KARACHI: The State Bank of Pakistan (SBP) has launched Regulatory Approval System (RAS) under which banks have been enabled to get approval digitally.

The SBP in a statement issued on Wednesday said that in order to promote digitalization and encourage eco-friendly practices, an online portal has been developed which called SBP RAS to enable regulated entities (i.e. banks, Electronic Money Institutions, Payment System Operators, Payment Service Providers etc.) to submit cases/proposals and receive regulatory decisions digitally.

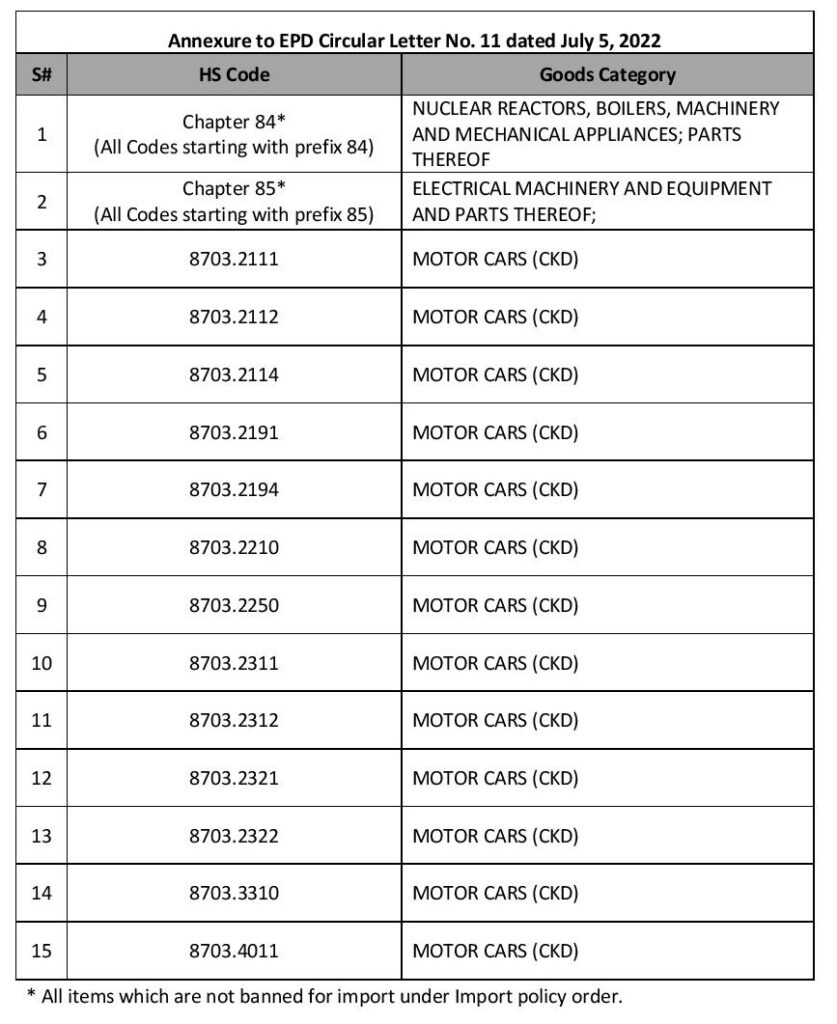

READ MORE: SBP makes permission mandatory for motor car import

Previously, SBP implemented RAS for its various functions aimed at end-to-end digitalization, whereby banks were enabled to electronically submit cases related to Banking Policy & Regulations and Exchange Policy.

With the launch of RAS banks, Development Finance Institutions (DFIs) and Microfinance Banks (MFBs) started submitting their request letters/ proposals on a dedicated online portal to SBP’s Banking Policy and Regulations Department.

READ MORE: Pakistan may see further 100bps hike in policy rate

Earlier in October 2020, SBP launched the SBP FX RAS for end-to-end digitization of Foreign Exchange (FX) related case submission process.

The objective of this initiative was to provide a fully digitalized platform to the business community and individuals in approaching banks for their foreign exchange related requests.

The system turned out to be a huge success as it enabled the customers to lodge their FX related requests from the location of their convenience and also enabled banks to submit FX related cases electronically for regulatory approval of SBP and SBP-Banking Services Corporation (BSC).

In a similar vein, RAS for Payment Systems Policy & Oversight is being rolled out for industry-wide implementation. RAS will make submission of requests and proposals by regulated entities efficient, easy to track and paperless.

READ MORE: SBP adopts Sharia standards of accounting, auditing

Moreover, it will also allow the dissemination of regulatory decisions to regulated entities electronically through RAS portal.

RAS will run in parallel with manual (conventional) mode of case submission for a period of one and a half months (1.5 months) whereby regulated entities will continue to submit cases manually (as well as digitally through RAS).

To facilitate users of RAS, a Service Help Desk has also been set up where complaints regarding business and technical aspects of RAS may be lodged. Service Help Desk User Manual is prepared to help users navigate through Service Desk.

This will allow SBP to identify and address potential issues that may arise during live operations. The move is expected to create trust and allow regulated entities to get used to the new system.

READ MORE: Pakistan’s central bank launches digital financial literacy for farmers