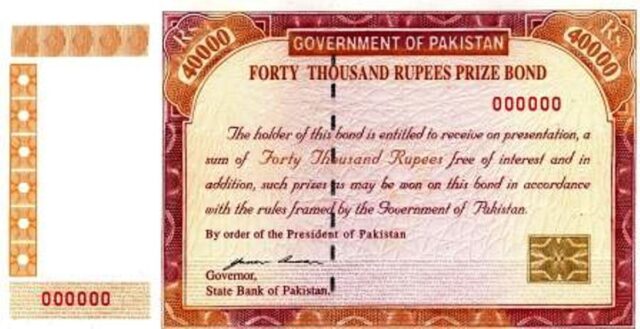

KARACHI: The investment in premium prize bonds of Rs40,000 denomination has increased by over 46 percent as the government stopped the circulation of bearer bonds of same denomination and launched campaign to document the economy.

According to statistics released by State Bank of Pakistan (SBP) the total investment into premium prize bonds of Rs40,000 denomination increased to Rs7.665 billion by end of June 2019 as compared with Rs5.245 billion in same month of the last year.

The premium prize bonds were launched by the government in March 2019 with the aim to bring undocumented money into the mainstream economy.

According to salient features of the premium bonds issued by Central Directorate of National Savings (CDNS):

— The bond is available in Rs40,000 denomination

— Registered in the name of investor.

— Quarterly prize money draws as well as bi-annual profit payment.

— For individuals, public and private sector institutions except banks, insurance companies and mutual funds.

— Direct credit and prize money and profit in investors bank account.

— No Application Forms required for claiming prize money & profit.

— Unlimited Investment and Tenure.

— WHT applicable and Exempt from Zakat.

— Transferable and Pledge-able.

— Can be purchased through Cash, Cheque, Pay-Order and Bank Draft

— Can be purchased from offices of State Bank of Pakistan Banking Services Corporations.

The growth in premium prize bonds investment is much faster in the month of June 2019 as compared with the previous month due to the government announcement to stop the circulation of bearer bonds of Rs40,000 denomination.

The investment in Rs40,000 prize bonds denomination grew by 24 percent to Rs7.665 billion in June 2019 as compared with Rs6.17 billion in May 2019.

The government on June 24, 2019 notified withdrawal of Rs40,000 denomination national prize bonds from circulation.

On the same date the State Bank of Pakistan (SBP) issued instructions to chief executives and banks of all banks for compliance.

The SBP instructed:

(a) National Prize Bonds of Rs40,000 denomination shall not be sold after June 24, 2019 and will not be encashed/redeemed after March 31, 2020.

(b) No further draws of Rs40,000 denomination national prize bonds shall be held.

(c) Cash payment for encashment of bonds is ‘Not’ allowed. However, the bond holder(s) shall have the following options to replace/encash the bonds:

1. Conversion of Premium Prize Bonds (Registered)

2. Replacement with Special Saving Certificate (SSC)/Defence Savings Certificate (DSC)

3. Encashment at Face Value.

The SBP also issued Standard Operating Procedure (SOP) for conversion to premium prize bonds (registered).

i. The bonds can be converted to premium prize bonds (registered) through the 16 field offices of SBP Banking Services Corporation, and authorized branches of six commercial banks i.e. National Bank of Pakistan, Habib Bank Limited, United Bank Limited, MCB Bank Limited, Allied Bank Limited and Bank Alfalah Limited.

ii. The bond holder shall be required to submit a written request for conversion of bearer bonds to premium prize bonds (registered) to be registered in his/her name on the prescribed application form.

iii. The bond holder shall also be required to submit prescribed application form for registration/purchase of premium prize bonds as per the procedure in vogue.

The SBP also issued procedure for replacement with Special Saving Certificate (SSC)/Defence Savings Certificate (DSC).

i. The bonds can be replaced with SSC/DSC through the 16 field offices of SBP Banking Services Corporation, authorized commercial banks and National Saving Centers.

ii. All authorized commercial banks shall therefore, accept requests for replacement of bearer bonds with SSC or DSC on the prescribed application form.

iii. The bond holder shall also be required to submit application form for purchase of SSC/DSC as per the prescribed procedure.

The SBP issued procedure for encashment at face value and said that the bonds will only be encashed by transferring the proceeds to the bond holder’s bank account through the 16 field offices of SBP banking services corporation as well as the authorized commercial bank branches.

The SBP further said that all commercial banks shall receive request for encashment of bearer bonds on the prescribed application form.

The SBP said that the prize bonds encashed/replaced by general public may be surrendered to concerned SBP BSC office through respective regional office of the commercial bank. For the purpose, the regional office may intimate the SBP BSC office three days in advance so that necessary arrangements for receipt of the bonds can be made.

Related Posts

Investment in saving certificates rises by 19 percent to Rs2,217 billion