Islamabad, July 16, 2025 – The Central Directorate of National Savings (CDNS) has officially announced the results of the Rs750 prize bond draw, held on July 15, 2025, in Rawalpindi.

(more…)Tag: prize bond

-

SBP Sets Deadline for Prize Bond Encashment

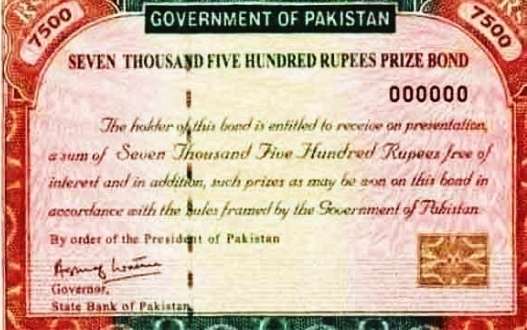

The State Bank of Pakistan (SBP) has reiterated its call to the public to encash, replace, or convert National Prize Bonds (NPBs) of denominations Rs 40,000, Rs 25,000, Rs 15,000, and Rs 7,500 before the final deadline of December 31, 2024.

(more…) -

Tax Rates on Prize Bond Winnings for 2024

Karachi, January 3, 2024 – As the New Year unfolds, the Federal Board of Revenue (FBR) in Pakistan has provided clarity on the tax rates applicable to prize bond winnings for the year 2024.

(more…) -

Pakistan Facilitates Conversion of Rs 5 Billion Worth Unregistered Prize Bonds

Karachi, September 8, 2023 – Pakistan has taken steps to facilitate its citizens in converting unregistered prize bonds worth approximately Rs 5 billion, with a deadline set for the end of June next year.

(more…) -

Bearer Prize Bonds of Rs40,000 not to be encashed after March 31

KARACHI: State Bank of Pakistan (SBP) has said that people can encashed Rs40,000 bearer prize bonds on or before March 31, 2020 and after that the financial instruments cannot be redeemed.

The central bank issued frequently asked questions (FAQs) related to the withdrawal of Rs. 40,000/- National Prize Bonds (Bearer) from Circulation to facilitate general public and investors.

Q: Have National Prize Bonds (Bearer) of Rs.40,000/- denomination been withdrawn from circulation?

A: Yes. The Finance Division (Budget Wing), Government of Pakistan vide Notification No. F.16(3)GSI/2014-1072 dated June 24, 2019 has restricted the sale of National Prize Bonds (Bearer) of Rs.40,000/-denomination after June 24, 2019.

Q: Is there a time limit for conversion/encashment of my National Prize Bonds (Bearer) of Rs.40,000/- denomination?

A: Yes. As per aforementioned Notification from the Government of Pakistan, National Prize Bonds (Bearer) of Rs. 40,000/- denomination can be encashed/redeemed upto March 31, 2020, after which they would not be encashed / redeemed.

Q: How can I encash/redeem my National Prize Bonds (Bearer) of Rs.40,000/- denomination?

A: The National Prize Bonds (Bearer) of Rs.40,000/- denomination can be encashed using the following options:

1. Conversion to Premium Prize Bonds (Registered)

2. Replacement with Special Savings Certificate (SSC) / Defence Savings Certificate (DSC)

3. Encashment through Bank Account

Q: How can I convert my National Prize Bonds (Bearer) of Rs.40,000/- denomination to Premium Prize Bonds (Registered)?

A: The National Prize Bonds (Bearer) of Rs.40,000/- denomination can be converted to Premium Prize Bonds (Registered) through the 16 field offices of SBP Banking Services Corporation, and six commercial banks i.e. National Bank of Pakistan, Habib Bank Limited, United Bank Limited, MCB Bank Limited, Allied Bank Limited and Bank Alfalah Limited. The documentary requirements for the purchase of Premium Prize Bonds (Registered) are available at: http://www.sbp.org.pk/sbp_bsc/PrizeBond/premium/FAQs.pdf

Q: How can I replace my National Prize Bonds (Bearer) of Rs.40,000/- denomination with Special Savings Certificates (SSC) / Defence Saving Certificates (DSC)?

A: The National Prize Bonds (Bearer) of Rs.40,000/- denomination can be replaced with SSC / DSC through the 16 field offices of SBP Banking Services Corporation, Authorized Commercial banks and National Savings Centers.

Q: How can I encash my National Prize Bonds (Bearer) of Rs.40,000/- denomination through bank account?

A: On submission of request on the prescribed application form (details at Q7 below) at 16 field offices of SBP Banking Services Corporation or Commercial Banks, the proceeds of encashment shall be credited to the bond-holder’s bank account.

Q: What information/documents are required to convert/redeem/encash my National Prize Bonds (Bearer) of Rs.40,000/- denomination?

A: Request for conversion/encashment of Rs.40,000/- National Prize Bonds (Bearer) shall be submitted on prescribed application form which is available at the following weblink:

http://www.sbp.org.pk/sbp_bsc/BSC/CMD/Circulars/2019/C1-Annex-A-Application-Form.pdf.

The requisite information/documents required for each encashment option is as follows:

1. Conversion to Premium Prize Bonds (Registered): Legible copy of valid CNIC / SNIC, Account

Maintenance Certificate (not older than one month from application date), Valid IBAN number

2. Replacement with Special Savings Certificate (SSC) / Defence Savings Certificate (DSC): Legible Withdrawal of Rs. 40,000/- National Prize Bonds (Bearer) from Circulation copy of valid CNIC / SNIC

3. Encashment through Bank Account: Valid IBAN number

Q: Can I receive cash against my National Prize Bonds (Bearer) of Rs.40,000/- denomination?

A: No. The National Prize Bonds (Bearer) of Rs.40,000/- denomination can only be encashed using the following options:

1. Conversion to Premium Prize Bonds (Registered)

2. Replacement with Special Savings Certificate (SSC) / Defence Savings Certificate (DSC)

3. Encashment through Bank Account

Q: Is there any tax / deduction against the conversion/encashment of National Prize Bonds (Bearer) of Rs.40,000/- denomination ?

A: No. There is no tax / deduction for any of the approved conversion/encashment options.

Q: For encashment of National Prize Bonds (Bearer) of Rs.40,000/- denomination through bank account, can I visit any Commercial Bank, or do I have to visit the Commercial Bank in which my account is maintained ?

A: The National Prize Bonds (Bearer) of Rs.40,000/- denomination bonds can be encashed at any branch of the Commercial Bank in which bondholder maintains an “individual” account.

Q: What is the timeline for credit of Face Value into my bank account?

A: The Face Value shall be credited to the bank account on the same day, subject to provision of required information.

Q: National Prize Bonds (Bearer) of Rs.40,000/- denomination are being encashed against cash at a discount rate. Is it allowed?

A: As per Rule 3(2) of Prize Bonds Rules 1999, only Offices of the State Bank of Pakistan Banking Services Corporation, Commercial Banks authorized in this behalf by SBP, and National Savings Centers are authorized to carry out business of National Prize Bonds (Bearer). Further, the Rule 3(3) of the said Rules restricts any other office, body or institution other than the office, body or institutions specified in Rule 3(2) of Prize Bonds Rules, 1999 from conducting any business relating to National Prize Bonds (Bearer).

The SBP said that the bondholders receive full amount (without any deduction) for any of the approved conversion/encashment options.

Q: Will there be any further prize money draws for National Prize Bonds (Bearer) of Rs.40,000/- denomination?

A: No. The last draw (78th draw) for Rs.40,000/- denomination National Prize Bonds (Bearer) was conducted on June 3, 2019. As per the Notification from Finance Division (Budget Wing) Government of Pakistan, no further prize money draws shall be conducted for National Prize Bonds (Bearer) of Rs.40,000/- denomination.

Q: I have a prize-winning National Prize Bond (Bearer) of Rs.40,000/- denomination. What is the time limit for claiming my prize ?

A: Under the governing rules, the prize money may be claimed by the holder of the prize bond at any time within a period of six years from the date of draw.

Q: Can I encash damaged National Prize Bond (Bearer) of Rs.40,000/- denomination?

A: Yes. Damaged National Prize Bonds (Bearer) of Rs.40,000/- denomination can be encashed at the 16 field offices of SBP Banking Services Corporation. However, it is pertinent to note that all such claims shall Withdrawal of Rs. 40,000/- National Prize Bonds (Bearer) from Circulation be decided by the authorized officials in light of relevant regulations.

-

Tax collected on prize bond winning to be final

KARACHI: The withholding tax collected on winning of prize bond shall be final tax liability either it is collected from person appeared on Active Taxpayers List (ATL) or not.

Sources in Federal Board of Revenue (FBR) said that the withholding tax collected on winning of prize bonds may not be adjusted against the total tax liability of a taxpayer.

Similarly, the withholding tax deducted on winning from a raffle, lottery or winning a quiz, prize offered by companies will also not be adjustable.

The collection of tax has been made under Section 156 of Income Tax Ordinance, 2001. While from tax year 2020 the withholding tax under this section has been increased by 100 percent for those persons not appearing on ATL.

Section 156: Prizes and winnings

Sub-Section (1): Every person paying 10[prize on] a prize bond, or winnings from a raffle, lottery, prize on winning a quiz, prize offered by companies for promotion of sale, or cross-word puzzle shall deduct tax from the gross amount paid at the rate specified in Division VI of Part III of the First Schedule.

Sub-Section (2): Where a prize, referred to in sub-section (1), is not in cash, the person while giving the prize shall collect tax on the fair market value of the prize.

Sub-Section (3): The tax deductible under sub-section (1) or collected under sub-section (2) shall be final tax on the income from prizes or winnings referred to in the said sub-sections.

The tax rate as specified under Division VI of Part III of the First Schedule of Income Tax Ordinance, 2001, shall be:

(1) The rate of tax to be deducted under section 156 on a prize on prize bond or cross-word puzzle shall be 15 percent of the gross amount paid.

(2) The rate of tax to be deducted under section 156 on winnings from a raffle, lottery, prize on winning a quiz, prize offered by a company for promotion of sale, shall be 20 percent of the gross amount paid.

However, with the introduction of Tenth Schedule of Income Tax Ordinance, 2001 the tax rate to be collected on such winning will be increased by 100 percent from persons not appearing on the ATL.

Therefore the tax rate on winning prize bond from person not appearing on ATL will be 30 percent. Similarly, the rate of tax will be 40 percent from persons wining winnings from a raffle, lottery, prize on winning a quiz, prize offered by a company for promotion of sale.

-

Withholding tax rate on winning prize bonds

The Federal Board of Revenue (FBR) has revealed the withholding tax rate on prize bonds and winning for Tax Year 2019, as outlined in Section 156 of the Income Tax Ordinance, 2001.

(more…)