The State Bank of Pakistan (SBP) has highlighted in its half-yearly report for July to December 2023-24 that Pakistan increased domestic petroleum prices despite a global downturn in oil markets.

(more…)Author: Shahnawaz Akhter

-

MSCI Adds National Bank of Pakistan to Frontier Market Index

In a significant development for Pakistan’s financial market, MSCI has announced the inclusion of National Bank of Pakistan (NBP) in its Frontier Market Index during the May 2024 index review.

The addition of NBP marks a notable milestone for Pakistan’s banking sector and underscores the country’s growing prominence in frontier market indices. According to Mohammad Sohail, CEO of Topline Securities Limited, the inclusion of NBP, along with an increase in the free float market capitalization of existing 20 constituents by approximately 12%, is expected to boost Pakistan’s weight in the Frontier Market Index by 30-40 basis points, reaching 4.0-4.3%.

Furthermore, Pakistan’s weight in the MSCI Small Cap Index is also anticipated to rise, despite no additional scrips being added to the index. This increase is attributed to the impressive performance of existing 56 constituents, which have delivered a remarkable 16% return in USD terms since the last review in February 2024, compared to a 5% decline in the MSCI Frontier Market Small Cap Index. The estimated increase in Pakistan’s weight in the Small Cap Index is projected to be in the range of 50-60 basis points, reaching 3.4-3.5%.

Analysts estimate that the changes in the overall weight and the addition of NBP to the Frontier Market Index could lead to gross inflows of approximately US$30-40 million. This projection is based on an assessment of assets under management (AUMs) benchmarked to the MSCI Frontier Market Index, which currently stand at around US$10 billion, with a free float of US$119 billion.

Foreign investment activity in Pakistan’s equity market has been notable in recent weeks. Since May 2, 2024, foreign corporates have already purchased shares worth US$34.4 million and sold shares worth US$20.7 million. This buying pattern suggests a growing interest among foreign investors in Pakistani equities.

Looking ahead, it is anticipated that Pakistan will continue to attract foreign investment leading up to the implementation date of the index changes, scheduled for June 3, 2024. The partial influx of funds observed in recent weeks indicates that the market has already begun to factor in the anticipated inflows resulting from the MSCI index adjustments.

Overall, the inclusion of NBP in the MSCI Frontier Market Index reflects positively on Pakistan’s financial market and underscores its attractiveness to international investors. As Pakistan’s market weight increases in key indices, stakeholders remain optimistic about the country’s economic prospects and its ability to attract foreign investment in the long term.

-

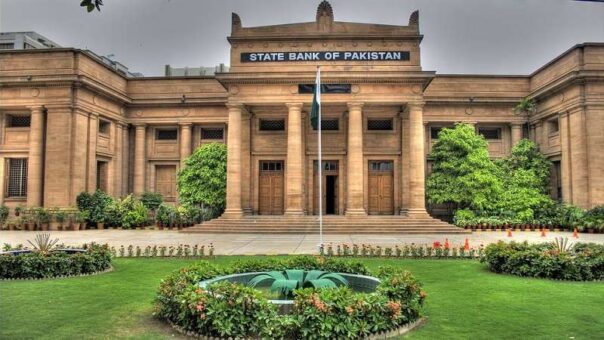

SBP Raises Red Flag on FBR’s Impressive Collection Growth

Karachi, May 14, 2024 – The State Bank of Pakistan (SBP) has cast doubt on the celebrated revenue collection growth reported by the Federal Board of Revenue (FBR), especially at a time of soaring inflation and steep rupee depreciation.

(more…) -

SBP Projections Indicate Missed 2023-24 Fiscal Year Targets

Karachi, May 14, 2024 – The State Bank of Pakistan (SBP) has released projections suggesting that several targets set by the government for the fiscal year 2023-24 are likely to be missed, with notable concerns surrounding GDP growth and fiscal deficit.

(more…) -

Deadline Approaches for Unregistered Prize Bonds in Pakistan

With the expiration date looming, holders of unregistered or bearer prize bonds in Pakistan are urged to take action before the window for redemption or exchange closes next month.

(more…) -

FPCCI Urges Urgent Reopening of Chaman Border

Karachi, May 13, 2024 – The Federation of Pakistan Chambers of Commerce and Industry (FPCCI) has called for the immediate reopening of the Chaman Border to facilitate seamless transportation and alleviate the hardships faced by traders and communities on both sides of the border.

(more…) -

Salaried Class Bears Excessive Tax Burden in Pakistan: OICCI

Karachi, May 13, 2024 – Startling revelations by foreign investors operating in Pakistan have shed light on an alarming fiscal trend: the salaried class is shouldering a disproportionate tax burden, eclipsing the combined contributions of exporters and retailers.

(more…) -

ATL Expands to 4.22 Million Amid SIM Blocking Fears

Karachi, May 13, 2024 – The Active Taxpayers List (ATL) has surged to 4.22 million individuals as the looming threat of SIM card blocking for non-compliance compelled previously non-compliant citizens to make tax filings, sources disclosed on Monday.

(more…) -

OICCI Demands Development of Sales Tax Laws for Distributors

Karachi, May 13, 2024 – The Overseas Investors Chamber of Commerce and Industry (OICCI) has urged the development of policy guidelines for sales tax laws on distributors, emphasizing the need for collaboration and coordination among federal and provincial tax regulators.

(more…) -

Foreign Investors Demand Elimination of Super Tax

Karachi, May 12, 2024 – Foreign investors operating in Pakistan have issued a fervent plea to authorities to eliminate the super tax as part of the budget for the fiscal year 2024-25.

(more…)