KARACHI: Sindh Chief Minister Syed Murad Ali Shah on Wednesday presented Rs1.2 trillion provincial budget 2020/2021 with announcing no new tax and increase of 10 percent salary of the provincial government employees.

On the floor of the house while delivering speech for budget 2020/2021, the chief minister said that the total outlay of budget for the next financial year 2020-2021 is Rs.1.2 trillion.

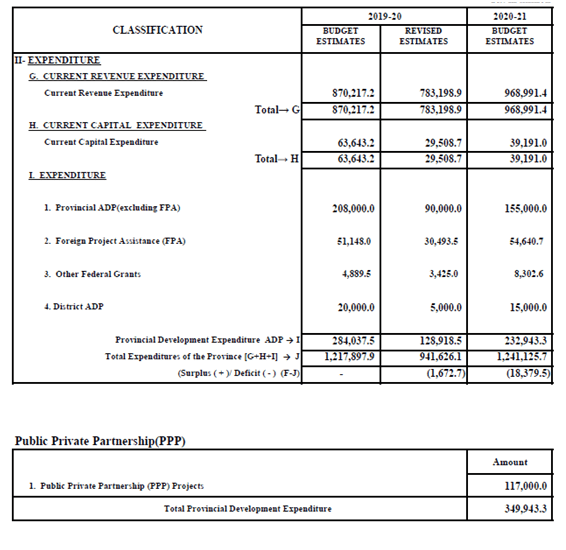

The total size of current revenue expenditure is Rs.968.9 billion.

“It is important to highlight here that for the next financial year, we have tried to align our Development as well as non-development expenditure priorities in line with the post COVID-19 situation,” the chief minister said.

He said that during financial year 2019-20, the province faced financial constraints due to COVID-19 which significantly affected development progress in the entire country. Sindh was no exception.

Government of Sindh budgeted Rs.284 billion as total development outlay in financial year 2019-2020, wherein Rs.208 billion were earmarked for Provincial ADP, Rs.20.0 billion for District ADP, Rs.51.0 billion in foreign projects assistance, and Rs.4.9 billion from Federal PSDP grant.

Looking at the financial constraints, stakeholder departments are likely to complete 425 schemes during 2019-20, 33 schemes less as compared to 458 completed in 2018-19.

“For the next financial year 2020-2021, the Administrative Departments in Sindh were earlier advised to prepare proposals for Provincial ADP 2020-21 at the size same as that of 2019-20 while allocating 85 percent for on-going schemes and 15 percent new schemes.

“However, in a post Covid-19 scenario, with a reduction in federal transfers and funding for development, the total development outlay for Sindh for the next financial year 2020-2021 is proposed at Rs.232.9 billion, allocating Rs.155.0 billion to Provincial ADP and Rs.15.0 billion to District ADP schemes.”

It would be pertinent to highlight that in this context Rs.54.6 billion are expected from Foreign Projects Assistance (FPA) and Rs.8.3 billion from Federal Government in Federal PSDP for 10 schemes under execution by Government of Sindh.

The government had earlier decided to keep the size of development budget for the next financial year 2020-21 for important sectors such as Education, Health, Social Safety & Poverty Reduction and Water & Sanitation nearly same as that of 2019-20. In exceptional cases such as Health, allocation has been increased from Rs.13.50 billion to Rs.23.50 billion in order to meet the challenges of COVID-19 situation.

The throw-forward amount in Provincial ADP 2020-2021 for 2209 schemes has reached at Rs.564.00 billion as compared to Rs.606.0 billion for 2705 schemes in 2019-2020.

Keeping in view above non-development and development expenditure priorities, the major milestone of our objectives are:

1. Exercise maximum austerity measures in our non-development expenditures.

2. Provide maximum resources for Health sector.

3. Enlarge substantially our social protection net through increased cash transfers to poverty inflicted people.

4. Provide ways and means for employment generation as well sustaining economic activity for the poorest of the poor, in rural as well as urban areas.

5. Continuing our focus on education, through increased allocations in financial year on development and non-development, despite huge resource constraints.

6. Fashion our development spending in sync with the above mentioned post Covid preferences with increased focus on Public Private Partnership (PPP) projects.

During his speech the chief minister said that the provincial government had decided not to introduce new tax in the budget 2020/2021.

Further, in order to provide relief the salary of provincial government employees has been increased by 10 percent for grade 1-16 and five percent for grate 17 and above.