On September 06, 2022, the Xiaomi Redmi A1+ debuted in Pakistan, with its price varying based on the selected storage capacity by the user.

(more…)Category: IT & Telecom

Explore IT and Telecom stories with Pakistan Revenue, your go-to source for the latest updates on Pakistan’s technology and telecom sector. Stay ahead with real-time industry insights and economic developments.

-

Lava introduces Blaze 2 with 13MP AI Dual Rear Camera

Lava has today introduced Lava Blaze 2 – the latest addition to the Indian smartphone market with its impressive camera, sleek design, and long-lasting battery.

(more…) -

Oppo F21 Pro 5G exceeds price tag of Rs100,000

Oppo released the F21 Pro 5G in Pakistan on May 31, 2022, offering the phone with 128 GB of internal memory and 8 GB of RAM for Rs104,999.

(more…) -

Motorola unveils Moto G Power 5G with 50MP camera

Motorola has unveiled its latest addition to the G family lineup in North America, the new moto g power 5G.

(more…) -

Increased prices of iPhone 14 Pro from April 10

Pakistan saw the launch of the iPhone 14 Pro on September 29, 2022. As per the latest reports, the price of the device differs depending on the storage capacity chosen by the user.

(more…) -

Prices of Samsung Galaxy Z Fold 4 from April 10

The Samsung Galaxy Z Fold 4 made its debut in Pakistan on October 18, 2022, and its prices as of April 10, 2023, vary according to storage capacity, as shown below.

(more…) -

Elon Musk reverts Twitter logo back to bird symbol

Elon Musk – CEO of Twitter on Friday replaced the Twitter’s logo to the bird’s symbol. Previously the logo had been changed to the Doge symbol.

(more…) -

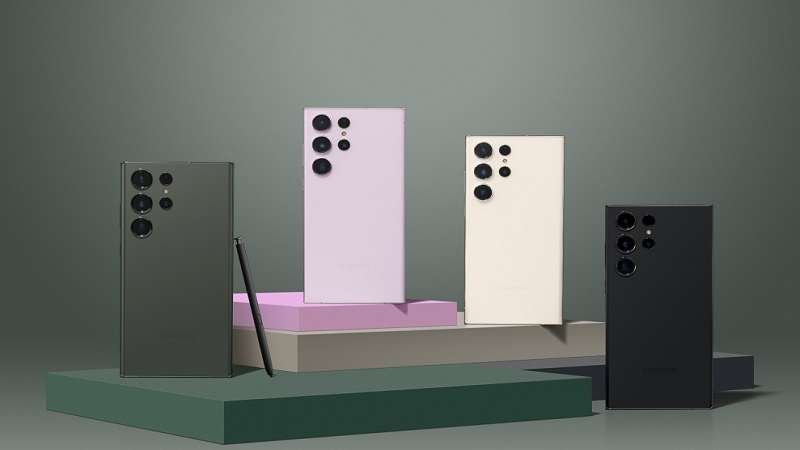

Get free Buds 2 Pro with Galaxy S23 Ultra: Last days to buy

For those who pre-order the Samsung Galaxy S23 Ultra, Samsung is offering a complimentary set of Galaxy Buds 2 Pro worth Rs49,000.

(more…) -

Samsung and AMD expand IP Licensing for Radeon graphics on mobile platforms

Samsung Electronics and AMD have solidified their strategic partnership by extending their intellectual property (IP) licensing agreement.

(more…) -

Prices of Xiaomi Redmi Note 11 Pro in April 2023

The Xiaomi Redmi Note 11 Pro made its debut in Pakistan on February 10, 2022 and is available at different prices depending on its storage capacity.

(more…)