KARACHI: Federal Board of Revenue (FBR) has collected Rs1.8 billion as capital gain tax on sale of securities during first eight months (July – February) 2020/2021.

The collection of capital gain tax on sale of securities has increased by 31 percent to Rs1.8 billion during first eight months of the current fiscal year as compared with Rs1.37 billion in the corresponding period of the last fiscal year, sources in Large Taxpayers Office (LTO) Karachi said on Friday.

The collection was made under Section 147 (5B) of Income Tax Ordinance, 2001.

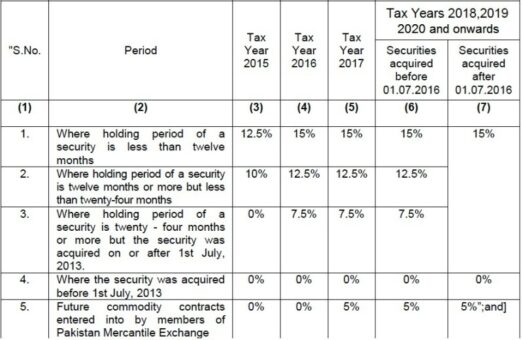

Adjustable advance tax on capital gain from sale of securities shall be chargeable as under, namely:—

Where holding period of a security is less than six months: the rate of advance tax shall be two percent of the capital gains derived during the quarter.

Where holding period of a security is more than six months but less than 12 months: the tax rate shall be 1.5 percent of the capital gains derived during the quarter.

Provided that such advance tax shall be payable to the Commissioner within a period of twenty-one days after the close of each quarter: Provided further that the provisions of this sub-section shall not be applicable to individual investors.