KARACHI – The Pakistan Stock Exchange (PSX) has officially announced its closure on Friday, May 07, 2021, in observance of Juma-tul-Wida, the Last Friday of the holy month of Ramadan.

(more…)Tag: PSX

-

Share market ends down by 186 points

KARACHI: The share market ended down by 186 points on Monday owing to roll-over trades from April future contract.

The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) closed at 44,076 points as against last Friday’s closing of 44,262 points, showing a decline of 186 points.

Analysts at Arif Habib Limited said that roll-over trades from April Futures Contract that remained outstanding at the end of Roll-over week on Friday caused mayhem today as well, especially the positions in TRG and NETSOL.

Resultantly, the Index slashed 632 points during the session. Recovery ensued, considering that the positions have rolled-over however, since the positions were still outstanding, the recovery efforts proved futile, ending the session -186 points.

NETSOL hit lower circuit since the beginning of the session, whereas TRG traded near lower circuit the entire session. Besides Technology stocks, selling pressure was observed in Cement and Steel sectors which kept the index down. Among scrips, UNITY led the table with 36.2 million shares, followed by TELE (25.2 million) and GGL (23 million).

Sectors contributing to the performance include Technology (-89 points), Textile (-58 points), Cement (-33 points), Power (-29 points) and Refinery (-12 points).

Volumes declined from 293.7 million shares to 238 million shares (-19 percent DoD). Average traded value also declined by 18 percent to reach US$ 73.8 million as against US$ 89.7 million.

Stocks that contributed significantly to the volumes include UNITY, TELE, GGL, TRG and WTL, which formed 46 percent of total volumes.

Stocks that contributed positively to the index include SYS (+41 points), HBL (+17 points), UNITY (+16 points), KTML (+13 points) and FFC (+13 points). Stocks that contributed negatively include TRG (-130 points), HUBC (-28 points), NML (-23 points), ANL (-16 points) and LUCK (-15 points).

-

Weekly Review: Corona restriction may put pressure on market

KARACHI: A possible strict lockdown due to rise in coronavirus cases in the country may put pressure on the stock market during next week.

Analysts at Arif Habib Limited said that the National Command and Operation Center (NCOC) had instructed stricter restrictions and shorter working hours, while a complete lockdown is still a possibility.

This could potentially continue to add pressure to the market next week.

The ongoing third wave of the novel coronavirus is likely to keep sentiment under pressure, while in addition to a strong results season (particularly cyclical sectors) we may see the market react on a positive note in the upcoming week.

The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) is currently trading at a PER of 6.6x (2021) compared to Asia Pac regional average of 16.0x while offering a dividend yield of ~7.4 percent versus ~2.6 percent offered by the region.

The week commenced on a positive note on Monday due to heavy investment from a major fund. For the remainder of the week the index was under pressure due to rise in the infection ratio, lockdowns in certain areas of the country and reduced business timings.

Finally, a discussion of a possible complete lockdown is still on the cards which added extra pressure to the index. On a positive note inflows to foreign exchange through the Roshan Digital Account (RDA) crossed the USD 1bn this week, while the Current Account posted a nominal deficit of USD 47 million for March 2021. The KSE-100 Index closed the week at 44,262 points, declining 445 points WoW.

Sector-wise negative contributions came from i) Technology & Communication (110) ii) Cement (95), iii) Tobacco (555 points), iv) Engineering (49 points) and v) Automobile Assembler (43 points).

Whereas sectors that contributed positively include i) Textile Composite (25 points), and ii) Chemical (16 points). Scrip-wise negative contributors were TRG (82 points), MCB (65 points), PAKT (55 points), NBP (39 points) and INIL (31 points) while positive contributors included HBL (48 points), BAHL (36 points), FFC (34 points), COLG (31 points) and UBL (24 points).

Foreign selling this week clocking-in at USD 13.1 million compared to a net buy of USD 7.3 million last week. Selling was witnessed in Commercial Banks (USD 4.8 million) and Technology and Communication (USD 1.5 million).

On the domestic front, major buying was reported by Other Organization (USD 16.1 million) and Mutual Funds (USD 13.4 million). Average volumes arrived at 331 million shares (down by 0.5 percent WoW) while average value traded settled at USD 110 million (up by 14 percent WoW).

-

KSE-100 index loses 601 points on selling pressure

KARACHI: The equity market ended down by 601 points on Friday owing to selling pressure witnessed across the board during the day.

The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) closed at 44,262 points as against 44,863 points, showing a decline of 601 points.

Analysts at Arif Habib Limtied said that end of roll-over week had a painful impact on market, causing the index to tumble 711 points during the session and closing -601 points.

Leveraged stocks, NETSOL, TRG and UNITY which had significant outstanding balance in the DFC open interest created negative sentiment, despite TRG declaring good results with a hefty payout.

NETSOL, on the other hand, posted negative earnings for the quarter. Resultantly, NETSOL hit lower circuit.

Besides, selling pressure was observed across the board with UBL contributing to loss on points table among banking sector stocks with the exception of HBL that maintained level above LDCP.

Among scrips, GGL topped the volumes with 34.8 million shares, followed by TRG (25.9 million) and TELE (22.4 million).

Sectors contributing to the performance include Technology (-133 points), Cement (-60 points), E&P (-50 points), O&GMCs (-46 points) and Banks (-42 points).

Volumes increased from 280.6 million shares to 293.7 million shares (+4 percent DoD). Average traded value also increased by 1 percent to reach US$ 89.6 million as against US$ 88.6 million.

Stocks that contributed significantly to the volumes include GGL, TRG, TELE, WTL and HASCOL, which formed 37 percent of total volumes.

Stocks that contributed positively to the index include BAHL (+19 points), HBL (+14 points), SCBPL (+6 points), SHFA (+6 points) and AGP (+5 points). Stocks that contributed negatively include TRG (-105 points), HUBC (-30 points), SYS (-28 points), NBP (-24 points) and NRL (-23 points).

-

Stock market sheds 196 points on selling activities

KARACHI: The stock market fell by 196 points on Thursday owing to selling observed during the day. The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) closed at 44,863 points as against last day’s closing of 45,059 points, showing a decline of 196 points.

Analysts at Arif Habib Limited said that the market declined further today with a drop of 278 points during the session and ended the session -196 points.

Selling was evident across the board, but had the most impact on Cement, Fertilizer, Steel sectors. Financial results have failed to generate the usual interest among investors perhaps due to the upcoming tight budget right after Ramadan and a long hibernating period till the next financial results will be announced.

International crude oil prices were on the rise overnight, however, E&P stocks did not react to it. Among scrips, HASCOL led the table with 43.8 million shares, followed by GGL (32.6 million) and TELE (19.5 million).

Sectors contributing to the performance include Banks (-58 points), Cement (-56 points), Fertilizer (-33 points), Power (-28 points) and Tobaco (-13 points).

Volumes declined from 305.7 million shares to 280.7 million shares (-8 percent DoD). Average traded value also declined by 16 percent to reach US$ 88.6 million as against US$ 105 million.

Stocks that contributed significantly to the volumes include HASCOL, GGL, TELE, TRG and GGGL, which formed 45 percent of total volumes.

Stocks that contributed positively to the index include HASCOL (+10 points), KTML (+10 points) and ICI (+8 points). Stocks that contributed negatively include FFC (-26 points), SNGP (-26 points), MCB (-14 points) and POML (-13 points).

-

PSX issues new trading, office timings

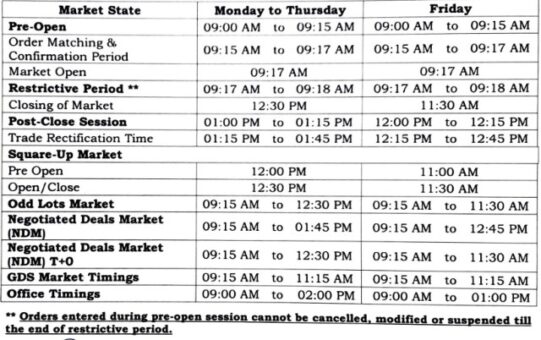

KARACHI: Pakistan Stock Exchange (PSX) on Wednesday issued new timings of trading and office of the exchange effective from Thursday April 29, 2021.

In a notification the exchange said that in line with the decision of National Command and Operation Center (NCOC) regarding the COVID-19 situation and subsequent reduction in banking hours by the State Bank of Pakistan (SBP) notified today, PSX has also revised its market and office timings keeping in view the smooth clearing and settlement within the reduced banking hours.

The revised timings, as appended, shall take effect from trading day April 29, 2021 and shall remain in force till further notice.

Following is the revised schedule of PSX:

-

Equity market ends down by 234 points in range bound trading

KARACHI: The equity market recorded a decline of 234 points on Wednesday while trading in range bound during the day.

The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) closed at 45,059 points as against previous day’s closing of 455,293 points, showing a decline of 234 points.

Analysts at Arif Habib Limited said that the market traded range bound today between -272 points and +296 points during the session.

Selling pressure was concentrated in Banks, E&P, Cement and Steel sector stocks similar to what was witnessed yesterday and the absence of active buyer exacerbated the situation leading to index closing lower than LDCP.

Technology stocks saw NETSOL performing, whereas TRG declined over the day. Service Global Footwear (SGF) hit upper circuit on the first day of listing on PSX, but selling pressure brought the price down. Among scrips, TELE topped the volumes with 29.3 million shares, followed by ANL (25.6 million) and TRG (18.3 million).

Sectors contributing to the performance include Banks (-93 points), E&P (-44 points), Technology (-35 points), Cement (-33 points), Pharma (-29 points) and Fertilizer (+30 points).

Volumes declined from 366.8 million shares to 305.7 million shares (-17 percent DoD). Average traded value also declined by 7 percent to reach US$ 104.6 million as against US$ 112.1 million.

Stocks that contributed significantly to the volumes include TELE, ANL, TRG, UNITY and GGGL, which formed 33 percent of total volumes.

Stocks that contributed positively to the index include COLG (+24 points), FFC (+21 points), NRL (+13 points), ENGRO (+13 points) and POL (+12 points). Stocks that contributed negatively include HBL (-39 points), OGDC (-36 points), PPL (-24 points), MCB (-23 points) and TRG (-21 points).

-

Stock market ends down by 390 points on selling in major scrips

KARACHI: The stock market fell by 390 points on Tuesday as selling seen in major scripts during the day. The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) closed at 45,293 points as against previous day’s closing of 45,683 points, showing a decline of 390 points.

Analysts at Arif Habib Limited said that excitement observed yesterday withered away when the benchmark index saw a decline of 513 points during the session.

The scrips that saw selling today included OGDC, PPL, PSO which performed well the other day. Investor sentiment remained at a low ebb throughout the session with persistent selling in O&GMCs, E&P, Cement and Steel sectors. Among Tech stocks,

TRG closed below LDCP whereas NETSOL hit upper circuit. Volume leaders include TELE with 48.1 million shares, followed by UNITY (43.4 million) and FLYNGR (26.5 million).

Sectors contributing to the performance include E&P (-182 points), Fertilizer (-58 points), O&GMCs (-50 points), Cement (-45 points) and Power (-34 points).

Volumes declined from 409 million shares to 366.8 million shares (-10 percent DoD). Average traded value also declined by 28 percent to reach US$ 112.1 million as against US$ 155.1 million.

Stocks that contributed significantly to the volumes include TELE, UNITY, FLYNGR, TRG and ANL, which formed 41 percent of total volumes.

Stocks that contributed positively to the index include NRL (+14 points), DAWH (+14 points), HBL (+12 points), AICL (+11 points) and ICI (+11 points). Stocks that contributed negatively include OGDC (-71 points), PPL (-59 points), ENGRO (-46 points), POL (-44 points) and PSO (-40 points).

-

Equity market gains 976 points on fund injection expectation

KARACHI: The equity market rebounded with an increase of 976 points on Monday on the anticipation of new fund injection by mutual funds.

The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) closed at 45,683 points as against last Friday’s close of 44,707 points, showing an increase of 976 points.

Analysts at Arif Habib Limited said that the market made a rebound today with the anticipation of new fund injection by mutual funds, despite the persistent selling witnessed in the past couple of sessions at the behest of rising cases of Corona.

Financial results announced earlier today failed to excite the market, when the index tumbled 317 points earlier in the session.

Aggressive buying was observed in OGDC, PPL and PSO, all of which hit upper circuits during the session although OGDC and PSO closed below the upper circuit. Similarly, buying was observed in HBL and UBL, which helped the index post 1246 points after sustaining loss of 317 points.

Session ended +976 points (unadjusted). Among scrips, TELE topped the volumes with 55 million shares, followed by TRG (53.5 million) and UNITY (26.4 million).

Sectors contributing to the performance include E&P (+239 points), Banks (+177 points), Cement (+99 points), Fertilizer (+87 points) and Pharma (+81 points).

Volumes increased from 240.4 million shares to 409 million shares (+70 percent DoD). Average traded value also increased by 103 percent to reach US$ 155.5 million as against US$ 76.6 million.

Stocks that contributed significantly to the volumes include TELE, TRG, UNITY, SILK and GGL, which formed 41 percent of total volumes.

Stocks that contributed positively to the index include OGDC (+102 points), PPL (+96 points), HUBC (+78 points), TRG (+60 points) and LUCK (+58 points). Stocks that contributed negatively include PSMC (-9 points), INIL (-8 points), AICL (-6 points), LOTCHEM (-5 points) and KEL (-5 points).

-

Weekly Review: third wave of coronavirus remains threat for stock market

KARACHI: The third wave of coronavirus with high number of cases is remained a key risk for the stock market during next week, analysts said.

Analysts at Arif Habib Limited said that while the NCOC has advised stricter restrictions and shorter work hours, a complete lockdown on a national level has been ruled out.

This will be a sigh of relief for the business community. Albeit the third wave of the novel coronavirus (more lethal than the last two) remained a key risk for the market.

The analysts said that the strong result season appears to be a solid indicator of the economic and corporate recovery.

The benchmark KSE-100 of Pakistan Stock Exchange is currently trading at a PER of 6.7x (2021) compared to Asia Pac regional average of 16.1x while offering a dividend yield of ~7.2 percent versus ~2.6 percent offered by the region.

With a perturbing political situation building up from last weekend (protests and sit-ins by TLP across the country and a series of failed negotiations with the government), the domestic equity bourse displayed adverse momentum at the beginning of the week.

Although slight relief appeared in the form of robust result announcements, it remained short-lived as growing prevalence of COVID-19 infection globally (India made a new high in reported cases; over 332,000 in a single day) and rising local cases, squashed any signs of recovery at the market. While expectations of a wider lockdown to be implemented by the NCOC, also kept investors wary. The KSE-100 index closed at 44,707 points, down by 1.3 percent / 599 points WoW.

Contribution to the downside was led by i) Oil and Gas Exploration Companies (210 points), ii) Cement (78 points), iii) Power generation (93 points), iv) Chemical (79 points), and v) Oil and Gas Marketing Companies (77 points). Whereas sectors that contributed positively include i) Commercial Banks (160 points) amid strong result outcomes, ii) Technology (58 points), and iii) Fertilizer (28 points). Scrip-wise major losers were OGDC (96 points), HUBC (76 points), and PPL (56 points). While top positive contributors were TRG (118 points), ENGRO (77 points), and HBL (60 points).

Foreigners accumulated stocks worth of USD 7.3 million compared to a net sell of USD 0.9 million last week. Major buying was witnessed in Technology and Communication (USD 4.80 million) and Commercial Banks (USD 2.42 million). On the local front, selling was reported by Mutual Fund (USD 7.73 million) followed by Companies (USD 5.35 million). That said, average daily volumes and traded value for the outgoing week were down by 10 percent and 3 percent to 333 million shares and USD 97 million, respectively.