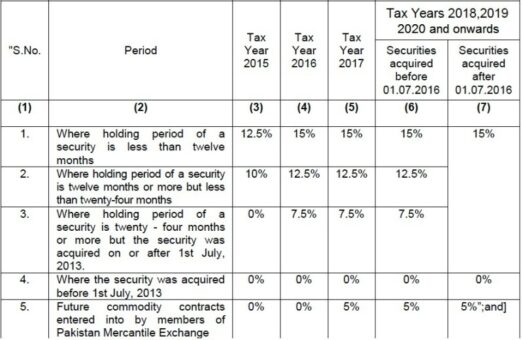

KARACHI: Following is the rate of capital gains tax on disposal of securities after the amendment made through Finance Act, 2020.

Officials at the Federal Board of Revenue (FBR) said that the rate of capital gains tax had been kept unchanged for tax year 2021 and subsequent years.

Provided that the rate of tax on cash settled derivatives traded on the stock exchange shall be 5 percent for the tax years 2018 to 2020.

Provided that the rate for companies shall be as specified in Division II of Part I of First Schedule, in respective of debt securities;

Provided further that a mutual fund or a collective investment scheme or a REIT scheme shall deduct Capital Gains Tax at the rates as specified below, on redemption of securities as prescribed, namely:—

| Category | Rate |

| Individual and association of persons | 10 percent for stock funds 10 percent for other funds |

| Company | 10 percent for stock funds 25 percent for other funds |

Provided further that in case of a stock fund if dividend receipts of the fund are less than capital gains, the rate of tax deduction shall be 12.5 percent:

Provided further that no capital gains tax shall be deducted, if the holding period of the security is more than four years.”

Explanation.- For removal of doubt, it is clarified that, the provisions of this proviso shall be applicable only in case of a mutual fund or collective investment scheme or a REIT scheme.