Accordingly, the SBP set quarterly targets with the mutual consent of Presidents/CEOs of banks supported by an incentive and penalty framework to motivate banks to achieve these goals.

Governor SBP, Dr Reza Baqir, also shared that in addition to strong growth in construction & housing finance, banks have started to extend housing finance under Government Markup Subsidy Scheme, commonly known as Mera Pakistan MeraGhar (MPMG), for the low to middle income segments of the society. Provision of housing finance to such segments of society is also unprecedented in Paksitan’s history.

In April 2021, banks were given separate targets under MPMG to induce them to grow this segement of housing finance. Consequently, the number of applications increased significantly and the amount of loans applied for more than doubled in the last quarter of FY21 to Rs111 billion. As of June 30, 2021, banks have approved home financing worth Rs39 billion.

Governor SBP also informed the Prime Minister that following his instructions to facilitate the public as much as possible, a simple one page application form has been designed separately for salaried persons, businessmen and applicants with informal income to apply for such housing finance.

In order to facilitate applicants with informal income, some very basic personal information, and payment information about house rent, utilities & children education will be required. Forms will be available both in English and Urdu by end July 2021.

While appreciating the SBP efforts to bring ease for borrowers through simple application form and processes, the Prime Minister voiced expectation that banks’ portfolio must show strong growth in disbursements in the coming days.

To facilitate access to home finance especially within lower and middle income groups, State Bank’s key initiatives include allowing acceptance of third party guarantee during the construction period, waiver of Debt Burden Ratio (DBR) in case of informal income and the introduction of standard facility offer letter by the banks. State Bank has also advised banks to develop and deploy income estimation models for borrowers with informal sources of income. In addition to gauge readiness, knowledge and appropriate behavior of banking staff towards MPMG customers, regular mystery shopping of banking branches on a pan Pakistan basis is conducted by State Bank.

In addition to State Bank’s dedicated online portal for the registration of complaints by MPMG customers, commercial banks have also established a 24/7 joint helpline to address the queries of general public regarding MPMG. Customers of MPMG can reach out to this helpline at 0-33-77-786-786.