PESHAWAR: The Khyber Pakhtunkhwa Government on Friday presented budget 2020/2021 with total outlay of Rs 923billion. The budget is a tax free and with an amount of Rs104 billion allocated for Annual Development Plan (ADP) for the next fiscal year.

(more…)Category: Budget 2020-2021

-

KCCI submits recommendations to rectify anomalies in Finance Bill 2020

KARACHI: The Karachi Chamber of Commerce and Industry (KCCI) has submitted its recommendations to rectify anomalies in the Finance Bill 2020, highlighting concerns over several taxation measures impacting trade and industry.

(more…) -

Reduction in rental income expense limit to encourage under-reporting

Presently, expenses incurred to the extent of 6 percent of rent chargeable wholly and exclusively for deriving rent are admissible as deduction against rental income.

The Bill proposed to reduce the limit from 6 percent to 2 percent.

The experts said that further reducing such limit would deprive a taxpayer for claiming a legitimate expense incurred solely for deriving taxable income and would ultimately lead to higher tax payable by the taxpayer. “It may encourage taxpayers to under-report their taxable income on the grounds that their legitimate expenses are disallowed,” experts at Deloitte Yousuf Adil Chartered Accountants said.

Presently, income from property derived by an individual or an Association of Persons is subject to tax at the specified slab rates and treated as a separate block of income.

However, individuals or AOPs whose income from property exceeds Rs 4 million per annum can opt to claim deductions under section 15A of the Ordinance and pay tax at normal rates specified in Division I of Part I of the First Schedule.

The Bill proposed to abolish such limit of Rs. 4 million and therefore an individual or AOP can now opt for claiming tax deductions and pay tax at normal rates irrespective of amount of income derived from property.

-

PRA empowered to arrest tax defaulters, imprison for six months

LAHORE: Punjab Revenue Authority (PRA) has been empowered to arrest defaulters and imprison for six months for making recovery of outstanding tax.

The Punjab Finance Bill, 2020 has proposed to empower PRA in certain provisions of Punjab Sales Tax Act, 2012 for making recovery of outstanding tax.

According to interpretation of Punjab Finance Bill, 2020 by PwC A. F. Ferguson, the bill proposes to empower tax authorities whereby they may also require a financial institution or banking company to make payment of tax due from a registered person out of running and demand finance extended to the registered person.

By way of insertion of clause (g) to section 70 of the Act, it also empowers the department to arrest a defaulter and imprison him for not more than six months where a tax demand has been upheld by the Appellate Tribunal.

No action is presently taken where a person deposits at least 25 percent of the tax demand during pendency of an appeal. It is proposed to reduce this limit to 10 percent of the tax demand. This is a positive amendment.

The amendments relating to administrative and procedural matters are summarized as under:

— The power of the PRA to de-register a person is proposed to be devolved to the Commissioner.

— The PRA is being authorized to specify format of invoices to be issued by a registered person or class of registered persons and to prescribe a procedure for authentication of such invoices.

— The PRA or authorized officer may require any registered person or class of registered persons to issue invoices electronically and transmit such invoices to PRA in the prescribed manner.

— To streamline audit proceedings, it is proposed to empower officers to conduct audit proceedings electronically through video links or any other facility as may be notified by PRA.

— It is proposed to empower even officers, below the rank of an Assistant Commissioner, to call for information or documents regarding any enquiry or audit.

Earlier, only an Assistant Commissioners or Officers with higher ranks may call for such information.

— To facilitate taxpayers, it is proposed that appeal before the Commissioner (Appeals) may also be filed through electronically.

— The period of filing an appeal before the appellate tribunal is proposed to enhance from 30 days to 60 days.

-

Punjab enlists records to be maintained by taxpayers

LAHORE: The service providers falling under the jurisdiction of Punjab Revenue Authority (PRA) are required to maintain records enlisted through provincial Finance Bill, 2020.

(more…) -

Sindh Budget 2020-2021 at a glance

KARACHI: The Sindh government on Wednesday presented budget for fiscal year 2020/2021. The following is budget at a glance:

-

Sindh unveils Rs1.2 trillion budget 2020/2021 with no new tax, 10 percent salary increase

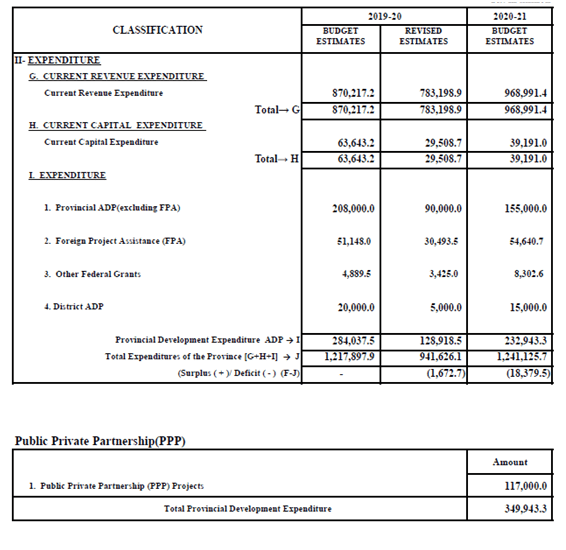

KARACHI: Sindh Chief Minister Syed Murad Ali Shah on Wednesday presented Rs1.2 trillion provincial budget 2020/2021 with announcing no new tax and increase of 10 percent salary of the provincial government employees.

On the floor of the house while delivering speech for budget 2020/2021, the chief minister said that the total outlay of budget for the next financial year 2020-2021 is Rs.1.2 trillion.

The total size of current revenue expenditure is Rs.968.9 billion.

“It is important to highlight here that for the next financial year, we have tried to align our Development as well as non-development expenditure priorities in line with the post COVID-19 situation,” the chief minister said.

He said that during financial year 2019-20, the province faced financial constraints due to COVID-19 which significantly affected development progress in the entire country. Sindh was no exception.

Government of Sindh budgeted Rs.284 billion as total development outlay in financial year 2019-2020, wherein Rs.208 billion were earmarked for Provincial ADP, Rs.20.0 billion for District ADP, Rs.51.0 billion in foreign projects assistance, and Rs.4.9 billion from Federal PSDP grant.

Looking at the financial constraints, stakeholder departments are likely to complete 425 schemes during 2019-20, 33 schemes less as compared to 458 completed in 2018-19.

“For the next financial year 2020-2021, the Administrative Departments in Sindh were earlier advised to prepare proposals for Provincial ADP 2020-21 at the size same as that of 2019-20 while allocating 85 percent for on-going schemes and 15 percent new schemes.

“However, in a post Covid-19 scenario, with a reduction in federal transfers and funding for development, the total development outlay for Sindh for the next financial year 2020-2021 is proposed at Rs.232.9 billion, allocating Rs.155.0 billion to Provincial ADP and Rs.15.0 billion to District ADP schemes.”

It would be pertinent to highlight that in this context Rs.54.6 billion are expected from Foreign Projects Assistance (FPA) and Rs.8.3 billion from Federal Government in Federal PSDP for 10 schemes under execution by Government of Sindh.

The government had earlier decided to keep the size of development budget for the next financial year 2020-21 for important sectors such as Education, Health, Social Safety & Poverty Reduction and Water & Sanitation nearly same as that of 2019-20. In exceptional cases such as Health, allocation has been increased from Rs.13.50 billion to Rs.23.50 billion in order to meet the challenges of COVID-19 situation.

The throw-forward amount in Provincial ADP 2020-2021 for 2209 schemes has reached at Rs.564.00 billion as compared to Rs.606.0 billion for 2705 schemes in 2019-2020.

Keeping in view above non-development and development expenditure priorities, the major milestone of our objectives are:

1. Exercise maximum austerity measures in our non-development expenditures.

2. Provide maximum resources for Health sector.

3. Enlarge substantially our social protection net through increased cash transfers to poverty inflicted people.

4. Provide ways and means for employment generation as well sustaining economic activity for the poorest of the poor, in rural as well as urban areas.

5. Continuing our focus on education, through increased allocations in financial year on development and non-development, despite huge resource constraints.

6. Fashion our development spending in sync with the above mentioned post Covid preferences with increased focus on Public Private Partnership (PPP) projects.

During his speech the chief minister said that the provincial government had decided not to introduce new tax in the budget 2020/2021.

Further, in order to provide relief the salary of provincial government employees has been increased by 10 percent for grade 1-16 and five percent for grate 17 and above.

-

Key points of amnesty scheme for real estate sector

KARACHI: The federal government has made amnesty granted to real estate sector to the part of Finance Bill, 2020 in order to get approval from the Parliament.

Deloitte Yousuf Adil Chartered Accountants in their budget explanations said that to stimulate investment in real estate and construction sector, a no-questions-asked amnesty has been introduced.

Under this amnesty the Federal Board of Revenue (FBR) has been restrained from asking question related to source of investment made into the real estate / construction business.

Both previous and current federal governments have launched tax amnesty schemes in 2018 and 2019, albeit the scope of this scheme is limited to investment made in construction sector only.

The proponent of this particular amnesty scheme argues that this would act as a catalyst to increase economic activity in the country thereby improving employment opportunities as number of sub-sectors and small and medium size industries are associated with construction industry.

The newly introduced scheme provides immunity from the provisions of section 111 of the Ordinance , and no questions will be asked regarding source of funds from investors making capital investment in new construction projects in the form of money or land, either as an individual, as an association of persons or a company, subject to conditions as explained below.

For individuals:

Monetary: Investor shall open a new bank account and deposit such amount in it on or before the 31st day of December, 2020

Land: Investor shall have the ownership title of the land at the time of commencement of the Tax Laws (Amendment) Ordinance, 2020

Corporate shareholder / Partner:

Monetary: Such amount shall be invested through a crossed banking instrument deposited in the bank account of such association of persons or company, as the case may be, on or before the 31st day of December, 2020

Land: Such land shall be transferred to such association of persons or company, as the case may be, on or before the 31st day of December, 2020. Provided that the person shall have the ownership title of the land at the time of commencement of the Tax Laws (Amendment) Ordinance, 2020

Registration: The Company or AOP shall be a single object company duly registered under the Companies Act, 2017 or Partnership Act, 1932 as the case may be.

Additional conditions to be met:

• Prescribed IRIS form shall be submitted by the person making investment.

• The investments made shall be wholly utilized in a project.

• Grey structure in case of builders and landscaping in case of developers have been completed on or before September 30, 2022, and duly certified by NESPAK or respective map approving authority.

• Further, for land developer, the following additional conditions should be met;

- 50 percent of plots have been booked for sale and 40 percent of sale proceeds thereof have been received by September 30, 2022 as duly certified by specified chartered accountancy firm.

- 50 percent of the project roads have been laid up to sub-grade level as duly certified by NESPAK.

• The value or price of the land or building shall be higher of

a) 130 percent of FBR assessed fair market value; or

b) At the option of person making investment, lower of the value determined by at least two independent SBP approved valuers.

Exclusion

The following incomes or persons are excluded from the relief provided under the amnesty scheme:

Holder of public office, benamidar or his spouse or dependents; or

Public Listed Company, real estate investment trust or any company whose income is exempt under the Ordinance.

Proceeds of crime including money laundering, terror financing excluding tax evasion.

Restriction of Ownership Changes

• Under the new amnesty, no change in ownership shall be allowed for incomplete projects except where 50 percent cumulative cost on the project has been incurred as certified by prescribed Chartered Accountants firm, with the exception of legal transmission to heirs.

• Inclusion of partners or shareholders after December 31, 2020 is permissible; however, such investors shall not be eligible to avail tax amnesty.

Amnesty to the purchaser

Provisions of section 111 shall also not apply to:

the first purchaser of a building or a unit in the building in respect of the purchase price both in case of new project or existing incomplete project where payment is routed through crossed banking instrument between the date of registration of project with the FBR and September 30, 2022.The purchaser of plot for building construction where the purchase, the payment thereof and commencement of construction has been made on or before December 31, 2020 subject to construction completion by September 30, 2022 and subject to registration of such purchaser with FBR on IRIS portal.

Thus no questions would be asked from the purchaser of building or plot regarding source of funds who complies with the above mentioned conditions.

-

FBR constitutes committees to remove anomalies in Finance Bill 2020

ISLAMABAD: Federal Board of Revenue (FBR) on Tuesday constituted two committees for identifying and removing anomalies in the Finance Bill, 2020.

The FBR issued two separate notifications for constituting the committees, which comprise FBR officials and representatives of business community.

Chairman of the first anomaly committee is Saqib Shirazi of Atlas Group.

The co-chairmen of the committee are Muhammad Javed Ghani, Member (Customs-Policy) and Dr. Hamid Ateeq Sarwar, Member (IR-Policy).

The other members of the committee are:

01. Ehsan Malik, Pakistan Business Council

02. Agha Shahab Khan, President, Karachi Chamber of Commerce and Industry (KCCI)

03. President, Khyber Pakhtunkhwa Chamebr

04. Abdul Samad, former president, Quetta Chamber of Commerce and Industry

05. Anjum Nisar, President, Federation of Pakistan Chamber of Commerce and Industry (FPCCI).

06. Zahid Shinwari, former president, Sarhad Chamber

07. Irfan Iqbal Sheikh, President, Lahore Chamber of Commerce and Industry (LCCI)

08. Amir Fayyaz, Former Chairman, All Pakistan Textile Mills Association (APTMA).

The FBR constituted the other technical anomaly committee. Ashfaq Tola, FCA, FCMA has been appointed as chairman of the committee.

The co-chairmen of the committee will be the same FBR officials of the first committee.

Other members of the committee are included:

01. Ali Jameel, FCA

02. Asif Haroon, FCA

03. Abdul Qadir Memon, President, Pakistan Tax Bar Association

04. Syed Yawar Ali, CEO, Pakistan Business Council

05. Mrs. Robina Ather, Chairperson, National Tariff Commission (NTC)

06. Muhammad Shahzad, ex-partner, A. F. Ferguson & Co.

07. Rashid Ibrahim, A. F. Ferguson & Co.

08. Khurram Mukhtar, Patron in Chief, PTEA.

The term of reference (TOR) for the committees is: to review the anomalies identified and submitted; and to advise FBR on removal of anomalies.

The FBR advised both the committees to submit the anomalies by June 19, 2020.

-

Restriction imposed on revising wealth statement

KARACHI: Taxpayers have been barred from revising their wealth statement after expiry of five years.

An amendment has been proposed to Income Tax Ordinance, 2001 through Finance Bill, 2020.

According to interpretation of Finance Bill, 2020 by Deloitte Yousuf Adil Chartered Accountants, presently, revision of wealth statement is allowed without a requirement to obtain approval of the Commissioner Inland Revenue, as is otherwise required for revision of return of income.

It is now proposed that such revision of wealth statement shall be contingent upon the similar approval of the Commissioner, which shall be granted, in case of bona fide omission or misstatement.

“However, no such revision is allowed after the expiry of five years from the due date of filing of return of return of concerned tax year.”

Another amendment has been proposed regarding assessment. The chartered accountants explained that currently where a taxpayer has furnished a return of income, the Commissioner Inland Revenue shall be treated to have made an assessment of taxable income and tax due thereon equal to amounts specified in the return.

Further, such return shall be taken for all purposes to be an assessment order issued by the Commissioner.

In order to ensure accuracy of the returns filed by taxpayers, automated adjusted assessment mechanism is being proposed.

Under this mechanism, the return filed shall be subject to an automatic review and adjustment within six months of filing of return for rectification of any numerical errors or incorrect claims, losses, deductible allowances or tax credit, or wrongful carry forward of losses that are apparent from the return of income.

In this regard, a notice shall be issued to the taxpayer before the adjustments are effected in the return, which is required to be responded within 30 days of the date of notice.

Further, where no such adjustments are made within the specified period of six months, the return filed shall be deemed to have been automatically adjusted on the day the return is filed and automatic intimation through IRIS shall be forwarded to the taxpayer.

The existing provisions as to deemed assessment order will now apply to adjusted return rather than the original return filed by the taxpayer.

For the purposes of this section, the following definition are proposed to be introduced vide Finance Bill 2021:

“Arithmetical Error” includes any wrong or incorrect calculation of tax payable including any minimum or final tax payable

“An incorrect claim apparent from any information in the return” shall mean a claim, based on an entry, in the return

i. of an item, which is inconsistent with another entry of the same or some other item in such return;

ii. regarding any tax payment which is not verified from the collection system; or

iii. in respect of a deduction, where such deduction exceeds specified statutory limit which may have been expressed as monetary amount or percentage or ratio or fraction.

The amended provision does not cater for situations where the tax payers have to make adjustments in the return due to inability of the online return form to cater to unique circumstances of the business of the taxpayer.

Application of this automated adjustment mechanism may create problems for the tax payers unless the online return is amended to cater for all situations that a tax payer may face in line with the provisions of law.