KARACHI: Pakistan Tax Bar Association (PTBA) has declared that deletion of column to deny refund adjustment made the income tax return invalid.

In a letter sent to Asim Ahmed, Chairman, Federal Board of Revenue (FBR) on Thursday, the PTBA apprised about the burning issue due to which the legal fraternity, taxpayers and other stake holders are very much perturbed that is with regard to deletion of tab previously available in the return to claim “adjustment of earlier refunds against the taxpayer of the current year”.

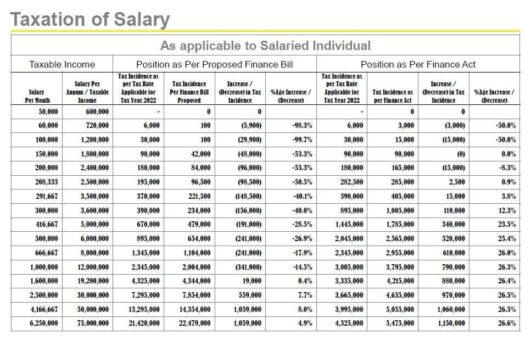

READ MORE: FBR notifies statutory tax rates for salaried persons

President PTBA Rana Munir Hassain said that the adjustment of refund against the payable tax is a fundamental right of a taxpayer a row for adjustment of earlier refunds before calculating net payable tax was always provided in the return forms.

He said that the proposed draft amendments in Income Tax Rules, 2002 through SRO 820(I)/2022, dated 21st June, 2022 (regarding draft Income Tax Return for the Tax Year 2022 for Ind/AOP/Cos) was issued in pursuance of section 237(3) of the Income Tax Ordinance, 2001, whereas, the row bearing code 92101 regarding “refund adjustment of other year(s) against demand of the current year was appearing” was provided therein as per past.

READ MORE: FBR slaps additional customs duty at 35% on motor vehicles

Subsequently, after lapse of statutory period of seven days, the final version of the Income Tax Return for the Tax Year 2022 was introduced through SRO.978(I)/2022 dated 30th June 2022, whereby, part-II-V was added in the Second Schedule, after Part II in the Income Tax Rules, 2002.

In the said final version, in the computation tab, the row as appearing against code 92101 is as under;

“refund adjustment of other year(s) against demand of this year”

The notified return which is part of the rules is now a valid return for all the purposes including deemed assessment order u/s 120(1) of the Ordinance.

Uploaded return electronically on IRIS, presently, having no column for adjustment of refund adjustment of other year(s), cannot be termed as “prescribed form of return” therefore, if filed, will not be a valid return in the eyes of law as under section 114(2)(a) a return is to be furnished in the prescribed form.

READ MORE: Tax exemption granted to donations for PM flood relief fund

It is also pertinent to mention here that the deletion of refund adjustment, row is against the fundamental rights, due process of law, whereas, the taxpayers have been deprived from their legitimate right as guaranteed by the constitution of Islamic Republic of Pakistan.

In the light of the above facts, the apex tax bar urged the FBR chairman to look into the matter personally and take necessary action on priority basis and restore the row “refund adjustment of the other year(s) against demand of this year” enabling the taxpayer and tax fraternity to file their Income Tax Returns for the Tax Year 2022 within stipulated time.

READ MORE: Pakistan raises Regulatory Duty to 100 % on motor vehicle import