KARACHI: The Sindh government on Wednesday presented budget for fiscal year 2020/2021. The following is budget at a glance:

KARACHI: The Sindh government on Wednesday presented budget for fiscal year 2020/2021. The following is budget at a glance:

KARACHI: Sindh Chief Minister Syed Murad Ali Shah on Wednesday presented Rs1.2 trillion provincial budget 2020/2021 with announcing no new tax and increase of 10 percent salary of the provincial government employees.

On the floor of the house while delivering speech for budget 2020/2021, the chief minister said that the total outlay of budget for the next financial year 2020-2021 is Rs.1.2 trillion.

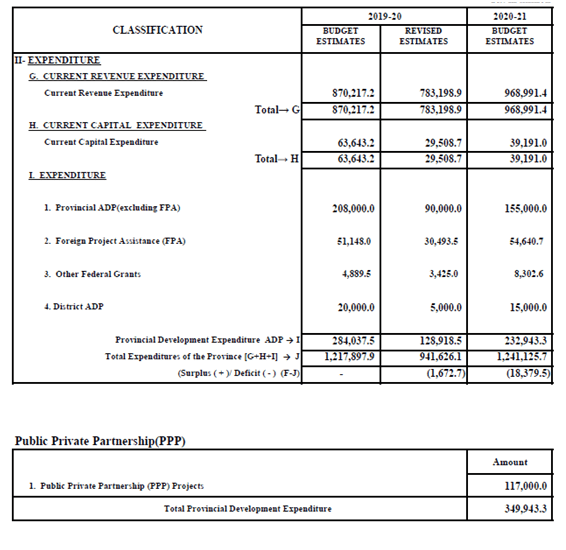

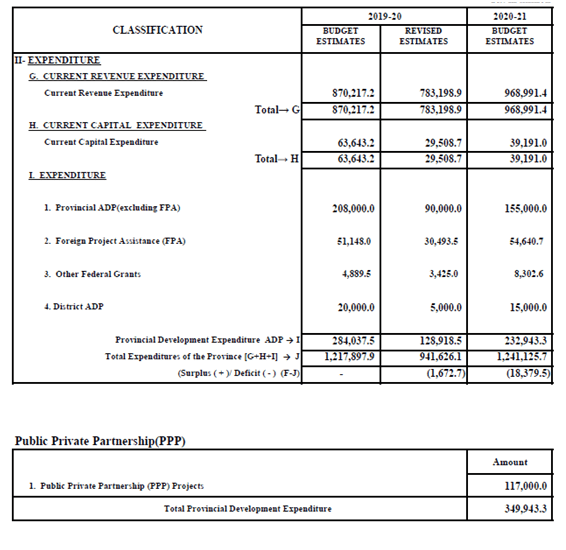

The total size of current revenue expenditure is Rs.968.9 billion.

“It is important to highlight here that for the next financial year, we have tried to align our Development as well as non-development expenditure priorities in line with the post COVID-19 situation,” the chief minister said.

He said that during financial year 2019-20, the province faced financial constraints due to COVID-19 which significantly affected development progress in the entire country. Sindh was no exception.

Government of Sindh budgeted Rs.284 billion as total development outlay in financial year 2019-2020, wherein Rs.208 billion were earmarked for Provincial ADP, Rs.20.0 billion for District ADP, Rs.51.0 billion in foreign projects assistance, and Rs.4.9 billion from Federal PSDP grant.

Looking at the financial constraints, stakeholder departments are likely to complete 425 schemes during 2019-20, 33 schemes less as compared to 458 completed in 2018-19.

“For the next financial year 2020-2021, the Administrative Departments in Sindh were earlier advised to prepare proposals for Provincial ADP 2020-21 at the size same as that of 2019-20 while allocating 85 percent for on-going schemes and 15 percent new schemes.

“However, in a post Covid-19 scenario, with a reduction in federal transfers and funding for development, the total development outlay for Sindh for the next financial year 2020-2021 is proposed at Rs.232.9 billion, allocating Rs.155.0 billion to Provincial ADP and Rs.15.0 billion to District ADP schemes.”

It would be pertinent to highlight that in this context Rs.54.6 billion are expected from Foreign Projects Assistance (FPA) and Rs.8.3 billion from Federal Government in Federal PSDP for 10 schemes under execution by Government of Sindh.

The government had earlier decided to keep the size of development budget for the next financial year 2020-21 for important sectors such as Education, Health, Social Safety & Poverty Reduction and Water & Sanitation nearly same as that of 2019-20. In exceptional cases such as Health, allocation has been increased from Rs.13.50 billion to Rs.23.50 billion in order to meet the challenges of COVID-19 situation.

The throw-forward amount in Provincial ADP 2020-2021 for 2209 schemes has reached at Rs.564.00 billion as compared to Rs.606.0 billion for 2705 schemes in 2019-2020.

Keeping in view above non-development and development expenditure priorities, the major milestone of our objectives are:

1. Exercise maximum austerity measures in our non-development expenditures.

2. Provide maximum resources for Health sector.

3. Enlarge substantially our social protection net through increased cash transfers to poverty inflicted people.

4. Provide ways and means for employment generation as well sustaining economic activity for the poorest of the poor, in rural as well as urban areas.

5. Continuing our focus on education, through increased allocations in financial year on development and non-development, despite huge resource constraints.

6. Fashion our development spending in sync with the above mentioned post Covid preferences with increased focus on Public Private Partnership (PPP) projects.

During his speech the chief minister said that the provincial government had decided not to introduce new tax in the budget 2020/2021.

Further, in order to provide relief the salary of provincial government employees has been increased by 10 percent for grade 1-16 and five percent for grate 17 and above.

KARACHI: Dr. Abdul Hafeez Shaikh, Advisor to Prime Minister on Finance and Revenue, has said that the upcoming budget 2020/2021 will be a relief budget and most of the recommendations of business community will be adopted in the budgetary measures to be announced by the government on June 12, 2020.

These assurance was given in a meeting held on Monday via video link between the KCCI’s team led by Chairman Businessmen Group & Former President KCCI Siraj Kassam Teli with the advisor to deliberate on the proposals of KCCI for the Federal Budget 2020-21.

On KCCI’s side, Siraj Teli was accompanied by President KCCI Agha Shahab Ahmed Khan and Former Senior Vice President Ibrahim Kasumbi.

Officials of the Finance Ministry and Chairperson Federal Board of Revenue Ms. Nausheen Jawed were also present at the meeting which lasted for more than 40 minutes.

In his opening remarks, President KCCI Agha Shahab Ahmed Khan stated that the budget for the year 2020-2021 is being prepared at a time when the country is facing an unprecedented crisis due to Covid-19 pandemic and every business and industry has been badly affected.

In these extraordinary circumstances, people of Pakistan in general and the business community in particular are looking forward to a budget which provides substantial relief measures to rescue the economy from the brink of disaster.

Chairman BMG Siraj Teli highlighted major macroeconomic issues during the meeting and elaborated on the measures which KCCI has recommended to rescue the trade and industry from devastating impact of a global economic meltdown caused by the spread of Covid-19 pandemic.

He reiterated that today the Name of the Game is survival of trade and industry which should be on top priority in the budget rather than the revenues.

Revenues can be recovered later only if the trade and industry survives hence the budget should focus on relief through these macroeconomic measures.

He said that the domestic economy, which contributes 92 percent to the GDP and provides bulk of employment and revenues, has not received the much needed relief and financial assistance.

He appreciated the reduction in prices of Petroleum products which was earlier proposed by KCCI and also the financial assistance given to the poor segment of population through Ehsaas program which provided much needed relief to the people.

Siraj Teli proposed that an across the board reduction of 50 percent in the rates of all Taxes including Income Tax, Sales Tax, FED and Customs duties on capital goods and raw materials should be announced in the Budget for one year.

Further, he suggested that rates of Electricity and Gas should also be reduced to half for at least one year to help revive the domestic economy. These measures may be reviewed when the economy shows improvement.

Commenting on the incentive scheme announced by the government for Construction Industry, Siraj Teli urged the Advisor Finance that similar incentives should be announced across the board for all sectors.

He stated that undocumented economy in Pakistan is twice the size of documented economy and a very large amount of capital is blocked in unproductive investments.

He said that it would immensely benefit the economy to release the blocked capital and encourage investments into all sectors of industry and business.

The unregistered persons in undocumented economy must be encouraged and allowed to get registered and become part of the documented economy.

As an incentive, a policy be adopted that no questions will be asked for all such investments. In the present global crisis due to Covid-19 pandemic, no objections are likely to be raised by IMF, World Bank, G20 and FATF etc.

It is therefore a good opportunity for Pakistan to unlock a huge untapped pool of capital.

Siraj Teli further added that although the interest rates have been revised downward by the SBP from 13.25 percent to 8.0 percent, it is still not sufficient to stimulate the growth. Reduction in interest rates in piecemeal and installments does not provide the desired impetus to growth.

To provide thrust the policy rate should be reduced to 4 percent in one go to stimulate growth and reduce cost of doing business.

All major economies are taking extra-ordinary measures to reverse the decline due to Covid-19 pandemic through quantitative easing and interest rates are down to zero.

In his presentation, Former Senior Vice President KCCI Ibrahim Kasumbi elaborated on various important proposals of the KCCI for the budget 2020-21.

These proposals included rationalization of tariff and WHT on industrial raw materials and capital goods, expeditious disbursement on Income Tax Refunds and enhancement of the limit of Rs.5.0 million, prioritizing of refunds on the basis of aging of cases, removal of automobile and motorcycle spare parts from third schedule of Customs Act, reduction in rate of Sales Tax and removal of RD on smuggling prone items.

In his response to the proposals and suggestions submitted by the KCCI item, Dr. Hafeez Shaikh said that despite the limitations of fiscal space, the Ministry of Finance has approved and adopted a significant number of KCCI’s proposals on the recommendation of the Federal Board of Revenue.

He emphasized that the government is keen to stand by the business community in these difficult times and maximum relief will be provided in the budget of FY2020-21. On the question of Income Tax refunds, Dr. Hafeez Shaikh stated that the Ministry of Finance is looking to enhance the amount of refund from Rs5.0 million up to Rs50.0 Million, depending on the available fiscal space.

In her comments, Ms. Nausheen Jawed, Chairperson FBR informed the KCCI team that their proposals were duly considered and a number of important proposals have been accepted for inclusion in the budgetary measures for FY2020-21.

Dr. Hafeez Shaikh thanked Siraj Kassam Teli and Agha Shahab Ahmed Khan for a productive meeting and participation of the KCCI team.

He further assured that he will be available to discuss any issues and remaining anomalies after the budget has been presented in the parliament.

KARACHI: Sindh government has announced to present provincial budget for 2020/2021 in first or second week of June 2020.

According to schedule issued by Sindh Finance Department the budget for the fiscal year 2021/2020 likely to be presented to the cabinet and the provincial assembly by the finance minister in the first or second week of June 2020.

According to the schedule by May 28, 2020, the finance department would complete all budget documents, schedules, and summaries for the cabinet.

The planning and development department would present finalized Annual Development Program (ADP) – 2020/2021 by third or fourth week of May 2020.

The meeting of National Economic Council (NEC) is scheduled for first week of May 2020.

The finance department would finalize new taxation proposals and review existing taxes and fees by April 30, 2020.

The meeting of Annual Plan Coordination Committee (APCC) to be held by fourth week of April 2020.

The finance department would finalize Medium Term Budge Framework (MTBF) 2022/2023 by March 31, 2020.

The finance department would finalize of revised estimates for 2019/2020, budget estimates for 2020/2021 and SNE 2020/2021 for recruitment budget by March 31, 2020.

Last date for incorporation of any modification in the ADP 2020/2021 for Annual Plan Coordination Committee by April 20, 2020.

The Sindh government issued budget circular which is integrated the formulation of the Recurrent (non-development) & Development budget and it is being issued in consultation with Planning & Development Department.

Accordingly two additional forms (Form BCC-X and BCC-XI) have been incorporated in the circular for the formulation of development budget.

The Planning & Development Department will have the lead role in development budget formulation, whereas, the Finance department will be formulating the non-development Budget, Receipts and MTBF.

All Administrative Departments are required to submit budgetary proposals on prescribed forms which will be scrutinized by Finance Department and Planning & Development Department in detail, as per prevailing practice.