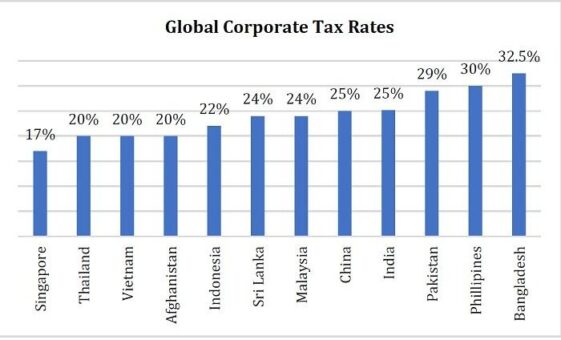

KARACHI: Tax rates are key element for any prospective investors, including foreign investors and key influencers in attracting foreign direct investment (FDI).

Overseas Investors Chamber of Commerce and Industry (OICCI) in its proposals for budget 2022/2023 sent to Federal Board of Revenue (FBR) said that the tax environment and tax rates are key consideration for any prospective investors, including foreign investors and amongst the key influencers in attracting FDI into a country.

READ MORE: KTBA recommends separate tax fraud proceedings

The OICCI, the representative body of the foreign investors operating in Pakistan, submitted the following proposals for budget 2022/2023:

Simplify the complex system of determining the corporate tax liability by:

a. Abolishing ACT (Alternative Corporate Tax);

b. Revamping the MTR (Minimum Tax Regime)

c. Doing away with undue recurring audit/ examinations/ reviews and recovery proceedings.

d. A number of Ease of Doing Business (EODB) and simplification of tax paying process issues can be addressed by the introduction of:

READ MORE: FBR urged to remove irritants in sales tax refund

i. Simplifying the procedures and forms for filing the sales tax and income tax return.

ii. One form for reporting all the tax liability in the country, including for FBR, and provincial revenue authorities, with efficient inter-revenue authorities’ coordination. Single Sales Tax return has not been fully implemented.

Tax policies should be predictable, transparent, and consistent. The policies should be implemented for long term to facilitate and protect longer term investment plans of local and foreign investors. No new taxes levied during the year except removing harsh anomalies – no supplementary budgetary measures.

The withholding tax regime continues to be a key irritant for most taxpayers, especially the manufacturing and services sector, and negatively impacts EODB.

READ MORE: Unified sales tax law for all tax authorities sought

Tax compliant sector provides FBR with information of registered/unregistered businesses, which FBR should use as a tool for broadening tax net. However, FBR unfairly penalizes these commercial organization by disallowing their legitimate expenses and input Sales tax through measures like those covered u/s 21(q) of Income Tax Ordinance, 23(1) and 8(1)(h) & (J) of Sales Tax Act.

Revenue Targets for field formations should be in line with the business growth trends. Unrealistic targets leads to harassment of compliant tax payers.

READ MORE: Proposals for recovery of sales tax on bad debts

To encourage investment in manufacturing facilities, incentives provided previously through various “tax credits” under section 65, should be restored.

OICCI will continue to emphasize on value creation through transparent and strong enforcement measures designed to facilitate compliant taxpayers and punish tax evaders. Furthermore, the value addition of our members should not only be measured from tax collection basis but also on the basis of creating livelihoods, promoting sustainable business model and supporting a tax compliant echo system.