Islamabad, September 7, 2024 – In a move aimed at addressing the nation’s financial challenges, the federal government has implemented a series of stringent austerity measures, effective immediately and lasting until further notice.

(more…)Tag: Finance Division

-

Pakistan raises petrol price to record high at Rs160/liter

ISLAMABAD: Pakistan on Tuesday sharply increased the price of petrol to a new record high level at around Rs160 per liter in the wake of surge in international oil prices.

According to a statement issued by the Finance Division, the government has announced a massive increase in all the petroleum products effective from February 16, 2022.

READ MORE; Petroleum prices kept unchanged for next fortnight

The government increased the rate of petrol by Rs12.03 to Rs159.86 from Rs147.83. The rate of high speed diesel has been enhanced by Rs9.53 to Rs154.15 from Rs144.62. The government increased the price of kerosene oil by Rs10.08 to Rs126.56 from Rs116.48. Similarly, the rate of light diesel oil has been increased b Rs9.43 to Rs123.97 from Rs114.54.

READ MORE: Pakistan’s petrol price rises to record high at Rs147.83

The finance division in the press release said that the price of petroleum products were showing drastic increase in the international markets and presently are at the highest level since 2014.

“Despite the unabated increase since the beginning of the year, Prime Minister Imran Khan deferred the last review of petroleum products prices on January 31, 2022 and advised against the summary of Oil and Gas Regulatory Authority (OGRA).”

READ MORE: Prices of all POL products increased to wish New Year

In order to provide utmost relief to the consumers, the government levied zero per cent sales tax and reduced petroleum levy rate against the budgeted targets.

Resultantly, the government is bearing the revenue loss of Rs35 billion (fortnightly) on account of budgeted to existing petroleum levy and sales tax rates.

READ MORE: Petrol price reduces to Rs140.82 per liter

The finance division said that in the fortnightly review of petroleum products prices, the Prime Minister has considered the recommendations to increase the prices of petroleum products in line with change in the international oil prices. “Despite the increase in the prices of petroleum products, petroleum levy and sales tax have been kept to the minimum,” it added.

-

SBP’s instructions on pensioners biometric verification

KARACHI: The State Bank of Pakistan (SBP) on Friday issued instructions regarding biometric verification of pensioners.

Prior to these instructions the SBP issued BC&CPD Circular Letter No. 01 dated February 01, 2021 and File Letter No. BC&CPD/O&SSD/BVS/5873 dated May 27, 2021 on the subject.

The Finance Division issued a letter on December 08, 2021 on the subject of Biometric Verification Service, contents of which are self-explanatory, the central bank said.

The said instructions of bio metric verification service are for pensioners drawing pension from AGPR Islamabad. All banks are advised to comply with the instructions contained therein.

Further, all banks are advised to ensure widespread publicity of the above initiative through branches and other means for awareness of the pensioners.

-

Mandatory biometric verification restored for pensioners

ISLAMABAD: The government has made mandatory the biometric verification for pensioners to make withdrawal of their pension amount from banking system.

In an office memo, the Finance Division said that the mandatory requirement of biometric verification has been restored for the pensioners, which was suspended due to COVID-19.

READ MORE: Grant of 10% increase in pension notified

The finance division on January 28, 2021 has made it mandatory for direct credit system (DCS) pensioners to undergo biometric verification on National Database and Registration Authority (NADRA) system through any branch of a bank every year in the months of March and October. However, the same was held in abeyance through office memo dated May 6, 2021 due to COVID-19.

Since the normal working has been restored, therefore, it has been decided to operationalize the biometric verification for federal government pensioners with immediate effect who were issued pension from AGPR Islamabad (for military pensioner, and those who were issued pension from AGPR sub-offices and District Account Offices will be communicated separately), according to the finance division.

READ MORE: Pensioners living abroad require presenting life certificate

-

Pakistan establishes Afghanistan relief fund

ISLAMABAD: Pakistan on Wednesday established a fund namely ‘Afghanistan Relief Fund’ to provide humanitarian assistance to Afghanistan.

According to a notification issued by the Finance Division, all proceeds on account of ‘Afghanistan Relief Fund’ and payment into the aforesaid fund will be received at all branches of State Bank of Pakistan, all treasuries and branches of National Bank of Pakistan and all other scheduled banks.

READ MORE: Pakistan donates 50,000MT wheat to Afghanistan

The finance division said that the fund may receive donations from both domestic, international donors and contributions from aboard which will be received at all the branches of above referred banks where such branches are existing. “In other foreign countries contributions will be received at Pakistan missions and remitted to the State Bank of Pakistan, which would prescribe necessary procedure for their accounting.”

All proceeds received in the name of the fund will be credited to the public account of the federal government under following head of account:

Major object: G12: Special deposit fund

Minor Object: G121: relief fund

Detailed Object (New): G12163: Afghanistan Relief Fund

The finance division said that accounts of the fund would be maintained by Accountant General of Pakistan Revenue, Islamabad and Fund will be administered by the ministry of economic affairs in consultation with the finance division.

-

Govt. offices given procedure for closure of commercial bank accounts

ISLAMABAD: The finance division has issued procedure for government offices to close their accounts with commercial banks and transfer of all available funds to treasury single account (TSA).

According to official documents made available on Sunday, the finance division said that as per the Cash Management and TSA Rules 2020, the government offices are neither allowed to undertake any cash operation outside the TSA nor obliged to open, operate or maintain a bank account in any commercial bank.

They can only operate through the principal government account i.e Central Account No.1 (Non Food) maintained with State Bank of Pakistan for deposit and withdrawal of all public moneys.

However, in contravention of the constitutional and legal provisions as mentioned in clause-1 above and the provisions of Cash Management and ‘NA Rules 2020, the Government Offices are maintaining a large number of commercial bank accounts purportedly to operate various funds, deposits, reserve funds etc, which are otherwise legally required to be maintained in the Public Account/Central Account No.1 (Non food).

Resultantly, considerable amount of public money has been parked in the commercial bank accounts, hence held outside the TSA system.

Therefore, under the Cash Management and TSA Rules 2020, they have been required to close all the bank accounts and transfer the public money held outside the TSA system, to the Central Account No.1 (Non food).

The prime objective of devising this procedure is to facilitate the Government Offices in closure of the commercial bank accounts, transfer of all the available balances to the Public Account/Central Account No.1 (Non food) and undertake further public account transactions through the Government Central Account No.1 (Non food).

It has therefore been found expedient to prescribe a dedicated and hassle free procedure for withdrawal of funds from the Public Account through non-lapsable special assignment account, as the existing Assail assignment account procedure is for withdrawal of funds from the Federal Consolidated Fund only.

Moreover, in order to ensure uniformity in fiscal operations, the Personal Ledger Accounts (PLAs), Special Drawing Accounts (SDAs) and Revolving Fund Accounts (Local Currency) shall be discontinued forthwith as already approved by the Finance Division.

-

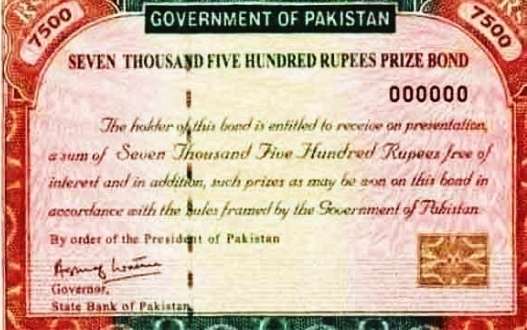

Sale of Prize Bonds Rs7,500, Rs15,000 stopped forthwith

ISLAMABAD: The finance ministry on Thursday announced that national prize bonds of denominations Rs7,500 and Rs15,000 shall not be sold with immediate effect.

In different notifications the finance division announced to withdraw the prize bonds of denominations Rs7,500 and Rs15,000 from circulation with immediate effect.

According to the notifications:

“… Prize bonds of Rs7,500 denominations shall not be sold with immediate effect and will not be encahsed / redeemed after December 31, 2020 … “

“ … Prize bonds of Rs15,000 denomination shall not be sold with immediate effect and will not be encahsed / redeemed after June 30, 2021 … “

The finance divisions also issued the procedure for redemption/conversion of bonds.

The bonds can be converted to premium prize bonds (registered) of denomination of Rs25,000 and Rs40,000 (subject to the adjustment of differential amount) through 16 field offices of State Bank of Pakistan (SBP) Banking Services Corporation, and branches of six commercial banks i.e. National Bank of Pakistan, Habib Bank Limited, United Bank Limited, MCB Bank Limited, Allied Bank Limited and Bank Alfalah Limited.

The bonds can be replaced with Special Saving Certificates/Defence Saving Certificates through the 16 field offices of SBP Banking Services Corporation, authorized commercial banks and National Savings Center.

The bonds will only be encashed by transferring the proceeds to the bonds holder’s bank account through the 16 field offices of SBP banking services corporation well as the authorized commercial bank branches and to the Saving Accounts at National Savings Centers.

-

Grant of disparity reduction allowance at 25pc for government employees notified

ISLAMABAD: The finance division has notified grant of disparity reduction allowance at 25 percent of the basic pay to the civil employees in BS-1-19 of the federal government.

Sources on Friday said that the finance division had issued a notification for the approval of the Federal Government for grant of Disparity Reduction Allowance at 25percent of the basic pay of Basic Pay Scales 2017 with effect from March 01, 2021.

This allowance shall be admissible to civil employees in BPS 1-19 of the Federal Government, (including employees of the Federal Secretariat and attached departments), who have never been allowed additional allowance/allowances equal to or more than 100 percent of the basic pay (whether frozen or not) or performance allowance subject to the following conditions:

a) This Allowance will not be admissible to the employees of the organizations as mentioned in Annexure-I and those employees who are drawing additional allowance/allowances equal to or more than 100 percent of the basic pay whether frozen or otherwise);

b) This allowance will be frozen at the level drawn on March 01, 2021

c) This Allowance will be subject to Income Tax;

d) This Allowance will be admissible during leave and entire period of L.P.R. except during extra ordinary leave;

e) This Allowance will not be treated as part of emoluments for the purpose of calculation of Pension/Gratuity and recovery of House Rent;

f) This Allowance will not be admissible to the employees during the tenure of their posting/deputation abroad;

g) This Allowance will be admissible to the employees on their repatriation from posting/deputation abroad at the rate and amount which would have been admissible to them, had they not been posted abroad;

h) This Allowance will be admissible during the period of suspension;

i) The term “Basic Pay” will also include the amount of Personal Pay granted on account of annual increment (s) beyond the maximum of the existing pay scales.

Annexure-I

Following is the List of organizations/Employees drawing Extra Allowances

1. President/ PM Secretariat

2. Federal Board of Revenue

3. Health personnel/ Health establishments

4. National Accountability Bureau (NAB)

5. All Superior Courts

6. Law & Justice Commission of Pakistan

7. Islamabad Capital Territory Police

8. National Highways & Motorways Police

9. Islamabad Model Traffic Police

10. Airport Security Force

11. Civil Armed Forces

12. Intelligence Bureau

13. Inter Services Intelligence

14. Federal Investigation Agency

15. National Highways & Motorways Police

16. National Assembly

17. Senate Secretariat

18. Parliamentary Affairs Division

19. District Population Welfare Office

20. Clinical Regional Training Institute

21. Directorate General of Special Education

22. National Institute of Rehabilitative Medicines

23. National Institute of Special Education

24. Rehabilitation Centre for Children with Development Disorders Islamabad

25. National Council for Rehabilitation

26. National Braille Press Islamabad

27. Rehabilitation Unit Vocational Rehabilitation & Employment of Disabled persons Islamabad

28. National Mobility & Independence Training Centre

29. National Training Centre for Special Persons G-9/2 Islamabad

30. Vocational Rehabilitation & Employment of Disabled persons SC-1 Islamabad

31. Provision of Hostel facilities at NSEC VHC Islamabad

32. National Special Education Centre for PHC Islamabad

33. National Special Education Centre

34. National Library & Resource Centre Islamabad

35. National Trust for the Disabled

36. Common Unit to Manage Global Fund

37. Federal Services Tribunal

38. Central Health Establishment and its Field Offices

39. Federal Tax Ombudsman

40. Appellate Tribunal Inland Revenue

41. Customs Excise and Sales Tax Appellate Tribunal

42. Environmental Protection Tribunal

43. Accountability Courts

44. Special Judge (Customs Taxation & Anti Smuggling)

45. Special Judge (Central)

46. Banking Courts

47. Special Courts (Control of Narcotics Substance)

48. Special Court (Offence in Banks)

49. Special Court (Anti Terrorism)

50. Competition Appellate Tribunal

51. Intellectual Property Tribunal

52. Drug Courts

53. Anti Dumping Appellate Tribunal

54. Senior Civil Judge West Islamabad

55. Senior Civil Judge East Islamabad

56. District & Session Judge West Islamabad

57. District & Session Judge East Islamabad

58. The civilian employees of PAF who are drawing additional allowance as allowed vide Finance Division’s U.O. note bearing No.F.1(7)lmp/2009-705, dated 19-12-2012.

-

Pensioners to undergo biometric verification twice a year; rules amended

ISLAMABAD: Pensioners are required to undergo biometric verification twice in a year in order to continue withdrawal of pension amount.

The Finance Division on Friday issued SRO dated January 28, 2021 to notify amendments in the Federal Treasury Rules.

As per the amendments, a pensioner drawing pension shall be bound to undergo biometric verification on National Database and Registration Authority (NADRA) system from any branch of a bank maintaining his pension account, every year in the months of March and October or provide a life certificate signed by a person authorized, if he is unable to undergo biometric verification due to incapacitation by bodily illness, infirmity or if his fingerprints do not exist due to old age or a genetic condition.

Authorities shall obtain declaration yearly from pensioners whose pension is terminable by their marriage or re-marriage and shall be attached to the bills for pension paid for September, however, this requirement shall be dispensed with after attaining by the pensioner the age of sixty years.

The disbursing officer must take special precautions to prevent imposition and must, at least once a year, receive proof of life or proof of continued existence of the pensioner, through NADRA’s biometric verification at any branch of a bank maintaining his pension account, which shall be conclusive proof of the continued existence of the pensioner.

“Any pensioner who is incapacitated by bodily illness or infirmity from so going to any branch of a bank for biometric verification or whose finger prints no longer exist due to old age or infirmity or a genetic condition, that pensioner shall give written request for exemption and for that pensioner, the disbursing officer shall allow proof of life through life certificate as conclusive proof of his continued existence.”

The disbursing officer shall be responsible for any payment wrongly made and in all cases of doubt, he must consult the Accountant General.

“If a pensioner drawing pension fails to submit a life certificate or fails to undergo NADRA’s biometric verification during the months of March and October or he does not draw his pension for consecutive six months, his account shall become dormant.”

-

Pension account to become inoperative on verification failure: Finance Division

ISLAMABAD: Bank account of a pensioner shall become inoperative if the person drawing pension fails to undergo biometric verification or is not drawing pension for consecutive six months.

The Finance Division in a letter to the governor of State Bank of Pakistan (SBP) on Thursday informed that that if a person drawing pension fails to submit a life certificate or fails to undergo biometric verification during the months of March and October or a pensioner does not draw pension for consecutive six months, the account shall become dormant.

The finance division said that following clarification for payment of pension through Direct Credit System (DCS):

(i) The pension shall be paid to a pensioner through a bank account either current or PLS maintained in his own name.

(ii) For payment of pension through bank account as mentioned at (i) above, a joint account shall not be valid.

(iii) Dedicated pension bank account shall not be mandatory for drawl of pension.

(iv) The requirement of indemnity bond from a pensioner, as laid down in para 3(f) and 9(xii) of the Revised SOP 2014 issued on July 14, 2014 is discontinued.

It said that the through a letter September 08, 2020 the finance division had already decided that no separate bank account is required for draw/disbursement of pension for all new retirees and that it may be ensured that the pensioner starts receiving pension payment on the date it falls due, in the same bank account, he or she was receiving the salary before retirement, if he or she desires so.

The finance division said that after necessary amendments in the relevant rules, the federal government is going to launch a system which would cater for all the requirements/documentations digitally to further facilitate the pensioners.

Salient features of the system are as under:

(a) A pensioner drawing pension under clause iii of sub rule (6) of Federal Treasury Rules shall be facilitated to undergo biometric verification from any branch of a bank maintaining his pension account, every year in the months of March and October. If the pensioner is unable to under biometric verification due to incapacitation by bodily illness, infirmity or if his fingerprints do not exist due to old or a genetic condition, he will provide a life certificate signed by a person authorized under rule 343 every six months.

(b) The declaration shall be obtained yearly from pensioner who pension is terminable by their marriage or remarriage and shall be attached to the pension bill paid in September instead of December and June.

(c) Further, submission of declaration regarding marriage or remarriage will be dispensed with after the widow or daughter of the pensioner attains the age of sixty year.

(d) If a person drawing pension fails to submit a life certificate or fails to undergo biometric verification during the months of March and October or a pension does not draw pension for consecutive six months, the account shall become dormant.