Islamabad, August 9, 2024 – In a significant stride towards Pakistan’s digital future, Huawei, under the dynamic leadership of Prime Minister Muhammad Shehbaz Sharif, has launched an ambitious training program aimed at empowering 300,000 students across the country.

(more…)Author: Web Desk

-

LTO Karachi Snags Rs 575 Million from High-Profile Builder

Karachi, August 6, 2024 — The Large Taxpayers Office (LTO) Karachi, the Federal Board of Revenue’s (FBR) largest tax collection unit, has achieved a significant victory by attaching bank accounts for recovery of Rs 575 million from a renowned builder.

(more…) -

Government Collects Rs 1.02 Trillion Petroleum Levy in FY24

Karachi, July 31, 2024 – The Ministry of Finance announced on Wednesday that the government collected a staggering Rs 1.02 trillion as petroleum levy during the fiscal year 2023-24.

(more…) -

Stricter Tax Regulations for Foreign Businesses in Pakistan

Karachi, July 31, 2024 – Pakistan has introduced stricter tax rules for non-residents with substantial business activities within the country. This initiative, driven by the Federal Board of Revenue (FBR), aims to capture a larger share of revenue from global entities benefiting from the Pakistani market.

(more…) -

SRB Notifies Sales Tax Rates for Property Services in TY2025

Karachi, July 23, 2024 – The Sindh Revenue Board (SRB) has notified new sales tax rates for services related to immovable property for the tax year 2024-25.

(more…) -

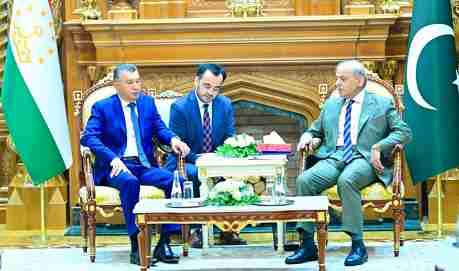

Pakistan Offers Tajikistan Use of Karachi Port for Transit Trade

Karachi, July 3, 2024 – In a significant move to boost regional trade and connectivity, Prime Minister Muhammad Shehbaz Sharif extended an invitation to Tajikistan to utilize Karachi Port for transit trade.

(more…) -

Pakistan’s 2024-25 Budget: Tough Choices and Limited Relief

Pakistan’s upcoming budget for the 2024-25 fiscal year is shaping up to be a challenging one, with analysts at Insight Research predicting a focus on long-term reforms over populist measures.

(more…) -

Gold and Silver Prices in Pakistan on May 26, 2024

The latest prices for gold and silver in Pakistan, as of 9:00 AM on May 26, 2024, have been updated and are as follows, along with the previous closing prices in the bullion market:

(more…) -

FBR Advised to Hike Tax for Non-ATL Electricity Consumers

Karachi, April 25, 2024 – In a recent move to widen the tax base, the Federal Board of Revenue (FBR) has been advised to increase the tax rates for residential electricity consumers not listed on the Active Taxpayers List (ATL).

(more…)