Section 193 of Income Tax Ordinance, 2001, updated up to June 30, 2021, now emphasizes that a taxpayer may face two years imprisonment on failure to keep record.

(more…)Day: September 21, 2021

-

Two years jail for income concealment

Income Tax Ordinance, 2001 has specifically outlined two years jail for concealment of income. Section 192A of the Income Tax Ordinance, 2001, as amended through the Finance Act, 2021 and updated until June 30, 2021, outlines serious legal consequences for concealment of income. According to this provision, any individual who deliberately hides their income or provides inaccurate details during tax proceedings can face strict legal action.

(more…) -

KIBOR rates on September 21, 2021

KARACHI: State Bank of Pakistan (SBP) on Tuesday issued the following Karachi Interbank Offered Rates (KIBOR) on September 21, 2021.

Tenor BID OFFER 1 – Week 7.20 7.70 2 – Week 7.24 7.74 1 – Month 7.28 7.78 3 – Month 7.44 7.69 6 – Month 7.66 7.91 9 – Month 7.81 8.31 1 – Year 8.00 8.50 -

KSE-100 index plunges 519 points amid selling

KARACHI: The benchmark KSE-100 index of the Pakistan Stock Exchange (PSX) plunged by 519 points on Tuesday due to across-the-board selling on closing.

The benchmark index ended at 46,009 points as against the previous day’s close of 46,528 points.

Analysts at Arif Habib Limited said that the market posted an increase of 305 points during the session early on, however lost that gain and by the end of session lost a total of 1055 points (including the erosion of 305 points earned earlier).

At closing, the market saw a steep decline. Selling was witnessed across the board, with heavy implications on Technology and Cement sectors.

Despite low leverage level in the market in DFC, MTS and MFS segments, index melted due to calls of redemption at Mutual Funds.

Regardless of the steep decline in Index, overall trading volumes remained low compared to the hay days seen in outgoing fiscal. Among scrips, TELE realized trading volumes of 28.1 million shares, followed by WTL (26.4 million) and TPL (21.4 million).

Sectors contributing to the performance include Cement (-101 points), Technology (-81 points), Banks (-45 points), Fertilizer (-39 points) and E&P (-34 points).

Volumes increased from 194.7 million shares to 325.9 million shares (+67 per cent DoD). Average traded value also increased by 53 per cent to reach US$ 73.1 million as against US$ 47.9 million.

Stocks that contributed significantly to the volumes include TELE, WTL, TPL, BYCO and TRG, which formed 33 per cent of total volumes.

Stocks that contributed positively to the index include HMB (+18 points), MCB (+18 points), BAFL (+14 points), ANL (+14 points) and COLG (+7 points). Stocks that contributed negatively include SYS (-53 points), MEBL (-37 points), HBL (-34 points), LUCK (-32 points) and TRG (-23 points).

-

Rupee gains 20 paisas against dollar

KARACHI: The Pak Rupee (PKR) gained of 20 paisas against the dollar on Tuesday. The rupee ended Rs168.52 to the dollar from previous day’s closing of Rs168.72 in the interbank foreign exchange market.

Currency experts said that the market witnessed inflows of exports receipts and workers’ remittances during the day.

They said that the external payment pressure had kept the higher demand for the greenback. The experts said that due to quarter ending dollar demand for external payment of import and corporate payments remained high.

The country has posted a current account deficit and trade deficit during the first two months of the current fiscal year, which also put pressure on dollar demand.

-

SBP issues customers exchange rates for September 21

Karachi, September 21, 2021 – The State Bank of Pakistan (SBP) has issued the exchange rates for customers on Tuesday, September 21, 2021.

(more…) -

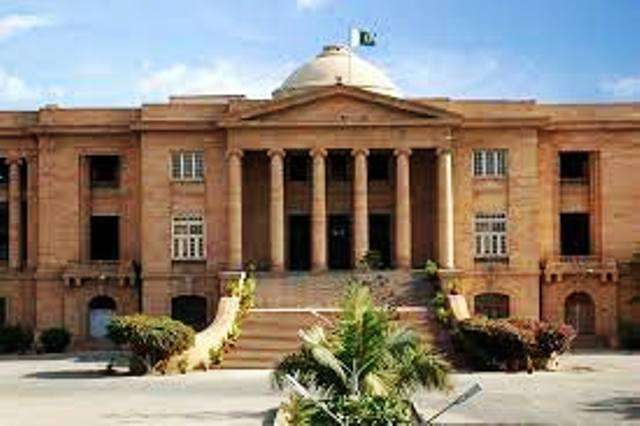

SHC dismisses petition challenging SRB show cause

KARACHI: Sindh High Court (SHC) has dismissed a petition filed by Hum Network Limited for a grant of relief against a show cause issued by the Sindh Revenue Board (SRB).

A division bench of the SHC in a case C.P.No.D-3735 of 2016, observed: “We are of the considered view that instant petition is misconceived and not maintainable for having been filed on mere issuance of show casue notice, which prime facie does not suffer from any jurisdictional defect or patent illegality, whereas, the objections raised by the petitioner through instant petition can be agitated before the statutory forums while submitting the response/reply to the impugned show cause notice in accordance with law.”

Accordingly, the petition has been dismissed. The bench has also made reference to its short order issued on February 12, 2019, in the following terms:

“For reasons to be recorded later, the instant petition is dismissed along with the listed application for being not maintainable. The petitioner may, however, be at liberty to raise all such legal and factual grounds before the respondent, including the ground of jurisdiction, which shall be considered and decided by the respondents strictly in accordance with law, whereas, an opportunity of being heard shall be provided to the petitioner before passing any adverse order against the petitioner.”

Hum Tv Network, the petitioner, is a public limited company operating satellite TV channels engaged in the business of production, advertisement, entertained and media marketing, had challenged a show cause notice issued by an official of the SRB before the SHC on the ground that the same was malafide, illegal and was issued without jurisdiction and lawful authority.

The show cause notice was issued by the official of the SRB under Section 23(2) read with Section 23(1A) of the Sindh Sales Tax on Services Act, 2011 for the periods from July 2011 to June 2012, July 2012 to June 2013, July 2013 to June 2014 and July 2014 to June 2015.

The petitioner prayed that the show cause notice was issued without jurisdiction and lawful authority, as the notice issuing officer belonged to Unit-21 Commissioner-IV, had not jurisdiction over the case as the authority over ‘Withholding of Sindh Sales Tax Act’ was with the Assistant Commissioner (unit-22).

The petitioner had also raised objection that in absence of any audit proceedings or inquiry pending against a registered persons, impugned notice cannot be issued.

The counsel for the respondents (SRB) argued that the constitutional petition was not maintainable against Show Cause Notice as the same had not suffer from any jurisdictional defect or patent illegality.

The SHC was informed that the petitioner had been given plenty of time on request of extension for reply. But the petitioner instead giving reply preferred to approach the court.

-

Exchange rates in PKR vs foreign currencies on Sept 21

KARACHI: Following are the exchange rates of foreign currencies in Pak Rupee (PKR) on September 21, 2021 (The rates are updated at 09:00 AM):

Currency Buying Selling Australian Dollar 120.50 122.5 Bahrain Dinar 386.60 388.36 Canadian Dollar 133.50 135.50 China Yuan 23.70 23.85 Danish Krone 23.40 23.70 Euro 197.50 199.50 Hong Kong Dollar 16.60 16.85 Indian Rupee 2.03 2.10 Japanese Yen 1.41 1.44 Kuwaiti Dinar 481.50 484.00 Malaysian Ringgit 36.40 36.75 NewZealand $ 96.25 96.95 Norwegians Krone 17.45 17.70 Omani Riyal 392.50 394.50 Qatari Riyal 39.70 40.30 Saudi Riyal 44.65 45.30 Singapore Dollar 122.75 124.00 Swedish Korona 18.10 18.35 Swiss Franc 159.60 160.50 Thai Bhat 4.80 4.90 U.A.E Dirham 46.00 46.50 UK Pound Sterling 232.50 235.50 US Dollar 169.00 170.00 Disclaimer: Team PKRevenue.com provides the available rates of the open market, which are subject to change every hour. Team PKRevenue.com provides the available exchange rates at the time of posting the story. So the team is not responsible for any inaccuracy of the data.