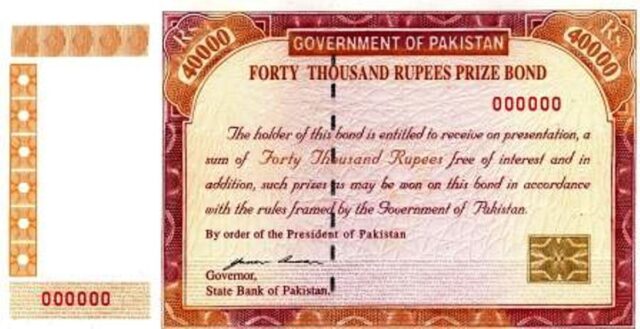

KARACHI: People can surrender Rs40,000 denomination bearer prize bonds by March 31, 2020 and exchange the amount with registered bonds or other given options.

The SBP stopped the issuance of Rs40,000 denomination prize bonds on June 24, 2019 and given deadline of March 31, 2020 for exchange the such denomination with other registered mode of investment.

Since the announcement of the central bank, the holders of bearer bonds had surrendered around Rs238 billion till November 2019.

The total investment Rs40,000 denomination bearer bonds peaked at Rs258 billion by May 2019, which reduced to around Rs20 billion by November 2019.

SBP stops banks selling Rs40,000 prize bonds, issues procedure for conversion into registered bonds

The SBP in a notification issued in June 2019 issued the following instructions regarding handling of Rs.40,000/- denomination National Prize Bonds are issued herewith for information, guidance and meticulous compliance:

a) National Prize Bonds of Rs.40,000/- denomination shall not be sold after June 24, 2019 and will not be encashed/redeemed after March 31, 2020.

b) No further draws of Rs.40,000/-denomination National Prize Bonds shall be held.

c) Cash payment for encashments of bonds is not allowed. However, the bond holder (s) shall have the following options to replace / encash these bonds:

1. Conversion of premium prize bonds (registered)

2. Replacement with special saving certificate (SSC)/Defence Saving Certificate (DSC)

3. Encashment at face value.

d) Appended below is the SOP for processing requests under the aforementioned options for compliance by all banks:

Conversion to Premium Prize Bonds (Registered)

i. The bonds can be converted to premium prize bonds (registered) through the 16 field offices of SBP Banking Services Corporation, and authorized branches of six commercial banks i.e. National Bank of Pakistan (NBP), Habib Bank Limited (HBL), United Bank Limited (UBL), MCB Bank Limited (MCB), Allied Bank Limited (ABL) and Bank Alflah Limited (BAFL).

ii. The bond holder shall be required to submit a written request for conversion of bearer bonds to premium prize bonds (registered) to be registered in his (her) name on the prescribed application.

iii. The bond holder shall also be required to submit prescribed applications forms for registrations / purchase of premium prize bond as per the procedure in vogue.

Replacement with the Special Saving Certificate (SSC)/Defence Saving Certificate (DSC)

i. The bonds can be replaced with SSC / DSC through the 16 field offices of SBP Banking Services Corporation, authorized commercial banks and National Savings Centers.

ii. All authorized commercial banks shall, therefore, accept requests for replacement of bearer bonds with SSC or DSC on the prescribed application form.

iii. The bondholder shall also be required to submit application form for purchase of SSC/DSC (SC-1) as per the prescribed procedure.

Encashment at Face Value:

i. The bonds will only be encashed by transferring the proceeds to the bond holder’s bank account through the 16 field offices of SBP Banking Services Corporation as well as the authorized commercial bank branches.

ii. All commercial banks shall receive requests for encashment of bearer bonds on the prescribed application form.

A copy of the application form, duly signed and stamped, shall be provided to the bondholder as an acknowledgement receipt.

The SBP said that it is needless to mention that the National Prize Bonds of Rs40,000 denomination tendered at the counters of banks shall be subject to through scrutiny to ascertain their genuineness. In this regard, details regarding the security features in Rs40,000 denomination National Prize Bonds are available online.

Moreover, the prize bonds encashed / replaced by general public may be surrendered to concerned SBP BSC office through respective regional office of the commercial banks. For the purpose, the regional office may intimate the SBP BSC office three days in advance so that necessary arrangements for receipt of the bonds can be made.

It is imperative to mention that a notice regarding the above / mentioned facilities must be displayed at prominent places within branch premises for awareness and information of general public.