KARACHI: The State Bank of Pakistan (SBP) has implemented stricter reporting measures for monthly foreign exchange returns submitted by banks, aiming to ensure more accurate data on remittances.

(more…)Tag: SBP

-

SBP allows reimbursement claims for payment of wages, salaries

KARACHI: State Bank of Pakistan (SBP) on Tuesday decided to allow reimbursement claims for those business concerns, which paid wages and salaries through own resources.

The central bank through a notification on April 10, 2020 launched refinance scheme for payment of wages and salaries to the workers and employees of business concerns considering the financial impact due to coronavirus and subsequent lockdown.

The SBP said that those borrowers who had applied for the facility in the month of April, 2020 but could not get approval in April due to the formalities were allowed to claim reimbursement of April salaries and wages paid from their own sources.

It has been decided to allow similar facilitation for the salaries of May 2020.

“Hence, businesses, who applied for the facility under the captioned Schemes in May 2020, can pay wages and salaries from their own sources and claim reimbursement of the same after their financing is approved.”

Further, to facilitate those borrowers who could not apply in month of April, 2020 and paid wages and salaries of April from their own sources can also claim reimbursement under the captioned schemes provided all other terms and conditions including not laying off the employees are met.

-

Foreign direct investment surges 127 percent in ten months

KARACHI: The inflow of Foreign Direct Investment (FDI) posted significant increase of 127 percent during first ten months of current fiscal year, State Bank of Pakistan (SBP) said on Monday.

The FDI was recorded $2.28 billion during July – April 2019/2020 as compared with $1 billion in the corresponding period of the last fiscal year.

The inflow under FDI was at $2.87 billion as compare during first ten months of current fiscal year as compared with $2.31 billion in the corresponding period of the last fiscal year.

Similarly, the outflows under the FDI was recorded 55 percent decrease to $590 million during the period under review as compared with $1.31 billion in the same period of the last fiscal year.

The portfolio investment posted 55 percent growth. The portfolio investment recorded outflow of $182 million during July – April 2019/2020 as compared with outflow of $408 million.

Total foreign private investment including FDI and portfolio investment urged 251 percent to $2.1 billion during first ten months of current fiscal year as compared with $598 million in the same period of the last fiscal year.

-

FPCCI says lowering interest rate by one percent not to help economy

KARACHI: Federation of Pakistan Chambers of Commerce and Industry (FPCCI) on Friday said that the decision to lower interest rate by one percent will not help the country to boost especially considering adverse impact of coronavirus.

FPCCI president Mian Anjum Nisar while responding to rate cut by State Bank of Pakistan (SBP) and said that despite clear message by all segments of economy particularly trade and industry the SBP reduction of one percent policy rate is surprising and unfavorable to bleeding economy.

He said that given the current deteriorating economic situation all the Central Banks are supporting by significant reduction in interest rate along with stimulus packages while current decision not based on forward-looking inflation.

He further stated that the FPCCI deplores the regulator’s conservative stance where the speed and the magnitude of the response do not match the havoc caused by the virus.

FPCCI completely agrees with the external account situation detailed in their monetary policy statement where current account deficit (CAD) will remain in control as was the case in April.

He said that May and June imports will be even lower than 3 billion per month on account of fewer orders placed by importers due to depressed demand under lockdown.

Nisar further said since the external situation is in manageable as per SBP, there is sufficient information available on the inflation front to forecast a much lower rate than 7-9 percent forecasted for next year by SBP.

Importantly, SBP in their 17th March, 2020 MPC press release stated: “Average headline inflation is expected to remain within the SBP’s 11-12 percent forecast in FY20, before falling to the medium-term target range of 5-7 somewhat earlier than previously forecast.”

FPCCI based on its own research tends to agree with SBP’s earlier assessment of 5 percent anticipated inflation. We would have understood a cautious approach if the situation was normal but in these unprecedented times, we urge the regulator to appreciate the gravity of the situation where most businesses are expected to accrue markup when their sales are ZERO.

The need of the hour is to take a more aggressive approach to policy making where what can be done tomorrow should be done today.

FPCCI acknowledges the regulator’s approach on refining their decisions and policies based on constructive feedback as has been demonstrated in multiple improved iteration of various refinance schemes. In the same spirit, we stand ready to work closely with the regulator in our quest to bring down the rate to 5% in the shortest possible time.

Mian Anjum Nisar President FPCCI urged the SBP to shift its pre-COVID-19 mindset and adopt the policies according to the sentiment of the Prime Minister Imran Khan and Businesses community to bring out economy from crises.

-

SBP slashes policy rate by 100 basis points to 8 percent

KARACHI: The State Bank of Pakistan (SBP) on Friday decided to further reduce the policy rate by 100 basis points to 8 percent as inflation outlook has improved further in light of the recent cut in domestic fuel prices.

A statement said that at its meeting on May 15, 2020, the Monetary Policy Committee (MPC) decided to reduce the policy rate by 100 basis points to 8 percent.

This decision reflected the MPC’s view that the inflation outlook has improved further in light of the recent cut in domestic fuel prices.

As a result, inflation could fall closer to the lower end of the previously announced ranges of 11-12 percent this fiscal year and 7-9 percent next fiscal year.

The MPC highlighted that the coronavirus pandemic has created unique challenges for monetary policy due to its non-economic origin and the temporary disruption of economic activity required to combat it.

While easier monetary policy can neither affect the rate of infection transmission nor prevent the near-term fall in economic activity due to lockdowns, it can provide liquidity support to households and businesses to help them through the ensuing temporary phase of economic disruption.

In particular, the successive policy rate cuts and sizeable cheap loans provided through the SBP’s enhanced refinancing facilities have helped maintain credit flows, bolster the cash flow of borrowers, and support asset prices.

This has contained the tightening of financial conditions that would otherwise have amplified the initial necessary contraction in activity.

The MPC noted the swift and forceful monetary easing of 525 basis point in the two months since the beginning of the crisis and SBP’s measures to extend principal repayments, provide payroll financing, and other measures to support liquidity.

Together with the government’s proactive fiscal stimulus―including targeted support packages for low-income households, SMEs, and construction―as well as assistance from the international community, these actions should provide ample cushion to growth and employment, while also maintaining financial stability.

This coordinated and broad-based policy response has provided relief and stability and should provide support for recovery as the pandemic subsides.

In reaching its decision, the MPC considered key trends and prospects in the real, external and fiscal sectors, and the resulting outlook for monetary conditions and inflation.

Key developments since the last MPC meeting

The MPC noted three key developments since the last MPC meeting on 16th April, 2020. First, the government has significantly reduced petrol and diesel prices by 30-40 percent in response to the continued fall in global oil prices, which has improved the outlook for inflation.

Second, most countries, including Pakistan, have begun easing lockdowns, which should help provide support to economic activity.

Nevertheless, as elsewhere, the situation remains highly uncertain. A possible rise in infections could prompt fresh lockdowns, and the recovery could prove more sluggish than is currently being anticipated.

Third, due to timely policy actions and international assistance, the initial volatility observed in domestic financial and foreign exchange markets has somewhat subsided in recent weeks, although global financial conditions remain considerably tighter than before the coronavirus outbreak.

Recent supportive developments have helped to restore the SBP’s foreign reserves position to close to pre-coronavirus levels of over US$ 12 billion.

Economic data has been consistent with the expected sudden and sharp drop in activity. LSM witnessed a steep decline of 23 percent (y/y) in March, due to the withdrawal from economic and social activity aimed at slowing the spread of the virus. High-frequency indicators of demand such as credit card spending, cement dispatches, credit off-take and POL sales also suggest a marked contraction in domestic economic activity in both March and April. At the same time, after showing signs of recovery earlier in the year, both consumer and business sentiment have fallen sharply.

More recently, the government has initiated a phased lifting of restrictions for different economic sectors conditional on the future course of the pandemic. If this easing proceeds smoothly, activity should pick up in coming months. The MPC noted that, in light of preliminary evidence from China and other countries that eased lockdowns earlier than others, activity in service sectors and consumption, which form a large part of the domestic economy, could remain subdued for longer.

The current account deficit has continued to narrow, even though both exports and imports have fallen sharply since the coronavirus outbreak. Exports declined by 10.8 percent (y/y) in March. Imports, after indicating some recovery on in recent months, contracted by 19.3 percent (y/y). The April figures from the Pakistan Bureau of Statistics reveal an even steeper decline in both exports (54 percent) and imports (32 percent). While remittances have so far remained resilient, there are potential downside risks given the economic difficulties across the world, especially in oil exporting countries.

Despite challenging global conditions, the outlook for external sector broadly remains stable. The current account deficit should remain bounded and the recent fall in portfolio inflows will be offset by official flows committed by the international community, such that Pakistan’s external position remains fully funded. Together, these developments, buttressed by the flexible exchange rate regime, should continue to support a steady build up in the SBP’s foreign exchange reserve buffers.

Like the external sector, the fiscal sector was also on track of much-needed consolidation before the coronavirus outbreak. The primary balance recorded a surplus of 0.4 percent of GDP in Jul-Mar FY20 against a deficit of 1.2 percent in the same period of FY19, the first 9-month surplus since FY16. However, the substantial fall in economic activity since March has significantly affected tax revenues. After rising by 17.5 percent (y/y) during Jul-Feb FY20, tax revenues declined sharply by 15 percent (y/y) in both March and April. Moreover, given the needed increase in spending to support healthcare, businesses, households and more vulnerable segments of society, the fiscal deficit is expected to widen substantially in Q4.

The MPC noted the significant reduction in headline inflation since January on the back of sharply decelerating food and energy prices, as well as easing core inflation. Looking ahead, this waning price momentum is expected to be complemented by the recent 30-40 percent cut in domestic petrol and diesel prices, creating room for today’s additional rate cut. Today’s decision has brought the cumulative reduction in the policy rate to 525 basis points, which was enabled by the fact that both the fall in inflation in Pakistan since January and the expected further decline next year are the highest among comparable emerging markets.

The inflation outlook is subject to two-sided risks. Inflation could fall further than expected if economic activity fails to pick up as expected next fiscal year. On the other hand, there are some upside risks from potential food-price shocks associated with adverse agricultural conditions. Price pressures could also emerge if the economy gains greater momentum in the second half of FY21.

Overall, the MPC felt that with today’s rate cut and based on available information, the monetary policy stance should support the economy over the coming months, while ensuring price and financial stability. In line with its previous communications, the MPC has remained data-driven and forward-looking in its interest rate decisions and stands ready to take appropriate actions as the need may arise.

-

Foreign exchange reserves ease to $18.74 billion

KARACHI: The foreign exchange reserves of the country eased by $10 million to $18.745 billion by week ended May 02, 2020, State Bank of Pakistan (SBP) said on Thursday.

The foreign exchange reserves were at $18.755 billion a week ago i.e. April 30, 2020.

The official reserves of the central bank fell by $58 million to $12.271 billion by week ended May 08, 2020 as compared with $12.329 billion a week ago.

The SBP said that the official reserves of the central bank fell due to external debt repayment.

The reserves held by commercial bank increased by $48 million to $6.474 billion by week ended May 08, 2020 as compared with $6.426 billion a week ago.

-

SBP likely to further ease monetary policy stance by 100bps: analysts

KARACHI: Analysts believe that the State Bank of Pakistan (SBP) likely to further ease the key policy rate by 100 basis points in the upcoming announcement scheduled for May 15, 2020.

Analysts Arif Habib Limited said that the monetary policy committee of SBP will convene on Friday (15th May 2020) to announce the monetary policy for the next two months.

“We expect the SBP to cut policy rates by 100 bps to 8.00 percent in the upcoming monetary policy statement,” the analysts said.

The said that the SBP may reduce the policy rate due to the following reasons:

i) Inflation is likely to continue its downward trend due to massive decline in prices of petroleum products (MoGas and HSD prices reduced by Rs15/liter and Rs27/liter) along with lower demand of perishable items which may reduce inflationary pressure; and

ii) Recent change in macros given outbreak of the Novel Coronavirus which may further induce the SBP to stimulate the economy by reducing policy rate further.

Moreover, it seems the fixed income market has already incorporated rate cut as treasury bills of 3-, 6- and 12-month are trading at 8.39 percent, 8.00 percent and 7.75 percent which are lower than current policy rate of 9.00 percent.

To recall, Monetary Policy Committee (MPC) convened emergency meeting on April 16, 2020 where the SBP announced a further cut in the policy rate by 200 basis points which is in addition to the 225 basis points cut announced in March, taking the policy rate to a single-digit of 9 percent.

The MPC opted rate cut stance on account of i) to cushion the economic fallout (slowdown in growth and employment) amid Coronavirus, ii) worsening outlook for global and domestic economic activity in the wake of the Coronavirus Pandemic, and iii) SBP forecasting inflation to come down to single digits between 7-9 percent in the next fiscal year.

-

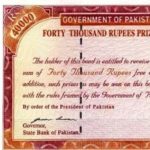

Premium prize bonds get Rs19.21 billion investment; grow by 228 percent

KARACHI: The investment in premium prize bonds has surged by 228 percent to Rs19.21 billion by March 2020 as compared with Rs5.86 billion by the same month a year ago.

(more…) -

Inflows of remittances registers 5.5 percent decline in April

KARACHI: The inflow of workers remittances has registered decline of 5.5 percent in April 2020, State Bank of Pakistan (SBP) said on Monday.

Workers’ remittances during April 2020 amounted to US $ 1.79 billion recording a decrease of US $ 104.4 million or 5.5 percent over remittance received during previous month (March 2020, US $ 1.89 billion).

The workers’ remittances received during July – April FY20 amounted to US $ 18.78 billion recording an increase US $ 980.6 million or 5.5 percent over remittances received during July – April FY19 (US $ 17.8 billion).

The remittances during April 2020 (US $ 1,790.0 million) increased by US $ 19.8 million or 1.1 percent over remittance received during corresponding month of FY 19 (US $ 1,770.2 million).

During April 2020, larger amounts of Workers’ Remittances are received from Saudi Arabia (US $ 451.4 million), USA (US $ 401.9 million), UAE (US $ 353.8 million) and UK (US $ 226.6 million) recording an increase of 14.0 percent for USA whereas a decrease of 0.2 percent, 15.8 percent and 8.8 percent for Saudi Arabia, UAE and UK respectively as compared to March 2020.

-

SBP to announce monetary policy on May 15

KARACHI: State Bank of Pakistan (SBP) on Monday said that it will announce monetary policy statement for next two months on Friday May 15, 2020.

The SBP in previous three announcement during past two months reduced the policy rate by 4.25 percent to 9 percent from 13.25 percent.

In the last monetary policy meeting on April 16, 2020 decided to cut the policy rate by a further 200 basis points to 9 percent.

The SBP said that at its last meeting on 24th March 2020, the Monetary Policy Committee (MPC) noted the worsening outlook for global and domestic economic activity in the wake of the Corona pandemic. Given the unfolding situation, the MPC noted that it “remains ready to take whatever further actions become necessary in response to the evolving economic impact of the Coronavirus.”

Since the last MPC meeting, the global and domestic outlook has further deteriorated. The world economy is expected to enter into the sharpest downturn since the Great Depression, contracting by as much as 3 percent in 2020, according to projections released this week by the IMF.

This is a much deeper recession than the 0.07 percent contraction during the global financial crisis in 2009. Moreover, there are severe risks of a worse outcome. In addition, global oil prices have plummeted further, with futures markets suggesting low prices will persist.

Domestically, high-frequency indicators of activity―including retail sales, credit card spending, cement production, export orders, tax collections, and mobility data from Google’s recently introduced Community Mobility Reports―suggest a significant slowdown in most parts of the economy in recent weeks. On the inflation front, both the March CPI out-turn and more recent weekly SPI releases in April also show a marked reduction in inflation momentum.

While there is exceptionally high uncertainty about the severity and duration of the Coronavirus shock, the developments discussed above imply further downward revision in the outlook for growth and inflation.

The economy is expected to contract by -1.5 percent in FY20 before recovering to around 2 percent growth in FY21. Inflation is expected to be close to the lower end of the previously announced 11-12 percent range this fiscal year, and to fall to 7-9 percent range next fiscal year.

While there are some upside risks to headline inflation in case of temporary supply disruptions or food price shocks, these are unlikely to generate strong second-round effects due to the weakness of the economy.

Similarly, the inflationary impact of the recent exchange rate depreciation is expected to be contained given low import demand and falling global prices.

This reduces forward looking real interest rates (defined as the policy rate less expected inflation) to around zero, which is about the middle of the range across most emerging markets.

The MPC was of the view that this action would cushion the impact of the Coronavirus shock on growth and employment, including by easing borrowing costs and the debt service burden of households and firms, while also maintaining financial stability. It would also help ensure that economic activity is better placed to recover when the pandemic subsides.

The MPC highlighted that this rate cut would complement other measures recently taken by the SBP to support the economy, including concessional financing to companies that do not lay off workers, one-year extension in principal payments, doubling of the period for rescheduling of loans from 90 to 180 days, and concessional financing for hospitals and medical centers incurring expenses to combat the Coronavirus pandemic.