ISLAMABAD: Following is the table of valuation of immovable properties in Karachi issued by the Federal Board of Revenue (FBR) for the purpose of deduction and collection of withholding tax.

The valuation of immovable properties in Karachi has been issued through SRO 837(I)/2019 dated July 23, 2019 in supersession of notification SRO 120(I)/2019 dated February 01, 2019.

The valuation of immovable properties is applicable from July 24, 2019.

The FBR said that:

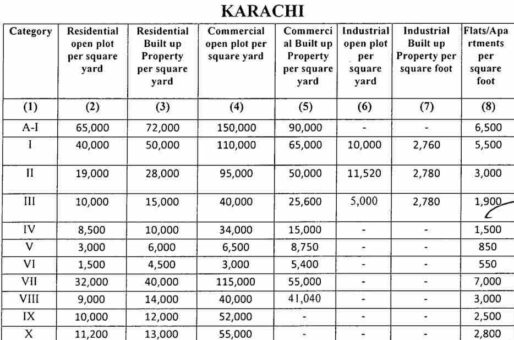

(i) Values in the above table are in rupees;

(ii) value is per square yard of the covered area of ground floor plus covered area for the additional floors;

(iii) commercial property built up value is per square yard of the covered area of the ground floor plus covered area of the additional floors, if any;

(iv) built up industrial property value is per square yard of the plot area per square foot;

(v) the value in respect of a residential building consisting of more than one storey shall be increased by 25 percent for each additional storey i.e. value of each storey other than ground floor shall be calculated at 25 percent of the value of the ground floor;

(vi) a property which does not appear to fall in any of the categories shown in the Appendix below shall be deemed to fall in the adjacent lowest category of the Appendix;

(vii) whether the land has been granted for more than one purpose. Viz residential, commercial and industrial, the valuation in such a case shall be the mean/average prescribed rate;

(viii) a flat means the covered residential tenement having separate property unit number / sub-property unit number;

(ix) in residential, multi storey building, additional storey shall be charged if it consists of bed room and bath room;

(x) the rates for basements of built in commercial property in categories I, II, III and IV shall be Rs13,500 per square yard; and

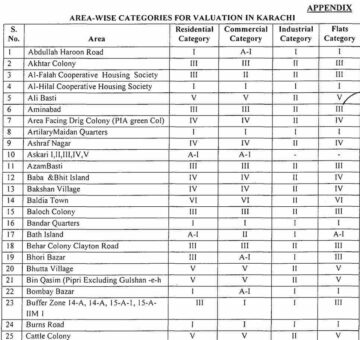

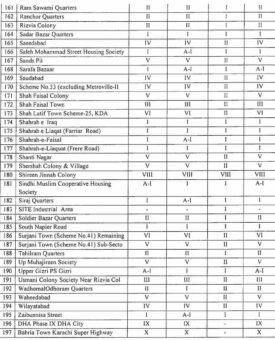

(xi) area-wise categories are in the following appendix