KARACHI: The income tax return filing by salaried persons, business individuals and Association of Persons (AOPs) is due on September 30, 2019. In order to file return one should get income tax registration.

Following is the procedure for obtaining income tax registration as issued by the Federal Board of Revenue (FBR).

The first step of filing your Income Tax Return is to register yourself with Federal Board of Revenue (FBR).

For Income Tax Registration Individual can register online through Iris Portal

Whereas, the principal officer of AOP and Company needs to visit Regional Tax Office (RTO)

Taxpayer Registration basics

Some important facts about Registration

An individual, a company and an association of persons (AOP) or foreign national shall be treated as registered, when they are e-enrolled on the Iris portal.

E-Enrollment with FBR provides you with a National Tax Number (NTN) or Registration Number and password.

In case of individuals, 13 digits Computerized National Identity Card (CNIC) will be used as NTN or Registration Number.

NTN or Registration Number for AOP and Company is the 7 digits NTN received after e-enrollment.

These credentials allow access to Iris portal, the online Income Tax system, which is only way through which online Income Tax Return can be filed.

Requirements before Registration

An individual needs to ensure that the following information is available before starting e-enrollment.

Requirements of e-enrollment for an individual are as follows:

CNIC/NICOP/Passport number

Cell phone number in use

Active e-mail address

Nationality

Residential address

Accounting period

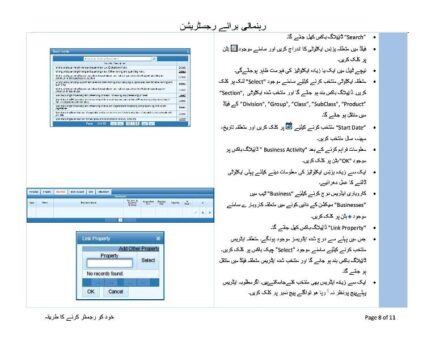

In case of business income

business name

business address

Principal business activity

Name and NTN of employer in case of salary income

Address of property in case of property income

Principal Officer of Company and AOP needs to ensure that the following information is available before starting e-enrollment

Following particulars are required for registration:

Name of company or AOP

Business name

Business address

Accounting period

Business phone number

E-mail address

Cell phone number of principal officer of the company or AOP

Principal business activity

Address of industrial establishment or principal place of business

Company type, like public limited, private limited, unit trust, trust, NGO, society, small company, modaraba or any other

Date of registration

Incorporation certificate by Securities and Exchange Commission of Pakistan (SECP) in case of company

Registration certificate and partnership deed in case of registered firm

Partnership deed in case firm is not registered

Trust deed in case of trust

Registration certificate in case of society

Name of representative with his CNIC or NTN

Following particulars of every director and major shareholder having 10% or more shares in case of company or partners in case of an AOP, namely:-

Name

CNIC/NTN/Passport and

Share %

Requirements for Registration of Non-Resident Company having permanent establishment in Pakistan shall furnish the following particulars:

Name of company

Business address

Accounting period

Phone number of business

Principal business activity

Address of principal place of business

Registration number and date of the branch with the Securities and Exchange

Commission of Pakistan (SECP)

Name and address of principal officer or authorized representative of the company

Authority letter for appointment of principal officer or authorized representative of the company

Cell phone number of principal officer or authorized representative of the company and

Email address of principal officer or authorized representative of the company

Non-Resident Company not having permanent establishment in Pakistan shall furnish the following particulars:

Name of company

Business address in the foreign country

Name and nationality of directors or trustees of the company

Accounting period

Name and address of authorized representative of the company

Authority letter for appointment of authorized representative of the company

Cell phone number of authorized representative of the company

Email address of authorized representative of the company

Principal business activity and

Tax Registration or incorporation document from concerned regulatory authorities of the foreign country

Registration process

Online Registration

Online registration is available only for:

Individual and not for Association of Person or Company;

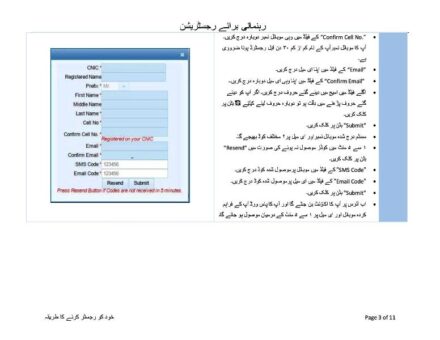

Before starting online registration, the Taxpayer must have:

Read User Guide;

A computer, scanner and internet connection;

A cell phone with SIM registered against their own CNIC;

A personal email address belonging to them;

Scanned pdf files of:

Certificate of maintenance of personal bank account in his own name;

Evidence of tenancy / ownership of business premises, if having a business;

Paid utility bill of business premises not older than 3 months, if having a business.

Online registration is available at Iris

Registration at Facilitation Counters of Tax Houses

Registration at Facilitation Counters of Tax Houses is available for all:

Individual, Association of Person and Company;

Income Tax and Sales Tax;

For Registration of an Individual, the Individual must:

Personally go to any Facilitation Counter of any Tax House;

Take the following documents with him:

Original CNIC;

Cell phone with SIM registered against his own CNIC;

Personal Email address belonging to him;

Original certificate of maintenance of personal bank account in his own name;

Original evidence of tenancy / ownership of business premises, if having a business;

Original paid utility bill of business premises not older than 3 months, if having a business.

For Registration of an AOP, anyone of the Members / Partners must:

Personally go to any Facilitation Counter of any Tax House

Take the following documents with him:

Original partnership deed, in case of Firm;

Original registration certificate from Registrar of Firms, in case of Firm.

CNICs of all Members / Partners;

Original letter on letterhead of the AOP signed by all Members / Partners, authorizing anyone of the Members / Partners for Income / Sales Tax Registration;

Cell phone with SIM registered against his own CNIC but not already registered with the FBR;

Email address belonging to the AOP;

Original certificate of maintenance of bank account in AOP’s name;

Original evidence of tenancy / ownership of business premises, if having a business;

Original paid utility bill of business premises not older than 3 months, if having a business.

For Registration of a Company, the Principal Officer must:

Personally go to any Facilitation Counter of any Tax House

Take the following document with him:

Incorporation Certificate of the Company;

CNICs of all Directors;

Original letter on letterhead of the company signed by all Directors, verifying the Principal Officer and authorizing him for Income Tax / Sales Tax Registration;

Cell phone with SIM registered against his own CNIC but not already registered with the FBR;

Email address belonging to the Company;

Original certificate of maintenance of bank account in Company’s name;

Original evidence of tenancy / ownership of business premises, if having a business;

Original paid utility bill of business premises not older than 3 months, if having a business.

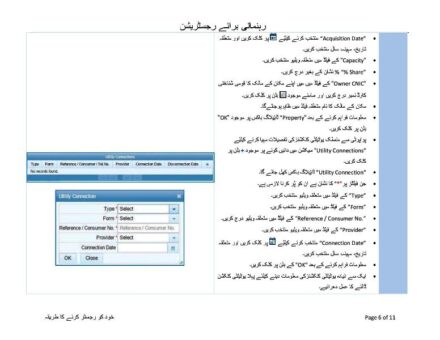

Modification of Income Tax Registration

Income Tax Registration of a person can be modified after discovering any change or omission in any information, particulars, data or documents associated with the registration of the person.

Person would have to file a modification form of registration in Iris to change the relevant particulars.

The Commissioner will grant or refuse the requested modification of the person after examining the modification form of registration and making any inquiry deemed necessary.

Person can within thirty (30) days of the decision regarding modification file a representation before the Chief Commissioner.

Chief Commissioner will decide on the merits of the representation filed.