The Federal Board of Revenue (FBR) in Pakistan issued a comprehensive list on Wednesday, March 8, 2023, outlining the imposition of a 25% sales tax on both imported and locally produced luxury goods.

This move, enacted through SRO 297(I)/2023, is part of the government’s strategy to generate additional income, as presented in the mini-budget on February 15, 2023.

Under the Finance (Supplementary) Act, 2023, the standard sales tax rate was increased from 17% to 18%. In addition to this adjustment, a new sales tax rate of 25% has been introduced specifically targeting the import and local supply of luxury goods. The FBR aims to leverage this taxation measure to enhance revenue collection and address fiscal challenges faced by the government.

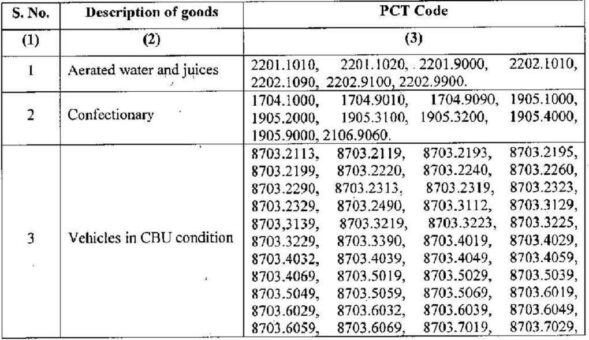

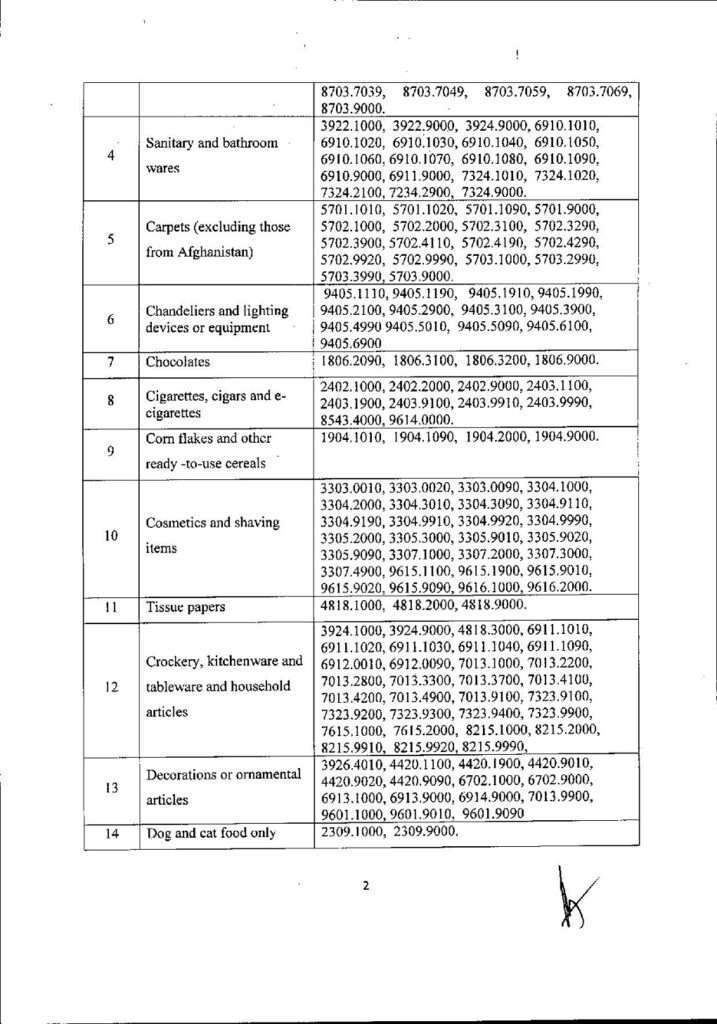

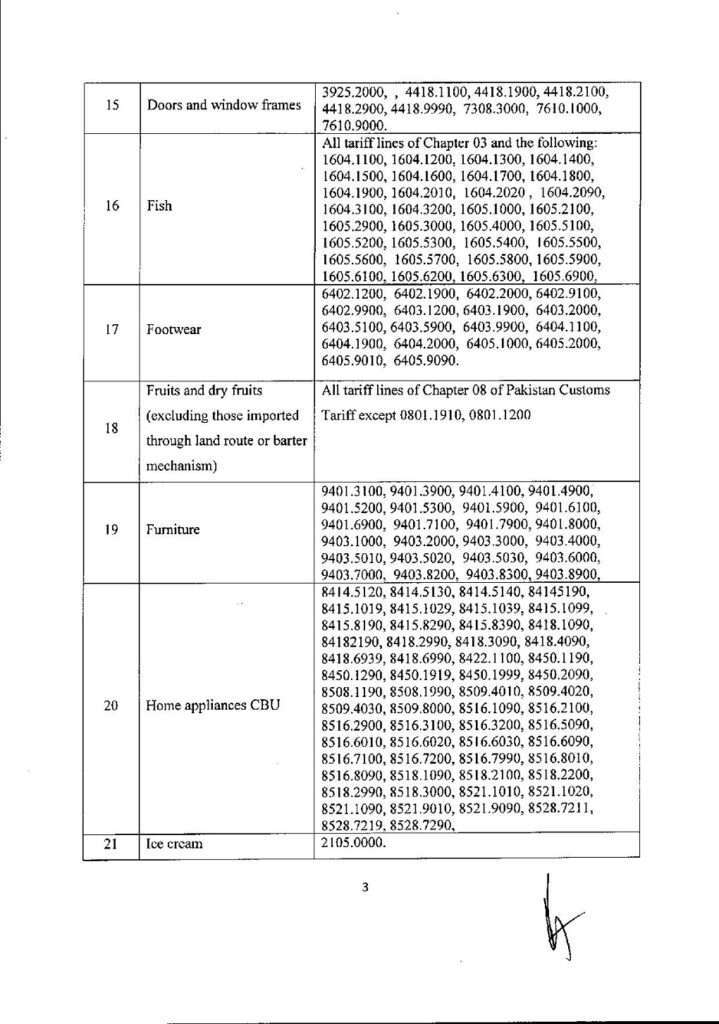

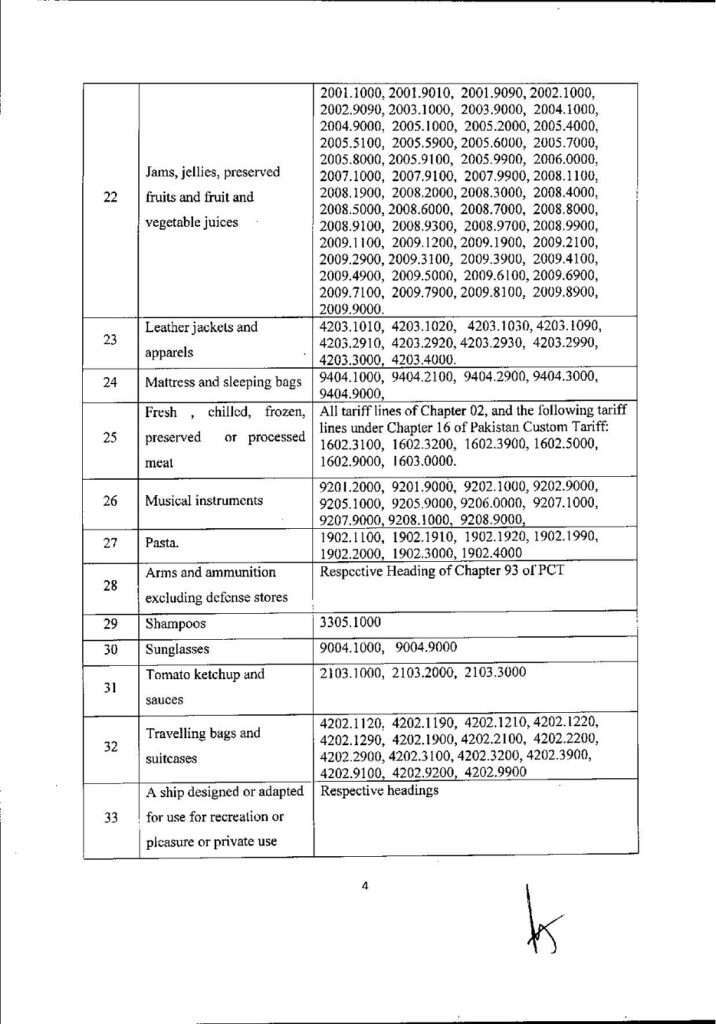

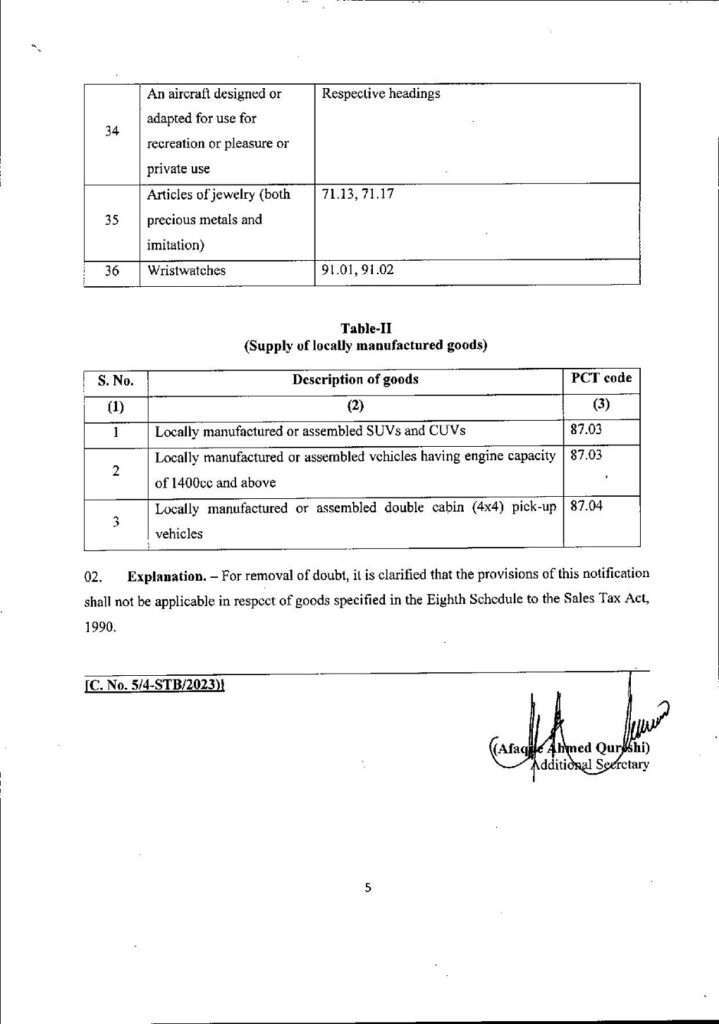

The SRO issued by the FBR identifies 36 imported items with lengthy tariff lines that fall under the ambit of the 25% sales tax rate. This includes a diverse range of products, reflecting the government’s intention to cover a broad spectrum of luxury items. Simultaneously, the revenue body has also issued a separate list that specifies locally manufactured or assembled Sports Utility Vehicles (SUVs) and Compact Utility Vehicles (CUVs) for the application of the same 25% sales tax rate.

It is important to note that the FBR has provided clarification to eliminate any ambiguity regarding the applicability of the notification. The provisions outlined in SRO 297(I)/2023 shall not be applicable to goods specified in the Eighth Schedule to the Sales Tax Act, 1990. This exemption aims to carve out essential items and prevent undue burden on everyday commodities.

The decision to impose a higher sales tax on luxury goods has garnered mixed reactions from different sectors of society. While some argue that it is a necessary step to boost government revenues and address fiscal deficits, others express concerns about the potential impact on consumer spending and economic growth. Proponents of the move highlight the progressive nature of taxing luxury items, suggesting that it targets those with greater spending capacity.

The business community, particularly those involved in the import and sale of luxury goods, is closely monitoring the developments. The FBR’s move is expected to influence pricing strategies and consumer behavior, with potential ripple effects on various industries.

The Federal Board of Revenue’s imposition of a 25% sales tax on imported and locally produced luxury goods represents a significant fiscal measure aimed at increasing government revenue. As Pakistan navigates economic challenges, this taxation strategy is part of a broader effort to ensure financial stability. The impact of this decision will unfold over time, and stakeholders across different sectors will closely watch its effects on consumer behavior, business dynamics, and overall economic trends.

Following is the list of imported and locally produced goods for application of sales tax rate at 25 per cent: