Karachi, June 14, 2025 – The Karachi Chamber of Commerce and Industry (KCCI) has expressed deep disappointment over what it calls the continued neglect of Karachi in both the federal and Sindh provincial budgets for the fiscal year 2025–26.

(more…)Tag: KCCI

-

FBR targets active KCCI member over offshore assets

Karachi, June 13, 2025 – In a stunning revelation that’s sending shockwaves through the business community, the Federal Board of Revenue (FBR) has placed a prominent and active member of the Karachi Chamber of Commerce and Industry (KCCI) under intense scrutiny over alleged offshore assets.

(more…) -

KCCI slams FY26 budget as camouflage of illusions

In a fiery response to the unveiling of the Federal Budget 2025-26, the Karachi Chamber of Commerce and Industry (KCCI) has slammed the government’s fiscal roadmap as nothing more than a “camouflage”—a deceptive mirage shrouding the painful realities and unrealistic ambitions for the coming year.

(more…) -

KCCI urges reduction in gas prices to safeguard industrial sector

Karachi, June 4, 2025 – The Karachi Chamber of Commerce and Industry (KCCI) has urged the government to immediately reconsider and reduce gas prices in order to safeguard the country’s struggling industrial sector and support sustainable economic growth.

(more…) -

KCCI endorses faceless customs, calls nationwide implementation

Karachi, June 1, 2025 – The Karachi Chamber of Commerce and Industry (KCCI) has extended its full support for the Faceless Customs Assessment (FCA) system and has urged the federal government to accelerate its expansion across all ports and customs stations in Pakistan.

(more…) -

KCCI demands subsidy release for incremental power consumption

Karachi, May 30, 2025 – The Karachi Chamber of Commerce and Industry (KCCI) has called on the federal government to urgently release the long-delayed subsidy related to incremental electricity consumption, which is critical for the survival and growth of Karachi’s industrial sector.

(more…) -

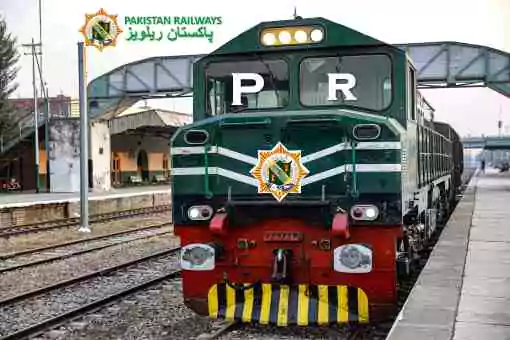

Railways key to easing Karachi’s cargo pressure, says DS

Karachi, May 27, 2025 – Divisional Superintendent (DS) Pakistan Railways, Mehmood ur Rehman Lakho, has stressed the urgent need to shift cargo movement from roads to railways to ease Karachi’s growing transportation burden.

(more…) -

KCCI advocates restoration of zero-rated sales tax under EFS

Karachi, May 21, 2025 – The Karachi Chamber of Commerce and Industry (KCCI) has strongly called for the restoration of zero-rated sales tax under the Export Facilitation Scheme (EFS) to support the local textile industry, particularly for the procurement of raw materials and yarn.

(more…) -

Parliamentarians seek KCCI input for inclusive budget 2025–26

Karachi, May 19, 2025 – A delegation of National Assembly members visited the Karachi Chamber of Commerce and Industry (KCCI) to gather key proposals and insights for the formulation of the Federal Budget 2025–26.

(more…) -

KCCI warns of nationwide protest over harsh tax laws

Karachi, May 15, 2025 — The Karachi Chamber of Commerce and Industry (KCCI) has issued a strong warning to the federal government, signaling the possibility of a nationwide protest if the newly introduced tax laws under the Tax Ordinance Amendment 2025 are not immediately withdrawn.

(more…)