KARACHI: The Federal Board of Revenue (FBR) has been suggested to gradually reduce the corporate tax rate from existing 29 per cent to 25 per cent.

Overseas Investors Chamber of Commerce and Industry (OICCI), a representative body of foreign investors operating in Pakistan, in its proposals for budget 2022/2023 proposed that the FBR should continue the previously announced policy to annually reduce the tax rate from 29 per cent to eventually to rate of 25 per cent, including banking companies.

READ MORE: Tax rates key element to attract foreign direct investment

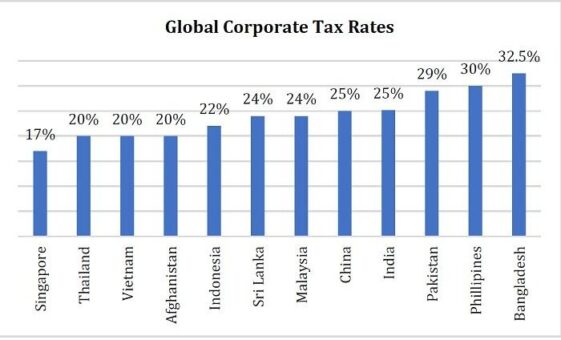

The corporate tax rate in Pakistan, at 29 per cent is higher than most of the regional countries, as can be noted from the table here.

Companies are required to pay various taxes in addition of income tax i.e., WWF (2 per cent), WPPF (5 per cent), Stamp Duty, Infra structure Cess (1.2 per cent) etc. which ultimately result in effective tax rate of around 35 per cent to 45 per cent which is far greater than effective tax rates of other countries in the region.

READ MORE: KTBA recommends separate tax fraud proceedings

Earlier, the OICCI informed the FBR that the tax rates are key element for any prospective investors, including foreign investors and key influencers in attracting foreign direct investment (FDI).

It said that the tax environment and tax rates are key consideration for any prospective investors, including foreign investors and amongst the key influencers in attracting FDI into a country.

The OICCI, the representative body of the foreign investors operating in Pakistan, submitted the following proposals for budget 2022/2023:

Simplify the complex system of determining the corporate tax liability by:

a. Abolishing ACT (Alternative Corporate Tax);

READ MORE: FBR urged to remove irritants in sales tax refund

b. Revamping the MTR (Minimum Tax Regime)

c. Doing away with undue recurring audit/ examinations/ reviews and recovery proceedings.

d. A number of Ease of Doing Business (EODB) and simplification of tax paying process issues can be addressed by the introduction of:

i. Simplifying the procedures and forms for filing the sales tax and income tax return.

READ MORE: Unified sales tax law for all tax authorities sought

ii. One form for reporting all the tax liability in the country, including for FBR, and provincial revenue authorities, with efficient inter-revenue authorities’ coordination. Single Sales Tax return has not been fully implemented.