The Federal Board of Revenue (FBR) has amended tax laws to legally authorize the direct recovery of sales tax amounts from the bank accounts of tax defaulters.

(more…)Tag: Federal Board of Revenue

The Federal Board of Revenue is Pakistan’s apex tax agency, overseeing tax collection and policies. Pakistan Revenue is committed to providing timely updates on the Federal Board of Revenue to its readers.

-

Income tax return filing hits record high of 3.11 million, reveals last weekly ATL-2019

ISLAMABAD: The annual income tax return filing hit all time high of 3.11 million, according to the last weekly updated Active Taxpayers List (ATL) for Tax Year 2019 issued by Federal Board of Revenue (FBR).

The FBR updated the last weekly ATL for tax year 2019 on February 22, 2021 and received record number on the basis of return filed up to February 21, 2021.

The FBR is scheduled to launch ATL for tax year 2020 on March 01, 2021. Therefore, more returns may be filed for tax year 2019 by February 28, 2021.

The FBR launches ATL every year on March 01 which carries names of those persons filed their income tax returns for immediate past tax year.

Previously, the FBR received 2.8 million income tax returns for tax year 2018 up to February 16, 2020. This shows an 11 percent increase in return filing when compared the two periods.

The FBR on February 24, 2021 announced it will launch the ATL for tax year 2020 on March 01, 2020 on the basis of income tax returns filed by due date or returns filed after due date (till February 28, 2021) with payment of surcharge.

The FBR received income tax returns around 2.52 million for tax year 2020 up to January 30, 2021. However, this number will increase as the ATL 2020 will remain applicable till February 28, 2022.

The revenue body said that persons included in the ATL have various benefits such as exemption from withholding tax at the time of cash withdrawal. Further, other banking transactions and payment of educational fees are also exempted from withholding tax for those persons whose names are on the ATL.

Similarly, those persons appeared on the ATL are entitled to pay reduced rate of withholding tax in making transactions including imports, profits, services, contracts, profit on debt, prizes, purchase of motor vehicles and immovable properties etc.

The FBR said that names of those persons would be included in the ATL-2020 who filed their annual returns within given deadline or filed within extended date given by Commissioner Inland Revenue.

The revenue body said that the ATL is being updated on weekly basis and available on the official website and mobile applications.

Those individuals and companies that failed to make compliance of return filing by due date or extended date given by commissioners Inland Revenue would require to pay surcharges for appearance on the ATL.

The rate of surcharge is Rs20,000 for corporate entities and Rs10,000 for Association of Persons, the FBR added.

-

FBR announces issuing ATL for tax year 2020 on March 01

ISLAMABAD: Federal Board of Revenue (FBR) on Wednesday said it will issue Active Taxpayers List (ATL) for tax year 2020 on March 01, 2021.

The ATL-2020 will include names of those taxpayers who had filed their income tax returns by due date or those who had filed their income tax returns after the due date with payment of surcharges.

At present ATL-2019 is applicable for deduction of withholding taxes at various transactions.

The FBR said that it released ATL every year on March 01 and it remained valid till last day of February next year.

The revenue body said that persons included in the ATL have various benefits such as exemption from withholding tax at the time of cash withdrawal. Further, other banking transactions and payment of educational fees are also exempted from withholding tax for those persons whose names are on the ATL.

Similarly, those persons appeared on the ATL are entitled to pay reduced rate of withholding tax in making transactions including imports, profits, services, contracts, profit on debt, prizes, purchase of motor vehicles and immovable properties etc.

The FBR said that names of those persons would be included in the ATL-2020 who filed their annual returns within given deadline or filed within extended date given by Commissioner Inland Revenue.

The revenue body said that the ATL is being updated on weekly basis and available on the official website and mobile applications.

Those individuals and companies that failed to make compliance of return filing by due date or extended date given by commissioners Inland Revenue would require to pay surcharges for appearance on the ATL.

The rate of surcharge is Rs20,000 for corporate entities and Rs10,000 for Association of Persons, the FBR added.

-

PRAL identifies vulnerabilities in Google Chrome; issues advisory

ISLAMABAD: The Pakistan Revenue Automation Pvt Limited (PRAL) has identified multiple vulnerabilities in Google Chrome, which are the most severe as those could allow for arbitrary code execution.

Google Chrome is a web browser used to access the internet.

In an advisory note issued on Wednesday, the PRAL said that the successful exploitation of the most severe of these vulnerabilities could allow an attacker to execute arbitrary code in the context of the browser.

Depending on the privileges associated with the application, an attacker could view, change or delete data.

“If this application has been configured to have fewer user rights on the system, exploitation of the most severe of these vulnerabilities could have less impact than if it was configured with administrative rights,” the PRAL said.

PRAL is providing taxation services to the Federal Board of Revenue (FBR) and other provincial revenue authorities.

The PRAL said that Google Chrome versions prior to 88.0.4324.182 were affected by the vulnerabilities.

In order to ensure prevention against the vulnerabilities, the PRAL recommended the following:

01. FBR IT Security Policy sanctioned by Member (IT) –FBR, must be strictly followed.

02. Run all software as a non-privileged user (one without administrative privileges) to diminish the effects of a successful attack. It is highly recommended that the computer system must be registered with LAN’s Active Directory server.

03. Avoid clicking unknown links and downloading attachments sent by anonymous users.

04. use of third-party antivirus is strictly prohibited. Only approved licenses of antivirus software must be installed on desktop PCs.

05. Always avoid using a suspicious USB flash stick. In case one needs to use the USB flash stick, then always scan the USB using approved antivirus software.

06. Regular update operating system, antivirus software, internet browsers and MS Office and disable macros.

07. Keep windows firewall enabled on the desktop computer system.

08. All sensitive information should be handled with care and dissemination to all concerned be done through secure means.

09. Use of official email is highly recommended.

10. Change the password of the receptive accounts regularly.

11. Always memorize the passwords, never write them.

12. Maintain regular offline backups or centralized offline backup of critical data.

13. Be aware of pop-ups in internet browsers or desktop screens and never enter confidential information in a pop-up screen.

-

FBR issues fresh customs valuation for mobile phones

KARACHI: Federal Board of Revenue (FBR) has issued fresh customs values of mobile phone devices for the determination of duty and tax, sources said on Tuesday.

The Directorate General of Customs Valuation has issued valuation advice dated February 18, 2021, in respect of mobile phone devices to determine assessable customs values of mobile phone devices.

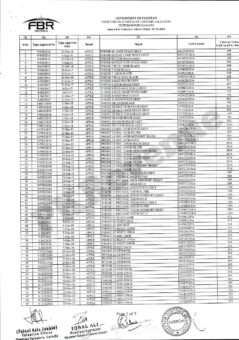

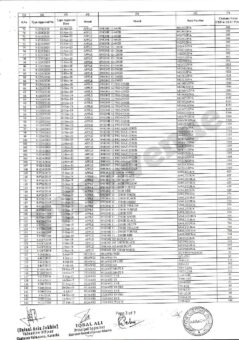

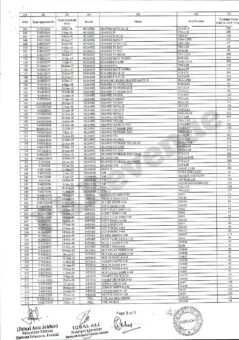

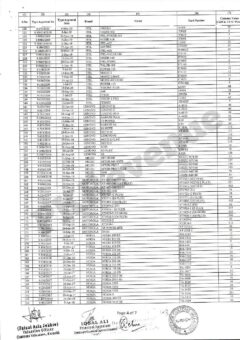

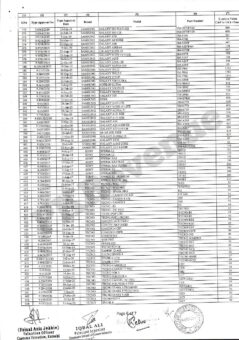

The directorate said that customs values as given in column 7 of the attached images may be considered for the purpose of assessment of duty and taxes.

These values will also be relevant for assessment and proceedings under SRO 1455(I)/2018 and SRO 1456(I)/2018 both dated November 29, 2018 read with Customs General Order No. 06/2018 dated November 29, 2018.

The directorate further said that the enclosed list is not exhaustive; however, mostly traded brands and models as provided by Mobile Phone Importers and Manufacturers Association (MPIMA).

For assessment of brands and models which are imported in commercial quantity but are not included in the enclosed annexure, the clearance collectorate have been advised to assess those under Section 81 of the Customs Act, 1969 and then forward a reference to the directorate for final determination of values thereof.

It further said that where in the enclosed annexure, type approval is not given or is under process, clearance collectorate shall fulfill the regulatory requirements pertaining for type approval/certificate of compliance from PTA first as envisaged under the law.

It is pertinent to mention that the valuation advice will be regularly updated and issued accordingly.

Following is the fresh customs valuation for mobile phone devices:

To watch the news in Urdu please visit and subscribe our YouTube Channel at

-

FBR allows income tax exemption on sugar import

ISLAMABAD: Federal Board of Revenue (FBR) on Tuesday allowed exemption from income tax on import of raw and refined sugar.

The FBR issued SRO 235(I)/2021 in pursuance to the federal cabinet decision dated January 26, 2021.

Through the SRO the FBR amended Second Schedule of the Income Tax Ordinance, 2001.

According to the amendments, the tax under Section 148 on commercial import of the white sugar shall be collected at the rate of 0.25 percent from January 26, 2021 till June 30, 2021.

Another clause added to the Second Schedule under which subject quota allotment by the commerce division, tax under section 148 shall be collected at the rate of 0.25 percent on import of raw sugar imported by sugar mills from January 26, 2021 to June 30, 2021 (both days inclusive) provided that such imports shall not exceed fifty thousand metric tons per sugar mill and three hundred thousand metric tons in aggregate by the sugar industry.

The FBR said that a new clause 12K had been inserted to the Second Schedule under which the provisions of Section 148 and Section 153 shall not apply on import and subsequent supply of five hundred thousand metric tons of white sugar imported by the Trading Corporation of Pakistan.

-

Concept of person defined for levy of income tax

Income Tax Ordinance, 2001 has defined the concept of person for the collection and deduction of tax on income.

The Income Tax Ordinance, 2001 updated up to June 30, 2020 issued by the Federal Board of Revenue (FBR), the “person” means a person as defined in section 80 of the Ordinance.

Section 80 defines person as:

(1) The following shall be treated as persons for the purposes of this Ordinance, namely: —

(a) An individual;

(b) a company or association of persons incorporated, formed, organised or established in Pakistan or elsewhere;

(c) the Federal Government, a foreign government, a political sub-Division of a foreign government, or public international organisation.

(2) For the purposes of this Ordinance —

(a) “association of persons” includes a firm, a Hindu undivided family, any artificial juridical person and anybody of persons formed under a foreign law, but does not include a company;

(b) “company” means —

(i) a company as defined in the Companies Ordinance, 1984 (XLVII of 1984);

(ii) a body corporate formed by or under any law in force in Pakistan;

(iii) a modaraba;

(iv) a body incorporated by or under the law of a country outside Pakistan relating to incorporation of companies;

(v) a co-operative society, a finance society or any other society;

(va) a non-profit organization;

(vb) a trust, an entity or a body of persons established or constituted by or under any law for the time being in force;

(vi) a foreign association, whether incorporated or not, which the Board has, by general or special order, declared to be a company for the purposes of this Ordinance;

(vii) a Provincial Government;

(viii) a Local Government in Pakistan; or

(ix) a Small Company as defined in section 2;

(c) “firm” means the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all;

(d) “trust” means an obligation annexed to the ownership of property and arising out of the confidence reposed in and accepted by the owner, or declared and accepted by the owner for the benefit of another, or of another and the owner, and includes a unit trust; and

(e) “unit trust” means any trust under which beneficial interests are divided into units such that the entitlements of the beneficiaries to income or capital are determined by the number of units held.

-

What is permanent establishment under income tax law?

Income Tax Ordinance, 2001 has defined the meaning of permanent establishment of a foreign entity operating in Pakistan.

The Income Tax Ordinance, 2001 updated up to June 30, 2020 issued by the Federal Board of Revenue 9FBR), defined as “permanent establishment” in relation to a person, means a fixed place of business through which the business of the person is wholly or partly carried on, and includes –

(a) a place of management, branch, office, factory or workshop, premises for soliciting orders, warehouse, permanent sales exhibition or sales outlet, other than a liaison office except where the office engages in the negotiation of contracts (other than contracts of purchase);

(b) a mine, oil or gas well, quarry or any other place of extraction of natural resources;

(ba) an agricultural, pastoral or forestry property;

(c) a building site, a construction, assembly or installation project or supervisory activities connected with such site or project but only where such site, project and its connected supervisory activities continue for a period or periods aggregating more than ninety days within any twelve-months period;

(d) the furnishing of services, including consultancy services, by any person through employees or other personnel engaged by the person for such purpose;

(e) a person acting in Pakistan on behalf of the person (hereinafter referred to as the “agent”), other than an agent of independent status acting in the ordinary course of business as such, if the agent –

“(i) has and habitually exercises an authority to conclude contracts on behalf of the other person or habitually concludes contracts or habitually plays the principal role leading to the conclusion of contracts that are routinely concluded without material modification by the person and these contracts are─

(a) in the name of the person; or

(b) for the transfer of the ownership of or for the granting of the right to use property owned by that enterprise or that the enterprise has the right to use; or

(c) for the provision of services by that person; or”

(ii) has no such authority, but habitually maintains a stock-in-trade or other merchandise from which the agent regularly delivers goods or merchandise on behalf of the other person; or

Explanation.—For removal of doubt, it is clarified that an agent of independent status acting in the ordinary course of business does not include a person acting exclusively or almost exclusively on behalf of the person to which it is an associate; or ”;

(f) any substantial equipment installed, or other asset or property capable of activity giving rise to income;

(g) a fixed place of business that is used or maintained by a person if the person or an associate of a person carries on business at that place or at another place in Pakistan and─

(i) that place or other place constitutes a permanent establishment of the person or an associate of the person under this sub-clause; or

(ii) business carried on by the person or an associate of the person at the same place or at more than one place

constitute complementary functions that are part of a cohesive business operation.

Explanation.—For the removal of doubt, it is clarified that─

(A) the term ”cohesive business operation” includes an overall arrangement for the supply of goods, installation, construction, assembly, commission, guarantees or supervisory activities and all or principal activities are undertaken or performed either by the person or the associates of the person; and

(B) supply of goods include the goods imported in the name of the associate or any other person, whether or not the title to the goods passes outside Pakistan.

-

Income tax ordinance defines non-profit organization

Income Tax Ordinance, 2001 has defined the meaning of Non-Profit Organization for the purpose of tax treatment on the activity of NPOs.

The Income Tax Ordinance, 2001 up dated up to June 30, 2020 issued by the Federal Board of Revenue (FBR), explained as:

“Non-profit organization” means any person other than an individual, which is —

(a) established for religious, educational, charitable, welfare purposes for general public, or for the promotion of an amateur sport;

(b) formed and registered by or under any law as a non-profit organization;

(c) approved by the Commissioner for specified period, on an application made by such person in the prescribed form and manner, accompanied by the prescribed documents and, on requisition, such other documents as may be required by the Commissioner; and none of the assets of such person confers, or may confer, a private benefit to any other person.