Karachi, February 20, 2026 – Khurram Ijaz, General Secretary of the Businessmen Panel Progressive (BPP) and former vice president of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI), has expressed serious concern over a sharp decline in foreign direct investment (FDI), urging the government to adopt consistent and business-friendly economic policies.

(more…)Tag: investment

-

Nestlé pledges $60 million additional investment in Pakistan

Islamabad, January 22, 2026 – Global food and beverage giant Nestlé on Thursday announced a further $60 million investment in Pakistan, reaffirming its long-term commitment to the country.

(more…) -

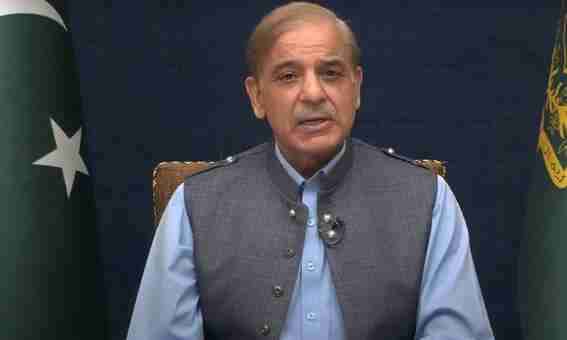

PM Shehbaz forms high-level committee for investment protection

Islamabad, April 24, 2025 — In a strategic step aimed at enhancing investor confidence and improving the business climate, Prime Minister Shehbaz Sharif has established a high-level committee to develop a comprehensive legal framework for the protection of investment in Pakistan.

(more…) -

Lowering Tax Rates Essential for Investment Growth: FCCI

Faisalabad, February 8, 2025 – The Faisalabad Chamber of Commerce and Industry (FCCI) has reiterated its call for reducing tax rates to attract both local and foreign investment, emphasizing that a lower tax burden is crucial for economic growth and development.

(more…) -

Pakistan to Gain from 800 Global Investments: Minister

Karachi, August 12, 2024: In a significant boost to international economic presence of Pakistan, Federal Minister for Commerce Jam Kamal Khan announced on Sunday that 800 companies from 70 countries are set to invest in the country. This influx is anticipated to enhance Pakistan’s stature in global markets, according to a press release issued by the ministry.

(more…) -

Pakistan, Azerbaijan Aim for $2 Billion Investment Boost

Pakistan and Azerbaijan pledged to significantly strengthen their economic ties, aiming for a combined investment of US$2 billion in mutually beneficial projects. This ambitious target was announced by Pakistani Prime Minister Muhammad Shehbaz Sharif during a joint press conference with Azerbaijani President Ilham Aliyev on Thursday.

(more…) -

Lamaison Developers Proposes Investment for Completion of Islamabad City Master Plan

Lamaison Developers Pvt Ltd., a real estate investor, has presented an investment proposal to complete the Islamabad City master plan based on the 1960 development plan.

(more…) -

Jazz invests Rs14.9 billion during first quarter

KARACHI: Jazz has invested PKR 14.9 billion under its ‘4G for all’ ambition during the first quarter of 2022, taking its overall investment in Pakistan to US$10.2 billion, according to a statement on Thursday.

A majority of its capital expenditure during this quarter was on the addition of approximately 500 new 4G sites, reaching a population coverage of its 4G service to 55.7per cent.

READ MORE: Jazz recognized for driving change beyond workplace

This network expansion played a key role in increasing Jazz’s 4G customer base by 27.8 percent YoY to reach 36.7 million while its overall subscriber base touched close to 75 million.

The performance of its digital services during the quarter solidified Jazz’s position as the country’s leading digital operator. Its digital financial service, JazzCash, reached 15.7 million monthly active users and 145, 000 active merchants. Its self-care app, Jazz World, continued to enjoy strong customer adoption levels with monthly active users growing by 23.1per cent YoY to reach 10.5 million.

READ MORE: Jazz Digital Park inaugurated in Islamabad

Jazz CEO Aamir Ibrahim, said, “We are continuously investing in expanding the outreach and capacity of our 4G network mainly in semi-urban and rural areas to empower the underserved, especially women, to benefit from the digital services portfolio we offer.

READ MORE: Jazz’s investment in Pakistan crosses $10 billion

“Jazz remains committed to addressing the barriers to an inclusive digital ecosystem, including device affordability, so our fellow citizens can access health, financial, and other life-enhancing services through mobile broadband.”

Other streaming and entertainment platforms such as Tamasha, Bajao, Jazz Cricket, and Deikho, also enjoyed further growth as their quarterly usage increased multiple times YoY.

-

PKIC to make Rs500 million investment in Planet N

KARACHI: Pakistan Kuwait Investment Company (Private) Limited (PKIC) announces that it is making an equity investment of Rs500 million in Planet N (Private) Limited. This is the largest equity investment by a local Financial Institution in a Tech Investment Platform in Pakistan. It was approved by the Board of PKIC in December, 2020.

This investment will help Planet N expand its operations and will also motivate other investors to explore opportunities to develop and strengthen tech entrepreneurship and disruption in the country.

With total assets of over rs107 billion and equity of over Rs38 billion, PKIC is Pakistan’s leading DFI engaged in investment and development financing activities in the country. PKIC was established as a joint venture between the Governments of Pakistan and Kuwait in 1979. It is a “AAA” (Triple A) rated financial institution.

Planet N has invested and nurtured tech start-ups such as Tapmad TV, Dawaai.pk, PublishEx, Tez Financial Services, Datalift, PiePie, Kashat, JinglePay, etc. spread across various jurisdictions including Pakistan, UAE, Egypt, Singapore and USA. It currently has more than 30 companies in its portfolio focusing on financial inclusion, fintech, digital media, data science & AI. This portfolio is expected to grow further after the equity investment by PKIC.

Speaking on the occasion of the signing ceremony, MD PKIC Mubashar Maqbool expressed his elation at this investment by PKIC and stated that PKIC has a firm desire to support all priority sectors of the economy, especially the growing technology sector, by providing traditional as well as innovative financing solutions to its prospective customers.

Maqbool hoped that this landmark investment should inspire other players, investors, family business houses, and investment companies to do the same and would also encourage the young entrepreneurs in the tech sector.

CEO Planet N Nadeem Hussain said he has always tried to encourage local investors to aid young entrepreneurs with innovative ideas. His initial investment in tech companies has seen exponential gains and he hopes that having PKIC as an equity partner will initiate a big disruption in the local- investors- horizon and their approach towards tech-based investments.

Irfan Siddiqui, CEO and President Meezan Bank Ltd, chief guest to the occasion said that this is one of its kind investment by a local DFI into a Tech disruption investment company paving the way for further investment by other financial institutions that will help tech start-ups in Pakistan.

Also, present on the occasion were Ariful Islam, Deputy CEO Meezan Bank Ltd, Khurram Hussain, MD Pak Libya Holding Co. and senior management from PKIC, Planet N, and Arif Habib Limited (AHL). AHL acted as the Financial Advisor to this landmark transaction.

Planet N was founded by Nadeem Hussain in 2016; with a vision to invest in growth oriented hi-tech companies. Hussain is the founder and ex-CEO of Telenor (previously Tameer) Microfinance Bank.

-

SBP allows investment abroad by resident individuals, companies

KARACHI: The State Bank of Pakistan (SBP) on Wednesday allowed resident Pakistani individuals and companies to make equity-based investment in entities abroad on repatriable basis.

The central bank issued FE Circular No. 01 dated February 10, 2021 under which the residents of Pakistan including firms and companies are allowed to make equity-based investment in entities abroad on repatriable basis, subject to the following terms and conditions and in the manner stipulated below:

I. Basic Terms and Conditions:

Following basic terms and conditions will apply to all categories of investment abroad:

1. Investment abroad is allowed only for those countries that allow repatriation of profits, dividends and capital. However, equity investment in India, shall be subject to prior approval of SBP.

2. The funds proposed for investment should be legitimate and tax paid, and the investor should have a clean record of loan repayments.

3. No ML and TF related investigation is pending against the applicant or its beneficial owner/key management personnel under Anti Money Laundering Act, 2010 or Anti-Terrorism Act, 1997 as amended from time to time.

II. Category-wise specific Terms and Conditions:

Following terms and conditions will apply specifically to each category of Investment abroad:

A- Establishment of subsidiary/branch office abroad by export oriented companies/firms for promoting exports:

a. In order to facilitate the companies/firms incorporated/registered in Pakistan, in increasing exports of the country by expanding their business offshore, designated Authorized Dealers are granted general permission to allow the following equity investment abroad transactions:

i Establishment/acquisition of subsidiary and additional capital injection in subsidiary.

ii. Establishment/acquisition of marketing/ liaison/ representative office abroad and remittance of their annual budgeted operational expenses.

b. However, this general permission is subject to following terms and conditions:

i. Total amount of remittance during a calendar year, under this general permission, should not exceed the 10% of average annual export earnings of last three calendar years of the applicant, or USD 100,000 whichever is higher. Authorized dealer can also open standby letter of credit to facilitate the offshore entity of the applicant for raising funds from offshore jurisdiction, within this limit.

ii. At any point of time, investment abroad of the applicant should not exceed 80% of its equity (after adjusting for investments in subsidiaries/ associates, goodwill, Deferred Tax Assets, receivables from related entities etc.).

iii. Transactions shall be carried out by the exporter by utilizing foreign currency funds available to the credit of special foreign currency accounts maintained in terms of applicable Foreign Exchange Regulations. However, if the balance available in its special foreign currency accounts is not sufficient, remittance of balance amount can be allowed from interbank market.

iv. The export overdue of intending investor shall not be more than 1% of the previous year’s exports.

v. The threshold of up to USD 30,000 shall be observed for allowing annual budgeted operational expenses of a marketing/ liaison/ representative office from second year onward (from date of investment). However, an increase of up to 10% may be allowed in annual budgeted operational expenses in the following years subject to valid justification of increase in expenses by the applicant.

vi. One entity per jurisdiction shall be allowed for establishment/ acquisition of subsidiary/ marketing/ liaison/ representative office abroad.

vii. The designated Authorized dealer shall ensure the following through assessment of relevant information/documents submitted by the applicant, before allowing the transaction under this general permission:

a. In case applicant’s export earnings during last three calendar years is less than USD 300,000 or equivalent in other currencies, the Authorized dealer shall obtain details of products to be exported by the applicant and an undertaking that proposed investment has the potential to increase the exports of Pakistan.

b. The business activity of the company, firm in which investment is desired to be made should ordinarily be of the same nature as that in which the applicant is already engaged in Pakistan. Proposal for investment abroad in the extended line of business or vertical business integration shall also be considered as similar line of business.

c. The investor should be financially sound as shown by its audited accounts for the last three years. In the case of a company in the I.T. business, the condition of three years may be reduced to one year.

d. The bonafides of the applicant and the genuineness of the transaction by verifying the necessary documents.

e. In case of acquisition of subsidiary abroad, the Authorized Dealer shall allow the transaction after satisfying itself with respect to valuation of the company being acquired. In case the target company is unlisted, and the amount of investment is above USD 1 million, the Authorized dealer may allow the transaction after satisfying itself through a valuation report from an accredited business valuation firm of the country in which investment is to be made.

f. While assessing any request for establishment/acquisition of subsidiary or marketing/ liaison/ representative office abroad, due weightage shall be given to the performance of previous investments abroad, if any, in terms of profit repatriation, increase in exports etc.

g. In case of additional capital injection in subsidiary, due weightage shall be given to its previous performance as well as future outlook.

B- Establishment of Holding Company (HoldCo) abroad by residents for raising capital from abroad:

a. In order to facilitate the resident companies (hereinafter referred as Operating Company or “OpCo”), having innovative and/or scalable businesses with a potential for high growth, to raise capital from abroad, following general permissions are granted:

i OpCo is allowed to incorporate a holding company (hereinafter referred as “HoldCo”) abroad. For this purpose, designated Authorized dealers are allowed to remit the initial incorporation expenses, on actual basis but not exceeding USD 10,000 or equivalent in other currencies, subject to condition that the applicant company is eligible as per terms and conditions.

ii After incorporation of the HoldCo abroad, the existing shareholders (individuals/ companies/ firms) of OpCo (“Founders”) are once allowed to swap their shares, of equal value, to mirror the shareholding of OpCo in HoldCo, within 30 days, by acquiring shares of HoldCo against transfer of their shareholding in OpCo to the nonresident HoldCo on repatriation basis. However, no remittance in this regard shall be allowed from Pakistan.

iii Subsequently, resident companies/firms and Founders are allowed to acquire the shares issued by HoldCo against payment of funds to OpCo locally in PKR. Consequently, the OpCo can issue shares of equal value in favor of non-resident HoldCo, on repatriation basis.

b. These general permissions are subject to following terms and conditions:

1. The company shall be eligible for incorporation of holding company abroad under this

general permission, provided that:

i. The company is incorporated as a private limited/public unlisted company under the Companies Act, 2017 (erstwhile Companies Ordinance 1984) for not more than 7 years, provided that such entity is not formed by splitting up, or reconstruction of a business already in existence

ii. The Company has annual revenue below PKR 2 billion since its incorporation

iii. The company has equity (including retained earnings) below PKR 300 million as per latest audited financials

2. HoldCo shall repatriate the funds, raised from abroad, through equity or borrowing, to Pakistan, as equity based investment in OpCo, in following manner:

i. At least 80% of the funds raised from abroad on annual basis until USD 1 million (net of dividend remitted by OpCo) is remitted to Pakistan.

ii. Subsequently, at least 50% of funds raised from abroad on annual basis until USD 10 million (net of dividend remitted by OpCo) is remitted to Pakistan on cumulative basis.

3. The OpCo can issue shares in favor of HoldCo, against the amount received from abroad, on repatriation basis in terms of provisions of para 6 and 7 of Chapter 20 of Foreign Exchange Manual. The OpCo shall report to SBP within 30 days of issuance of shares through its designated Authorized dealer, along with details of funds raised by HoldCo.

4. HoldCo shall remit the dividends to Pakistan against shares acquired by resident companies/firms and Founders.

5. Designated Authorized Dealer shall arrange to ensure the compliance of all terms and conditions.

C- Investment abroad by resident companies/firms for expansion of business:

The residents of Pakistan including firms and companies are allowed to make equity based investment (other than portfolio investment) in entities abroad on repatriable basis, with prior permission of State Bank of Pakistan and subject to the following terms and conditions:

i. Only companies incorporated in Pakistan including foreign controlled companies and firms owned by Pakistani Nationals resident in Pakistan are allowed investment under this category.

ii. The business activity of the company, firm, joint venture in which investment is desired to be made should ordinarily be of the same nature as that in which the investor is already engaged in Pakistan, or in which the investor has the potential to acquire sufficient expertise from the market for running the business. Proposal for investment abroad in the extended line of business or vertical business integration shall also be considered as similar line of business.

iii. The investor should be financially sound as shown by its audited accounts for the last three years. In the case of a company in the I.T. business, however, the condition of three years may be reduced to one year.

iv. The proposal should be economically viable as evidenced from a feasibility report. It should have the potential for future earnings of foreign exchange coupled with other advantages to the country such as employment opportunities for Pakistani nationals and improvement in national human resources.

v. Funding for the proposed investment abroad shall be allowed from the foreign currency funds available to the credit of special foreign currency accounts maintained by the applicant in terms of applicable Foreign Exchange Regulations. However, in case the applicant does not have any such account or the balance available in its special foreign currency accounts is not sufficient, remittance can be allowed from interbank market.

vi. The State Bank under the aforesaid guideline would also deal with the proposals emanating from the Public Sector Organizations providing financial services whereas the concerned ministry would deal with the investment proposals from all other public sector organizations.

D- Investment abroad by Resident Individuals:

1. Small Investment by Individuals in Listed companies abroad:

General permission is granted to Designated Authorized Dealers to effect remittance on behalf of resident individuals for investments in shares of listed companies abroad, subject to following terms and conditions:

i. Designated Authorized Dealer is allowed to remit a maximum amount of USD 25,000 or equivalent during a calendar year, under this general permission, on behalf of a resident individual.

ii. The maximum shareholding by an individual, in a single investee company, under this general permission, shall not exceed 1% of shares of the investee company at any time.

2. Employee Stock Option Plans

General Permission is granted to Designated Authorized Dealers to effect remittance on behalf of resident employees of subsidiaries of foreign companies in Pakistan to participate in their share option plans, subject to following terms and conditions:

i. Subsidiaries of foreign companies in Pakistan shall approach to their designated Authorized Dealer with complete share option plans.

ii. Designated Authorized Dealer is allowed to remit a maximum amount of USD 50,000 or equivalent during a calendar year, under this general permission, on behalf of a resident individual.

iii. The maximum stake by an individual, in a single investee company, under this general permission, shall not exceed 3% of shares of the investee company at any time.

3. Sweat Equity

General permission is granted to resident individuals to acquire the shares of companies abroad issued to them as sweat equity against their efforts and services, without any monetary consideration. This general permission is subject to the following terms and conditions:

i. The maximum shareholding, under this general permission, shall not exceed 20% of shares of the investee company at any time.

ii. The investor could acquire shares under this general permission against its efforts and services related to the field where the investor has expertise.

iii. The investor shall submit the agreement, confirming this arrangement, to SBP through its designated Authorized Dealer while reporting this investment, along with its detailed profile showing his/her filed field of expertise with documentary evidences.

III. Post investment requirements:

After making investment, in terms of these regulations, the investor is required to:

i. Submit the documentary evidences related to establishment/ acquisition of subsidiary/ branch office/shares abroad, within one month of making the investment, through designated authorized dealer.

ii. Make a return to State Bank on the prescribed form V-100 through their banker within one month of making the investment;

iii. Each entity who invested abroad under this policy shall submit audited financials of the investee company to the Authorized Dealer on annual basis.

iv. Repatriate the dividend/disinvestments proceeds (including capital gains) to Pakistan through normal banking channels. The amounts so received would be converted to local currency by the bank concerned and a Proceeds Realization Certificate in original evidencing the same shall be filed by the owner with the State Bank through its Authorized Dealer. Such amounts shall not be allowed for credit to a Foreign Currency Account or for purchase of Pakistani securities on Repatriable basis.

IV. Designation and application processing:

1. Designation of Authorized Dealer

i. All the Investments under the general permission granted for categories of investment abroad mentioned at Para 13(II) A, B & D above, shall be routed through only one branch of an Authorized Dealer to be designated by the applicant. For this purpose, request for designation shall be submitted by the applicant through the Authorized Dealer, intended to be designated, to the Exchange Policy Department of State Bank of Pakistan, for acknowledgement. The request for designation of the branch shall be routed through the Head Office of the Authorized Dealer, where record of all such designations shall be maintained.

ii. The Authorized Dealer at its relevant branch so designated by the applicant shall be liable to ensure compliance of terms and condition stipulated for each category of investment abroad and maintain complete party wise record of transactions processed by it. The Authorized Dealer shall also maintain at the designated branch the complete record of repatriation of dividend/disinvestment proceeds from investments abroad by its each customer.

iii. In case applicant desires to change the designated bank/branch, it shall submit an application through the Head Office of bank/branch desired to be designated for the acknowledgment of Exchange Policy Department along with the following :

a) NOC from previous designated bank/branch regarding change of designation. The previous designated Authorized Dealer shall be required to issue the NOC and share the record related to investment abroad transactions of the applicant with the new Authorized Dealer, within three working days from the date of request received from the new Authorized Dealer.

b) Confirmation from bank/branch to be designated regarding acquisition of compete record, regarding previous investment abroad transactions, from bank/branch designated previously.

2. Processing of application by Authorized Dealer

The detailed applications along with audited accounts, particulars of Directors/Partners of the investor company/firm (not required in case of individuals), name and address of the foreign company/firm in which investment is desired to be made, its line of business and particulars of its Directors/Partners, shall be forwarded to the Authorized Dealer. The applications with respect to proposals of investment abroad pertaining to Para 13(II) A, B & D above, shall be processed by the designated Authorized Dealer. In case of any exemption/waiver is required, the application will be forwarded by the designated Authorized Dealer to Exchange Policy Department, State Bank of Pakistan as per procedure detailed below. With respect to proposals of investment abroad pertaining to Para 13(II) C above, applications shall be forwarded by the Authorized Dealer to State Bank of Pakistan as per procedure detailed below.

3. Processing of application by State Bank of Pakistan

The detailed applications with respect to Para 13(II) C or any exemption/waiver from Para 13(II) A, B & D shall be forwarded by Authorized Dealers to Director, Exchange Policy Department, State Bank of Pakistan, Karachi, along with its review of the application (against applicable terms and conditions) and specific recommendations. Any application submitted to State Bank without proper review and specific recommendation of the Authorized Dealer would not be entertained.