ISLAMABAD: Pakistan on Tuesday slapped regulatory duty at 5 per cent on the import of filament yarns.

The 5 per cent regulatory duty would be imposed on filament Yarns falling in Pakistan Customs Tariff (PCT) of 5402.3300, 5402.4600, 5402.4700, 5402.5200 and 5402.6200.

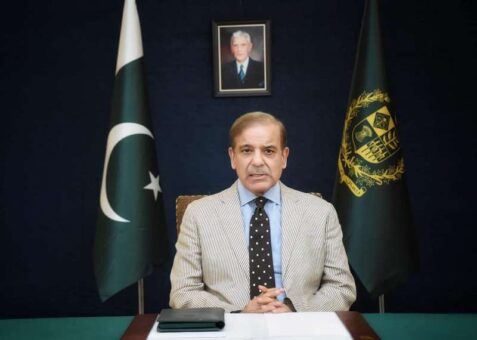

The decision has been taken at a meeting of Economic Coordination Committee of the Cabinet (ECC) which was presided over by Finance Minister Ishaq Dar.

READ MORE: PYMA urges government not to impose regulatory duty on yarn

Ministry of Commerce submitted a summary on Individual Tariff Rationalization proposal from different sectors for review of Regulatory Duties (RDs). The ECC after discussion approved the proposal to reduce RD on Disodium Carbonate (PCT – 2836.2000) from current rate of 20 per cent to 10 per cent and imposed RD at rate of 5 per cent on filament Yarns (PCT 5402.3300, 5402.4600, 5402.4700, 5402.5200 and 5402.6200).

Federal Minister for National Food Security and Research Tariq Bashir Cheema, Federal Minister for Power Khurram Dastgir Khan, Federal Minister for Industries and Production Syed Murtaza Mahmud, Federal Minister for Information and Broadcasting Ms. Marriyum Aurangzeb, Federal Minister for Planning, Development and Special Initiatives Ahsan Iqbal, Shahid Khaqan Abbasi MNA/Ex-PM, SAPM on Finance Tariq Bajwa, SAPM on Revenue Tariq Mehmood Pasha, Coordinator to PM on Commerce and Industry Rana Ihsan Afzal, Federal Secretaries, Chairman Federal Board of Revenue (FBR) and other senior officers attended the meeting.

READ MORE: ECC approves raising petroleum levy to Rs50 per liter on RON 95

Finance Division submitted a summary on launch of Credit Guarantee Scheme under Credit Guarantee Trust Fund through Second Supplemental Trust Deed.

It was presented that Pakistan Mortgage Refinance Company Limited (PMRC) has been setup as a joint initiative of the government of Pakistan and Commercial Banks/Development Finance Institutions (DFIs) to provide medium and long term funding to primary mortgage lenders by raising from the capital debt market at cheaper rates.

PMRC being the trustee launched a scheme titled, Credit Guarantee Trust Scheme under the First Supplemental Trust Deed.

To expand the provision of risk cover to FIs against financing in housing sector, the WB approved an additional credit line to the government of Pakistan for housing finance project which may be passed on to Credit Guarantee Trust Fund.

READ MORE: Petroleum sales decrease by 22% in four months of 2022-2023

In view of above, the ECC allowed to launch a new scheme titled, Credit Guarantee Trust Scheme for low income housing through Second Supplemental Trust Deed with an amount of $85 million to be obtained from the World Bank (WB) to provide risk cover to financing institutions against their financing in housing sector.

Ministry of National Food Security and Research submitted a summary on fixation and notification of Minimum Indicative Prices of Tobacco Crop 2023. After detailed deliberation, the ECC approved minimum indicative prices for various types of tobacco for different areas for 2023 tobacco crop as under: S. No Types of Tobacco Minimum Indicative prices for 2023 Crop (Rs. Per Kg) 1. Flue Cured Virginia (FCV) i. Plain Area ii. Sub-mountainous Area 310 351 2. Dark Air-Cured Tobbaco (DAC) 190 3 White Patta 146 4. Burley 223 5. Naswar/ Snuff/Hookah and other Rustica tobacco and its products 146 6.

Sun Cured Virginia (SCV) 200 Power Division submitted a summary on Uniform tariff for K-electric. It was submitted that KE applicable uniform variable charge is required to be modified to maintain the uniform tariff across the country with category wise increases including general supply tariff – residential, general supply tariff – commercial, industrial supply tariff, bulk supply tariff, agriculture tariff, and public lighting with recovery period of four months.

READ MORE: K-Electric posts huge losses despite 144% jump in tariff adjustment revenue

It was also shared such adjustment shall be applicable on the consumption from October 2022 to January 2023 to be recovered from consumers in December 2022 to March 2023, respectively.

The ECC after deliberation approved this proposal. Power Division submitted another summary on settlement of payables to Government Owned Power Plants at par with IPPS. The ECC approved Technical Supplementary Grant of Rs. 93.438 billion in three tranches of Rs. 31.146 billion each.

The ECC discussed summary submitted by Ministry of National Food Security and Research submitted on Kissan Package-2022 and approved base tariff for electric tube wells at Rs. 13/kWH from Rs. 16.60/kWH, providing relief to farmers of Rs. 3.60/kWH effective from November 01, 2022 to compensate the damage caused by the floods and heavy rains.

Ministry of Information and Broadcasting submitted a summary for allocation of budget to launch comprehensive media awareness campaign on government initiatives, programmes and projects. The ECC after detailed discussion approved Supplementary Grant of Rs. 2 billion for flood related media campaigns.

ECC approved Rs. 15 billion in favour of Election Commission of Pakistan for Current Financial Year 2022-23. Out of Rs. 15 billion, Rs. 5 billion will be released immediately while the balance will be released in tranches on utilization of the first tranche.

The ECC also approved Technical Supplementary Grant amounting to Rs. 162.521 million in favour of Ministry of Housing and Works in addition to approving Rs. 250 million for execution of development scheme titled “Construction of Railway underpass, Gojra, District Toba Tek Singh” and Rs. 144.210 million for execution of development schemes in District D.I. Khan.