Pakistan has constituted a high powered commission for making suggestion to end the black economy or parallel economy. Finance Minister Ishaq Dar last week constituted a high powered tax commission for identifying bottlenecks in tax system and recommending pro-economic policies.

(more…)Category: Top stories

Find top stories in this section. Pakistan Revenue brings you the latest and most important news from Pakistan and around the world, keeping you informed with key updates and insights.

-

Commercial banks urged to withdraw appeals in Riba case

ISLAMABAD: A leading scholar of the country on Sunday urged commercial banks to withdraw their appeals against the order of Federal Shariat Court (FSC).

The FSC judgment declared that Riba (usury) is Haram and prevailing banking system with interest system should be abolished forthwith.

READ MORE: State Bank, NBP to withdraw petitions in Riba case: Ishaq Dar

State Bank of Pakistan (SBP) and National Bank of Pakistan with other six commercial banks filed a review before the Supreme Court against the judgment of the FSC.

Recently, the SBP and NBP reportedly withdrew the appeals. However, private banks are still in litigation to contest the judgment of FSC.

“The private banks should withdraw their appeals to annul the judgment of the Federal Shariat Court (FSC) against the Riba (usury),” said Hafiz Muhammad Tahir Mehmood Ashrafi, Prime Minister’s Special Representative for Interfaith Harmony and the Middle East Hafiz Muhammad Tahir Mehmood Ashrafi, while talking to the state media.

READ MORE: KCCI demands implementation of Riba free banking

He said the government had taken practical steps by withdrawing appeals of national and state banks from the apex court in a bid to get rid of the interest-based economic system.

Ashrafi, who is also the chairman of Pakistan Ulema Council, assured the government all-out support of Ulema and Mashaykh in the implementation of FSC’s decision in letter and spirit.

He proposed all the financial institutions devise a combined strategy to make the country’s economic system free of interest which was totally against the divine commands.

He also urged the government to take stern action against the people who were allegedly involved in an interest-based system at the local level.

READ MORE: SBP seeks Supreme Court guidance on Riba case judgement

He said Pakistan, currently, was facing a critical financial crisis and its solution was lying in political stability and improved law and order situation in the country.

He urged all the religious and political parties to unite on one platform and help cope with burgeoning polarization, extremism, and the new wave of terrorism with collective efforts.

He also appealed the Pakistan Tehreek-e-Insaf Chief Imran Khan to come to the table-talk to evolve consensus on the ‘Charter of Pakistan’ as it was the need of the hour and it would help control increasing violence in the society and improve the ailing economy of the country.

He proposed that the way ‘Message of Pakistan’ was designed to promote religious harmony in all sections of the society, there should be long-term policies on the country’s social, economic, and foreign affairs issues in the shape of ‘Charter of Pakistan’ and it should be implemented by all the governments to come and national institutions in the larger national interest.

READ MORE: IPS demands implementation of court judgment on Riba

Ashrafi emphasized that Pakistan had to go out of the box in the matter of its foreign policy as there was a paradigm shift in the external affairs of the Islamic and Arab world.

He also thanked the Saudi leadership for extending the term of deposit in the State Bank of Pakistan (SBP) from the Saudi Fund for Development.

Expressing gratitude to Custodian of the Two Holy Mosques King Salman bin Abdulaziz and his Crown Prince Muhammad bin Salman, he said the relationship between Pakistan and Saudi Arabia was like two brothers.

He said Prime Minister Muhammad Shehbaz Sharif’s meetings with Saudi Crown Prince Mohammed bin Salman would yield further cooperation in the shape of Saudi investment in the days to come ahead in the country.

“Similarly, other Islamic countries are also increasing trade and economic cooperation with Pakistan,” he said expressing the hope that there would be good news from the United Arab Emirates, Qatar, Turkey and Saudi Arabia in the near future.

Ashrafi hinted that there was a big hand of the external forces and anti-state elements behind an organized smear campaign against the national security institutions and armed forces.

“We must counter the concocted propaganda of our arch enemy against our national defense institutions and Pakistan Army with a pragmatic approach instead of becoming part of it,” he maintained.

-

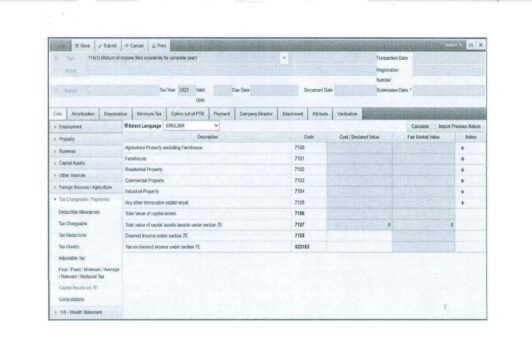

Separate property declaration under Section 7E only for returns already filed

A separate declaration for immovable property income has been allowed only for those returns filed prior October 13, 2022.

The FBR issued SRO 2068(I)/2022 dated December 01, 2022 to enforce the draft amendments issued through SRO 2052(I)/2022 dated November 22, 2022.

As per the instant SRO 2068(I)/2022, the FBR said that where return has been furnished prior to coming into force of notification No. SRO 1891(I)/2022, dated October 13, 2022, the form specified in the said notification shall be furnished separately by December 31, 2022.

Through Finance Act, 2022 deemed income on immovable property has been imposed from tax year 2022 (July 01, 2021 – June 30, 2022) and declaration has been made mandatory of the deemed income along with annual return by December 15, 2022.

READ MORE: Tax on deemed income from immovable property under Section 7E

According the FBR, a new section 7E has been introduced through Finance Act, 2022 whereby for tax year 2022 and onwards, a resident person is treated to have derived income equal to five percent of fair market value of the capital assets situated in Pakistan which will be chargeable to tax at the rate of 20 per cent under Division VIIIC of Part I of First Schedule of the Ordinance.

Following exclusions have been provided to which this section will not apply:

(i) One capital asset owned by the resident person;

(ii) Self-owned business premises from where the business is carried out by the persons appearing on the active taxpayer’s list at any time during the year;

(iii) Self-owned agriculture land where agriculture activity is carried out by the person but excluding farmhouse and annexed land. Farmhouse has been defined in this section;

READ MORE: Supreme Court discourages taxpayers seeking relief in show cause notices

(iv) Capital asset allotted to —

(a) A Shaheed or dependents of a Shaheed belonging to Pakistan Armed Forces;

(b) A person or dependents of a person who dies while in the service of Pakistan armed forces or federal or provincial government;

(c) A war wounded person while in service of Pakistan armed forces or federal or provincial government;

(d) An ex-serviceman and serving personnel of armed forces or ex-employees or serving personnel of federal and provincial governments who are original allotees of the capital asset as duly certified by the allotment authority;

(v) Any property from which income is chargeable to tax under the Ordinance and tax leviable has been paid;

(vi) Capital asset in the first year of acquisition on which tax under section 236K has been paid;

READ MORE: Member Customs assures swift clearance of export consignments

(vii) Where fair market value of the capital assets in aggregate excluding capital assets mentioned in serial nos. (i) to (vi) above does not exceed rupees twenty-five million;

(viii) Capital assets which are owned by a provincial government or local government;

(ix) Capital assets owned by local authority, a development authority, builders and developers for land development and construction subject to the condition that such persons are registered with Directorate General of Designated Non-Financial Businesses and Professions.

-

Pakistani rupee may devalue to PKR 270 against dollar by year end: report

KARACHI: Pakistani rupee likely devalue to PKR 270 against the dollar by end of the current fiscal year or June 30, 2023, a report said on Saturday.

The report released by Topline Securities, predicted that rupee to reach PKR 270 by Jun 2023 with FY23 average of Rs241.

READ MORE: PKR ends stable to dollar on $3 billion Saudi rollover

With PKR likely to weaken further, inflationary pressure may persist even after 900bps increase in policy rate by SBP in last 1.5 years, the report added.

Pakistan currency is going through lot of uncertainty in spite of 21 per cent fall in PKR against US Dollar in 2022 so far.

Since 2019 Pakistan is following a market-based exchange rate regime. Even though official exchange rate remains in the range of Rs221-225 in recent past, black market rate is trading at a premium of more than 10 per cent at Rs240-250.

READ MORE: SBP foreign exchange reserves fall to $7.5 billion

The report said that since State Bank of Pakistan (SBP) has tightened rules for exchange companies, there is hardly any foreign currency supply in the open market except for few currencies available for travelers at a premium of 3 per cent.

This reemergence of black market with 10 per cent difference, analysts at the Topline Securities believe, cannot continue for long as it has started affecting USD inflows especially inward remittances.

Given low foreign reserves, it is highly likely that the official exchange rate will adjust to close to black market rate.

READ MORE: Pakistan official reserves fall to around 1 ½ months import coverage

As per their base case, the analysts expect PKR to reach Rs270 by Jun 2023 with FY23 average of Rs241. With PKR likely to weaken further, inflationary pressure may persist even after 900 basis points increase in policy rate by SBP in last 1.5 years.

Now with SBP revising its FY23 estimate of CPI to 21-23 per cent, they think interest rates to remain at higher levels. In Base Case under IMF supervision this tightened monetary policy will continue in 2023 also. Though the analysts expect Consumer Price Index (CPI) inflation coming down to 14 per cent in FY24, but policy rate will remain around 15 per cent.

READ MORE: PKR remains resilient against dollar, makes 26 paisas gain

-

Pakistan exports plunge 18.34pc in November 2021

ISLAMABAD: Pakistan exports have registered 18.34 per cent decline Year on Year (YoY) in November 2022 owing to import restrictions and slowdown in global demand.

Data released by Pakistan Bureau of Statistics (PBS) on Thursday revealed that exports fell to $2.37 billion in November 2022 when compared with $2.9 billion in the corresponding month last year.

READ MORE: Pakistan’s import restrictions help narrowing trade deficit by 27%

Imports of the country recorded 33.60 per cent decline to $5.245 billion in November 2022 when compared with $7.9 billion in the same month of the last year.

This resulted contraction in trade deficit of 42.46 per cent to the deficit of $2.876 billion in November 2022 as against $5 billion in the same month of the last year.

READ MORE: Pakistan import bill falls by 12.72% in 1QFY23

The decline in exports can be attributed to the restrictions imposed on imports which hampered industrial and export activities. Furthermore, global slowdown also added to export fall.

Meanwhile, exports recorded a nominal decline of 0.63 per cent to $2.37 billion in November 2022 when compared with previous month of September 2022 at $2.38 billion.

However, imports recorded an increase of 11.34 per cent to $5.24 billion on Month on Month (MoM) in November 2022 when compared with $4.71 billion in the previous month.

READ MORE: Pakistan trade deficit narrows by 17% in 2MFY23

This brings the widening of trade deficit by 23.59 per cent to $2.876 billion in November 2022 when compared with the deficit of $2.33 billion in September 2022.

Overall trade deficit during first five months (July – November) 2022/2023 contracted by 30.14 per cent to $14.41 billion when compared with the deficit of $20.62 billion in the corresponding months of the last fiscal year.

READ MORE: Pakistan’s trade deficit narrows by 18% in July 2022

Exports of the country recorded 3.48 per cent decline to $11.93 billion during first five months of the current fiscal year as against $12.36 billion in the same months of the last year.

Whereas, import bill fell by 20.15 per cent to $26.34 billion during the period of July – October of fiscal year 2022-2023 as against $32.98 billion in the same period of the last fiscal year.

-

SBP denies restricting import payment for petroleum products

KARACHI: State Bank of Pakistan (SBP) on Thursday strongly rejected reports of restricting oil and petroleum products import payment.

The central bank clarified that some reports suggested regarding restriction on import of oil and petroleum products by the SBP.

READ MORE: Last date extended up to Dec 31 for exchanging old designed banknotes

“It is clarified that SBP has not placed any restriction (verbal or otherwise) on opening of Letters of Credit (LCs) or contracts for import of crude oil, LNG and petroleum products,” according to a statement issued by the central bank.

Such misinformation is being spread with ulterior motives to create uncertainty in the market, it added.

READ MORE: SBP withdraws NADRA Verisys for activation of dormant bank accounts

In fact, SBP ensures timely processing of foreign exchange payments through banks related to import of oil and gas products (including LNG) and in accordance with the contractual maturity of the trade documents.

All the LCs/contracts for oil import are being retired on their due date through interbank foreign exchange market without any delay.

READ MORE: Pakistan rebuts reports of stopping payments to Google

The same is also evident from trade data released by SBP in terms of which country’s oil import stood at $1.48 billion and $1.47 billion for the month of September 2022 and October 2022, respectively.

-

Tax commission constituted to make pro-economic growth policies

ISLAMABAD: Finance Minister Ishaq Dar has constituted a high powered tax commission for identifying bottlenecks in tax system and recommending pro-economic policies.

The Federal Board of Revenue (FBR) issued a notification on Thursday regarding constitution of Reforms and Resource Mobilization Commission (RRMC).

The commission comprising following members:

READ MORE: FBR notifies circular to allow third extension in date of return filing

01. Ashfaq Tola, Chairman of the commission

02. Asif Haroon

03. Haider Ali Patel

04. Abdul Qadir Memon

05. Dr. Veqar Ahmed

06. Saqib Sherazi

07. Ghazanfar Bilour

08. President of FPCCI or his nominee

READ MORE: FBR collects Rs2.69 trillion in 5MFY23 despite tax free petroleum products

09. President Pakistan Tax Bar Association

10. Chairman FBR

11. Member (Reforms & Modernization) FBR Secretary to the Commission

Subject Experts included:

12. Nisar Muhammad-Customs

13. Dr. Muhammad Iqbal-Income Tax

14. Abdul Hameed Memon-Sales Tax

According to Terms of Reference (TORs), the commission will advise and made recommendations to the finance minister on the following areas:

READ MORE: Tax return filing date extended up to Dec 15, 2022

(i) To review existing revenue policies, evaluate FBR data and macro level, and identify initiatives/measures/policies for resource mobilization, ease of doing business and pro-economic growth.

(ii) To identify issues/difficulties/snags/risks of the existing tax system and recommend remedial measures.

(iii) To review the budget proposals, evaluate their consequences on business, and advise the finance minister on practical aspects of budget proposals.

(iv) To review the proposed amendments in Finance Bill and make recommendations to the finance minister on implications of proposed amendments on businesses.

(v) To review the complexities of tax legislation and recommend simplification e.g. different compliance level for different categories of taxpayers.

READ MORE: FBR sets up check posts for monitoring supplies from tax exempt areas

(vi) To suggest action plan to curb the parallel economy and to make recommendations for improving financial inclusion in the documented system.

(vii) To review and recommend a robust IT system on modern lines and upgrade existing IT facilities to maximize tax compliance, enforcement, broaden the tax base and provide taxpayer facilitation.

(viii) To make recommendations for minimizing taxpayer/tax collector interaction and maximizing trust between the FBR and the taxpayers.

(ix) To revie and advise restructuring of FBR from the following perspectives:

a. To evaluate the possibility of making FBR autonomous.

b. To evaluate the possibility of establishing and independent audit system.

c. To evaluate the possibility of establishing a separate legal department.

(x) To make recommendations on harmonization of GDT between the Federation and provinces and development of a single portal for filing of sales tax returns.

(xi) Any other related matter.

According to the notification, the commission:

READ MORE: Tax on deemed income from immovable property under Section 7E

(i) Shall be independent and headed by a full-time chairman; its chairman shall report directly to the finance minister.

(ii) May interact with stakeholders and form sub-group, and evaluate their proposals for the federal budget.

(iii) May co-opt any other person with the prior approval of the finance minister.

(iv) May avail services of any expert (s) on need basis.

(v) Will have a full-time secretariat at FBR Headquarter, and FBR shall provide logistic and human resource support to the commission.

(vi) Shall take decision by majority vote of all members.

(vii) Shall submit its first report by mid of April 2023.

-

Pakistan’s inflation increases by 23.8pc in November 2022

Pakistan’s headline inflation based on Consumer Price Index (CPI) increased by 23.8 per cent in November 2022, according to official data revealed on Thursday.

CPI inflation General, increased to 23.8 per cent on year-on-year basis in November 2022 as compared to an increase of 26.6 per cent in the previous month and 11.5 per cent in November 2021. On month-on-month basis, it increased to 0.8 per cent in November 2022 as compared to an increase of 4.7 per cent in the previous month and an increase of 3.0 per cent in November 2021.

READ MORE: Headline inflation surges by 26.6% in October 2022

CPI inflation Urban, increased to 21.6 per cent on year-on-year basis in November 2022 as compared to an increase of 24.6 per cent in the previous month and 12.0 per cent in November 2021. On month-on-month basis, it increased to 0.4 per cent in November 2022 as compared to an increase of 4.5 per cent in the previous month and an increase of 2.9 per cent in November 2021.

READ MORE: Pakistan’s headline inflation rises 23.2% in September 2022

CPI inflation Rural, increased to 27.2 per cent on year-on-year basis in November 2022 as compared to an increase of 29.5 per cent in the previous month and 10.9 per cent in November 2021. On month-on-month basis, it increased to 1.3 per cent in November 2022 as compared to an increase of 5.0 per cent in the previous month and an increase of 3.1 per cent in November 2021.

READ MORE: Pakistan’s headline inflation hits 47-year high in August 2022

Sensitive Price Indicator (SPI) inflation on YoY increased to 27.1 per cent in November 2022 as compared to an increase of 24.0 per cent a month earlier and an increase of 18.1 per cent in November 2021. On MoM basis, it increased by 6.1 per cent in November 2022 as compared to a decrease of 1.5 per cent a month earlier and an increase of 3.6 per cent in November 2021.

READ MORE: Pakistan inflation hits 14-year high at 25% in July

Wholesale Price Index (WPI) inflation on YoY basis increased to 27.7 per cent in November 2022 as compared to an increase of 32.6 per cent a month earlier and an increase of 27.0 per cent in November 2021. On MoM basis, it decreased by 0.02 per cent in November 2022 as compared to a decrease of 0.5 per cent a month earlier and an increase of 3.8 per cent in corresponding month i.e. November 2021.

-

Pakistan keeps prices of petrol, HSD unchanged till December 15, 2022

ISLAMABAD: Pakistan on Wednesday kept the prices of petrol and high speed diesel (HSD) for next fortnight starting December 01, 2022.

However, the prices of kerosene oil and light speed diesel (LDO) reduced by Rs10 per liter and Rs7.5 per liter, respectively.

READ MORE: Pakistan to decide petroleum prices effective from December 01, 2022

Finance Minister Ishaq Dar in a press conference announced the revision in petroleum prices for the period December 01 to 15, 2022.

Previously, on September 30, 2022 the government made changes in petroleum prices.

READ MORE: Pakistan may impose petroleum tax to avert revenue shortfall

The new prices of petroleum products for next fortnight will be as follow:

The prices of petrol and HSD shall be Rs224.80 per liter and Rs235 per liter, respectively.

However, the rate of kerosene shall be reduced by Rs10 to Rs181.83 per liter from Rs191.83. Similarly, the price of LDO shall be reduced by Rs7.50 to Rs179 per liter from Rs186.50.

READ MORE: Petroleum prices in Pakistan for next fortnight effective from November 16, 2022

The benchmark Brent crude oil ended at $83.19 a barrel on November 28, 2022, having slumped more than 3 per cent to $80.61 earlier in the session for its lowest since January 4, 2022.

The Brent crude has hit above $120 per barrel during mid-June this year and now fell to the present level leaving ample room to the present government to revise downward the prices to provide relief the domestic consumers.

READ MORE: Petroleum prices in Pakistan effective from November 01, 2022

-

Tax return filing date extended up to Dec 15, 2022

ISLAMABAD: The federal government on Wednesday extended the last date for filing income tax returns by 15 days to December 15, 2022 from November 30, 2022.

Finance Minister Ishaq Dar at a press conference announced the extension in return filing date.

READ MORE: Another tax return filing date extension on the cards?

A large number of taxpayers have filed their income tax returns for tax year 2022. Yet many taxpayers are stuck up in a complicated calculation of income from property and unable to discharge their liability of return filing.

The Federal Board of Revenue (FBR) had extended the last date till November 30, 2022 for filing income tax return for tax year 2022. However, tax experts believe that the FBR should have to resolve the matter under Section 7E of Income Tax Ordinance, 2001 before setting deadline for return filing.

The last date for filing income tax return was September 30, 2022 for all taxpayers except companies, which are required to file their returns up to December 31, 2022.

However, through Circular No. 16 of 2022 and Circular No. 17 of 2022, the FBR granted date extension twice due to current flood situation in the country and request from various trade bodies and tax bar associations.

Tax practitioners said that although the FBR had extended the date for return filing and resolved many issues pertaining to the return filing yet the taxpayers are facing problems related to calculation of deemed income under Section 7E of the Income Tax Ordinance, 2001.

Interestingly, the FBR issued SRO 1955(I)/2022 on October 24, 2022 to amend Income Tax Rules, 2002 and made it mandatory for taxpayers to provide details pertaining to deemed income of immovable property along with the return for tax year 2022.

Since many taxpayers had filed their income tax returns during July 01 – October 23 so the amendment deprived such taxpayers in providing the required details.

In order to resolve the issue the FBR issued another SRO 2052(I)/2022 allowing to submit details of deemed income by those taxpayers, who filed their returns before October 24, 2022.

The tax practitioners said that the FBR should have been allowed relaxation to all the taxpayers the mandatory requirement of deemed income detail. They said that it should be deferred for one year as many taxpayers may not able to fulfil the requirement.

During his recent visit Karachi, FBR chairman Asim Ahmad had made it clear that no date extension would be granted further beyond November 30, 2022. He however assured the tax practitioners that all the issues pertaining to the return filing would be resolved. Furthermore, tax authorities promised to issue a clarification related to Section 7E.

Tax practitioners said that so far no such clarification was issued and complications in this regard was also not resolved.

A month ago, Karachi Tax Bar Association (KTBA) sent a letter to the FBR chairman highlighting many issues related to return filing. At present the issues pertaining to Section 7E still are creating hurdles in return filing.