The Pakistan Stock Exchange (PSX) has been mandated to apply a reduced rate of three percent income tax on payments to non-residents, according to officials from the Federal Board of Revenue (FBR).

(more…)Month: July 2020

-

SBP allows business to avail loan scheme for early payment of salary, wages

KARACHI: State Bank of Pakistan (SBP) has allowed businesses to avail loan scheme for early payment of salary and wages in the wake of Eid-ul-Azha.

The SBP also relaxed condition for obtaining loans from more than one bank for the payment of salary and wages.

The central bank in a notification issued on Friday said that in order to facilitate businesses facing problems in availing financing under the above schemes from one bank due to their credit limits or for any other reason, it has been decided to allow them to avail financing from more than one bank.

However, a business cannot avail financing for a specific month from more than one bank.

Further, businesses may avail financing under above schemes for early payment of wages/salaries for the month of July, 2020 before Eid-ul-Azha.

Businesses may also avail reimbursement of wages/salaries of July, 2020 in case they make early disbursements from their own resources to their workers/employees due to Eid-ul-Azha.

The central bank in April 2020 introduced loan scheme at reduced rate for businesses to ensure no layoff of employment and payment of salary and wages in the wake of spread of coronavirus.

-

Stock market recovers early day losses on above expectation result of HBL

The stock market gained 29 points on Friday, recovering from earlier losses of 319 points, thanks to the strong performance of Habib Bank Limited (HBL).

(more…) -

SBP not to hold regular monetary policy committee meeting

KARACHI: State Bank of Pakistan (SBP) on Friday decided not to hold regular meeting of monetary policy committee meeting scheduled for July 2020.

Given the number of MPC meetings that have taken place in recent months, and actions taken in those meetings, the MPC does not consider it necessary to hold the regular meeting of July 2020.

The next regular meeting of the MPC will now be held in September 2020, the SBP said.

The MPC continues to observe economic conditions and stands ready to take whatever further actions may become necessary in response to any adverse impact on the economy because of the pandemic or any other factor.

-

Rupee gains 36 paisas against dollar on improved inflows

KARACHI: The Pak Rupee gained 36 paisas against dollar on Friday owing to improved inflows of export receipts and remittances.

The rupee ended Rs167.26 to the dollar from previous day’s closing of Rs167.62 in interbank foreign exchange market.

Currency experts said that sufficient foreign currency was available in the market to meet import payment demand.

The workers’ remittances rose by a significant 50.7 percent during June 2020 to reach monthly record high $2.46 billion compared with $1.63 billion in June 2019.

Similarly, on a cumulative basis, workers’ remittances increased to a historic high level of $23.12 billion during FY20, witnessing a growth of 6.4 percent over $21.74 billion during FY19.

According to Pakistan Bureau of Statistics (PBS) the import bill of the country fell by 18.6 percent to $44.57 billion as compared with $54.76 billion in the preceding fiscal year.

This helped the country to curtail the trade deficit for the year. The trade deficit of the country shrank by 27 percent to $23.18 billion during fiscal year 2019/2020 as compared with the deficit of $31.8 billion in the preceding fiscal year.

-

HBL announces 287 percent surge in half year profit

KARACHI: Habib Bank Limited (HBL) on Friday declared massive increase of 287 percent in half-year profit tax for the period ended June 30, 2020.

The bank, one of the largest bank in Pakistan, declared Rs15.188 billion profit after tax for the period January 01 to June 30, 2020 as compared with Rs3.927 billion in the same period of the last fiscal year.

The bank also declared earning per share of Rs10.32 for the period under review as compared with EPS Rs2.53 declared in the same period of the last year.

The net mark-up income/interest income of the bank surged by 32 percent to Rs63.075 billion during first half for the period ended June 30, 2020. The bank declared Rs47.7 net interest income in the same period of the last year.

The bank also paid income tax amounting Rs10.64 billion during January – June 2020 as compared with Rs5.96 billion in the corresponding period of the last fiscal year.

The HBL declared Rs11.08 billion net profit for the quarter April – June 2020 as compared with Rs749 million declared in the same quarter of the last year.

Net interest income of the bank increased to massive Rs10.86 billion during the quarter under review as compared with Rs1.3 billion in the corresponding period of the last year.

-

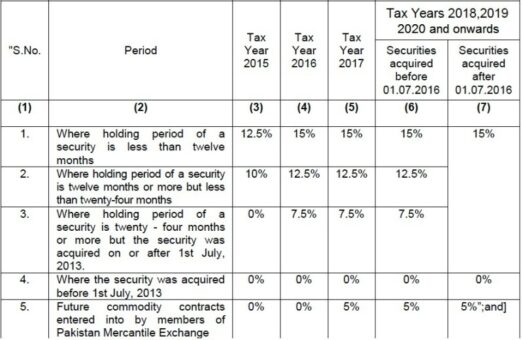

Rate of capital gains tax on disposal of securities

KARACHI: Following is the rate of capital gains tax on disposal of securities after the amendment made through Finance Act, 2020.

Officials at the Federal Board of Revenue (FBR) said that the rate of capital gains tax had been kept unchanged for tax year 2021 and subsequent years.

Provided that the rate of tax on cash settled derivatives traded on the stock exchange shall be 5 percent for the tax years 2018 to 2020.

Provided that the rate for companies shall be as specified in Division II of Part I of First Schedule, in respective of debt securities;

Provided further that a mutual fund or a collective investment scheme or a REIT scheme shall deduct Capital Gains Tax at the rates as specified below, on redemption of securities as prescribed, namely:—

Category Rate Individual and association of persons 10 percent for stock funds 10 percent for other funds Company 10 percent for stock funds 25 percent for other funds Provided further that in case of a stock fund if dividend receipts of the fund are less than capital gains, the rate of tax deduction shall be 12.5 percent:

Provided further that no capital gains tax shall be deducted, if the holding period of the security is more than four years.”

Explanation.- For removal of doubt, it is clarified that, the provisions of this proviso shall be applicable only in case of a mutual fund or collective investment scheme or a REIT scheme.

-

KE starts updating information of industrial, commercial consumers for tax purpose

KARACHI: K-Electric has launched updating details of industrial and commercial consumers, which is mandatory under income tax law.

The company, which is providing electricity to 2.5 million consumers including residential, commercial, industrial and agriculture, has asked the consumers to update their details through an electronic form along with providing details of CNIC and NTN.

The K-Electric said that pursuant to Section 181AA of Income Tax Ordinance, 2001 all entities with industrial and commercial electricity connections are required to maintain a National Tax Number (NTN) issued by the Federal Board of Revenue (FBR).

In order to comply with the above-mentioned law, KE is updating its customer information database and in this regard we request you to share your NTN and CNIC numbers at earliest for our record.

The power utility asked the consumers to provide details, included: name, CNIC, consumer number, mobile number, NTN, email address and occupancy.

-

Power generation eases by one percent in FY20

KARACHI: Power generation in Pakistan declined by one percent YoY to 121,867 GWh (23,618 MW) during FY20 as compared to 122,708 GWh (23,781 MW) in FY19 due to overall slow economic activity during the year and the impact of COVID-19 related lockdowns and restrictions during Mar-May 2020, analysts said on Thursday.

The analysts at Topline Securities said that power mix during FY20 moved in favor of Hydel (32 percent in FY20 against 26 percent in FY19) and Coal (21 percent in FY20 against 13 percent in FY19), replacing Gas (12 percent in FY20 against 18 percent in FY19) and Furnace Oil based generation (3 percent in FY20 against 7 percent in FY19).

RLNG contributed 20 percent to the overall power mix, with Nuclear and Wind based generation clocking in at 8 percent and 2 percent, respectively during the year.

Coal power generation has increased due to the commencement of China Hub Power Generation (1,220 MW) and Engro Powergen Thar (660 MW), while Hydel power generation increased due to improved availability of water amidst higher water availability during the year.

The demand for Furnace Oil and Gas based power fell due to their higher cost of producing power, which resulted in their respective decline in merit order list.

The installed Capacity in the country touched 34,157MW in Jun-2020 compared to 30,590 MWin Jun-2019.

Power Generation started to decline in Mar-2020 (down by 9 percent YoY to 6,911 GWh from 7,621 GWh in Mar-2019) largely due to COVID-19 related lockdowns and restrictions.

A similar trend was also witnessed in Apr-2020 and May-2020 as Power Generation declined by 14 percent YoY and 5 percent YoY, respectively.

However, encouragingly Power Generation has picked up, though up 1 percent YoY, it is has almost double (+92 percent) from the low recorded in Mar-2020.

With industries opening up post COVID-19 lockdown and subsequent pick up in economic activity, we expect demand for Power to increase from here forth.

The average fuel cost was down by 3 percent YoY to Rs5.97/KWh in FY20 compared to Rs6.13/KWh in FY19.

This is mainly due to increase in Hydel based generation by 20 percent YoY (no fuel cost) and increased in coal based power generation at a lower cost of Rs6.1/Kwh.

-

Foreign exchange reserves increase to $19.047 billion

KARACHI: Pakistan’s liquid foreign exchange reserves have increased by $95 million to $19.047 billion by week ended July 17, 2020, State Bank of Pakistan (SBP) said on Thursday.

The foreign exchange reserves of the country were at $18.952 billion by week ended July 10, 2020.

The official reserves held by the central bank increased by $66 million to $12.121 billion by week ended July 17, 2020 as compared with $12.055 billion a week ago.

Similarly, the foreign exchange reserves held by commercial banks improved by $29 million to $6.926 billion from $6.897 billion a week ago.