Karachi, December 16, 2024 – The Pakistan Stock Exchange (PSX) witnessed a historic surge during intraday trading on Monday, crossing the 116,000-point mark at 12:00 PM. The benchmark KSE-100 Index climbed to 116,104 points, gaining 1,802 points from Friday’s close of 114,302, fueled by anticipation of a major policy rate cut.

(more…)Category: Top stories

Find top stories in this section. Pakistan Revenue brings you the latest and most important news from Pakistan and around the world, keeping you informed with key updates and insights.

-

Pakistan Revises Petroleum Prices for Final Fortnight of 2024

Islamabad, December 16, 2024 – Pakistan has announced a revision in petroleum prices for the final fortnight of the year 2024. According to a statement issued by the Finance Division, the price of petroleum-based petrol will remain unchanged at Rs252.10 per litre for the next two weeks. However, the government has reduced the prices of high-speed diesel (HSD), kerosene, and light diesel oil (LDO), providing some relief to consumers.

(more…) -

FBR Imposes 24% Tax on Brokerage Commission for Non-ATL

Karachi, December 15, 2024 – The Federal Board of Revenue (FBR) has announced a significant tax policy revision, imposing a 24% advance income tax on brokerage commissions earned by individuals not included in the Active Taxpayers List (ATL) for the tax year 2025. This move aims to ensure compliance and widen the tax net.

(more…) -

Pakistan Maintains Regular Sales Tax Rate at 18%

Karachi, December 15, 2024 – Pakistan has maintained its regular sales tax rate at 18% for the tax year 2025. This decision aligns with the Federal Board of Revenue’s (FBR) directive, following the increase in the sales tax rate from 17% to 18% introduced through the Finance (Supplementary) Act, 2023.

(more…) -

FBR Takes Disciplinary Action, Suspends Nine IR Officials

Karachi, December 14, 2024 – The Federal Board of Revenue (FBR) has taken decisive disciplinary action by suspending nine officials of the Inland Revenue (IR) department over alleged violations of the code of conduct.

(more…) -

SBP Shelters Around 99% Bank Depositors in Protection Regime

KARACHI: The State Bank of Pakistan (SBP) has reaffirmed its commitment to safeguarding the interests of the country’s bank depositors, ensuring protection for approximately 99% of all account holders through its robust deposit protection framework.

(more…) -

CTO Karachi Arrests Suspect in Rs 1 Billion Sales Tax Fraud

Karachi, December 14, 2024 – The Corporate Tax Office (CTO), Karachi, has made a significant arrest in connection with an alleged sales tax fraud exceeding Rs 1 billion.

(more…) -

PayPal Payment Solution Discussed for Pakistan’s Freelancers

Islamabad, December 13, 2024 – A high-level meeting of the Prime Minister’s Committee on IT Export Remittances convened to address the pressing need for payment solutions, including PayPal, to support Pakistan’s freelancers. The meeting emphasized the urgency of enabling access to global payment gateways and developing localized payment systems to empower IT professionals and enhance Pakistan’s global competitiveness.

(more…) -

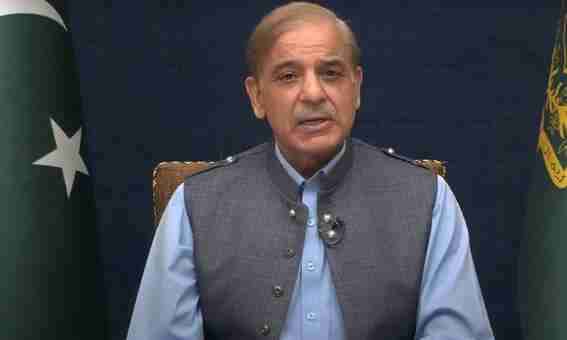

PM Shehbaz Directs Further Reduction in Electricity Tariffs

Islamabad, December 13, 2024 – Prime Minister Muhammad Shehbaz Sharif has directed authorities to take further steps in reducing electricity tariffs and to fast-track the implementation of plans for future power generation projects.

(more…) -

FBR Issues Guidelines for Notices on Unexplained Income

Karachi, December 13, 2024 – The Federal Board of Revenue (FBR) has issued detailed instructions to all Chief Commissioners of Inland Revenue (CCIRs) regarding the issuance of notices for unexplained income. These guidelines emphasize the procedural requirements that must be adhered to before initiating proceedings for amending tax assessments.

(more…)