Pakistan is on the cusp of a historic shift in its financial landscape as the newly-passed 26th Constitutional Amendment Bill, 2024, sets January 1, 2028, as the deadline to eliminate Riba (interest-based banking) from the country’s economic system.

(more…)Tag: riba

-

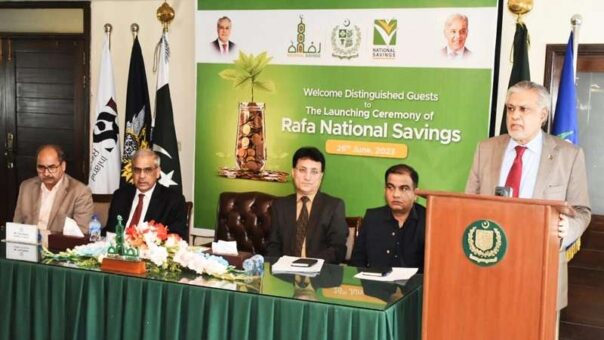

Pakistan to Achieve Fully Interest-Free Financial System in Five Years: Dar

Islamabad: Finance Minister Mohammad Ishaq Dar announced on Monday his strong determination to transform Pakistan into a fully interest-free financial system within the next five years.

(more…) -

Pakistan Takes Significant Step Towards Implementing Riba-Free Banking System

State Bank of Pakistan works towards Sharia-compliant financial system

Karachi, June 19, 2023: In a significant move that aligns with Islamic teachings, Pakistan is on the verge of implementing a Riba-free banking system in the country.

(more…) -

Security Investment Bank applies for Shariah certificate

Security Investment Bank Limited (SIBL) has applied to become a Shariah-compliant investment bank following the issuance of comprehensive guidelines by the Securities and Exchange Commission of Pakistan (SECP).

(more…) -

Dar chairs meeting to review implementation of Riba free system in Pakistan

ISLAMABAD: Finance Minister Ishaq Dar on Friday chaired a meeting on implementation of Riba free system in Pakistan.

(more…) -

Pakistan Islamic banks stick to KIBOR – interest based benchmark

KARACHI: Pakistan Islamic banks are stick to Karachi Interbank Offered Rate (KIBOR) – an interest based benchmark.

(more…) -

Pakistan financial system capable of implementing Riba-free banking

KARACHI: Financial system of Pakistan is capable of implementing Riba-free banking as per the injunctions of Islam.

(more…) -

Commercial banks urged to withdraw appeals in Riba case

ISLAMABAD: A leading scholar of the country on Sunday urged commercial banks to withdraw their appeals against the order of Federal Shariat Court (FSC).

The FSC judgment declared that Riba (usury) is Haram and prevailing banking system with interest system should be abolished forthwith.

READ MORE: State Bank, NBP to withdraw petitions in Riba case: Ishaq Dar

State Bank of Pakistan (SBP) and National Bank of Pakistan with other six commercial banks filed a review before the Supreme Court against the judgment of the FSC.

Recently, the SBP and NBP reportedly withdrew the appeals. However, private banks are still in litigation to contest the judgment of FSC.

“The private banks should withdraw their appeals to annul the judgment of the Federal Shariat Court (FSC) against the Riba (usury),” said Hafiz Muhammad Tahir Mehmood Ashrafi, Prime Minister’s Special Representative for Interfaith Harmony and the Middle East Hafiz Muhammad Tahir Mehmood Ashrafi, while talking to the state media.

READ MORE: KCCI demands implementation of Riba free banking

He said the government had taken practical steps by withdrawing appeals of national and state banks from the apex court in a bid to get rid of the interest-based economic system.

Ashrafi, who is also the chairman of Pakistan Ulema Council, assured the government all-out support of Ulema and Mashaykh in the implementation of FSC’s decision in letter and spirit.

He proposed all the financial institutions devise a combined strategy to make the country’s economic system free of interest which was totally against the divine commands.

He also urged the government to take stern action against the people who were allegedly involved in an interest-based system at the local level.

READ MORE: SBP seeks Supreme Court guidance on Riba case judgement

He said Pakistan, currently, was facing a critical financial crisis and its solution was lying in political stability and improved law and order situation in the country.

He urged all the religious and political parties to unite on one platform and help cope with burgeoning polarization, extremism, and the new wave of terrorism with collective efforts.

He also appealed the Pakistan Tehreek-e-Insaf Chief Imran Khan to come to the table-talk to evolve consensus on the ‘Charter of Pakistan’ as it was the need of the hour and it would help control increasing violence in the society and improve the ailing economy of the country.

He proposed that the way ‘Message of Pakistan’ was designed to promote religious harmony in all sections of the society, there should be long-term policies on the country’s social, economic, and foreign affairs issues in the shape of ‘Charter of Pakistan’ and it should be implemented by all the governments to come and national institutions in the larger national interest.

READ MORE: IPS demands implementation of court judgment on Riba

Ashrafi emphasized that Pakistan had to go out of the box in the matter of its foreign policy as there was a paradigm shift in the external affairs of the Islamic and Arab world.

He also thanked the Saudi leadership for extending the term of deposit in the State Bank of Pakistan (SBP) from the Saudi Fund for Development.

Expressing gratitude to Custodian of the Two Holy Mosques King Salman bin Abdulaziz and his Crown Prince Muhammad bin Salman, he said the relationship between Pakistan and Saudi Arabia was like two brothers.

He said Prime Minister Muhammad Shehbaz Sharif’s meetings with Saudi Crown Prince Mohammed bin Salman would yield further cooperation in the shape of Saudi investment in the days to come ahead in the country.

“Similarly, other Islamic countries are also increasing trade and economic cooperation with Pakistan,” he said expressing the hope that there would be good news from the United Arab Emirates, Qatar, Turkey and Saudi Arabia in the near future.

Ashrafi hinted that there was a big hand of the external forces and anti-state elements behind an organized smear campaign against the national security institutions and armed forces.

“We must counter the concocted propaganda of our arch enemy against our national defense institutions and Pakistan Army with a pragmatic approach instead of becoming part of it,” he maintained.

-

State Bank, NBP to withdraw petitions in Riba case: Ishaq Dar

ISLAMABAD: Finance Minister Senator Muhammed Ishaq Dar Wednesday said that State Bank of Pakistan (SBP) and National Bank of Pakistan (NBP) will withdraw their petitions from the Supreme Court of Pakistan against the judgment of Federal Shariat Court in which the Court had ordered implementation of interest-free (Riba free) banking system in the country.

READ MORE: KCCI demands implementation of Riba free banking

He said that in this regard he held several meetings and detailed discussions with the SBP Governor and under the special directives of Prime Minister, it was decided that both the SBP and NBP would withdraw their petitions against the decision.

He said that the government would also expedite its efforts to introduce Shariah compliant banking system in the country for rapid growth and promotion of Islamic bank and finance.

READ MORE: SBP seeks Supreme Court guidance on Riba case judgement

He further informed that during 2013-2018 several steps were being taken to promote Islamic economic system and a special committee comprising on Islamic scholars were also formed, adding that Islamic Banking system also observed significant growth and progress at that time.

READ MORE: IPS demands implementation of court judgment on Riba

However, he said that from last few years the sector was completely neglected and no further progress was witnessed, adding that promotion of Islamic economic system and interest free banking was the top priority of incumbent government

He said that government was also determined to overcome all the challenges faced for introducing interest free banking system and it will take all possible measures to take forward the interest free banking and economy for the prosperity of nation.

-

KCCI demands implementation of Riba free banking

KARACHI: Karachi Chamber of Commerce and Industry (KCCI) on Friday demanded the government for early implementation of Riba free banking in Pakistan.

Chairman Businessmen Group in the KCCI, Zubair Motiwala, and KCCI President, Muhammad Idrees have extended gratitude to Prime Minister Shahbaz Sharif for taking interest in the implementation of the Federal Shariah Court’s decision of introducing Riba Free banking in Pakistan.

READ MORE: KCCI appeals rescuing small traders in Catch-22 situation

They have requested the government to introduce interest free banking in Pakistan according to the Islamic Principles and implement the court’s decision in true letter and spirit.

The Federal Shariah Court gave a verdict on 28 April 2022 after a lapse of 19 years. In the judgment, it declared that Riba was prohibited according to the injunctions of Islam so it should be eliminated from the country with in a period of five years.

This statement was issued in response to an appeal filed by the State Bank of Pakistan, and four other banks in the Supreme Court of Pakistan against the Shariah Court’s Judgment. They termed the appeal as move to delay the conversion of conventional banking system to Riba free mode to banking. They also appreciated the assurance given by the PM Shahbaz Sharif to influence the banks to withdraw their appeals from the Supreme Court so that the Shariah Court’s decision could be implemented.

READ MORE: Energy price hike jolts trade, industry: Businessmen Panel

Chairman BMG Zubair Motiwala said, “Other Islamic countries like Saudi Arabia, Iran and Malaysia have made significant headway in implementing Islamic mode of financing in their respective countries. Like, Malaysia has an Islamic Financial Services Board which has set Standards, Guiding Principles and Technical Notes for the Islamic financial services industry. I believe that if these countries are able to successfully adopt Islamic financial system, Pakistan can also shift to Islamic Financing system in the decent span of five years”.

READ MORE: Govt. halts gas supply to export industry: APTMA

President KCCI Muhammad Idrees urged that all stakeholder groups should be consulted and if there are any genuine issues then these should be resolved on a fast-track basis to pave way for timely implementation of Islamic Financial System in the country.

READ MORE: SITE industrialists reject increase in power tariff, POL prices