Islamabad, June 10, 2025 – As part of the ongoing fiscal reforms, the Federal Board of Revenue (FBR) has unveiled major amendments to the Income Tax Ordinance, 2001 through the Finance Bill 2025.

(more…)Tag: Income Tax Ordinance

-

Tax Officials Empowered to Arrest for Income Concealment

Karachi, November 24, 2024 – The Income Tax Ordinance, 2001, grants tax officials of the Federal Board of Revenue (FBR) the authority to arrest individuals accused of concealing income. Section 203B of the updated ordinance outlines the specific powers and procedures tax officials must follow in such cases.

(more…) -

Peshawar High Court Declares Section 7E Unconstitutional

Islamabad, February 14, 2024 – The Peshawar High Court (PHC) has struck down Section 7E of the Income Tax Ordinance, 2001, terming it beyond the legislative competence of the Parliament.

(more…) -

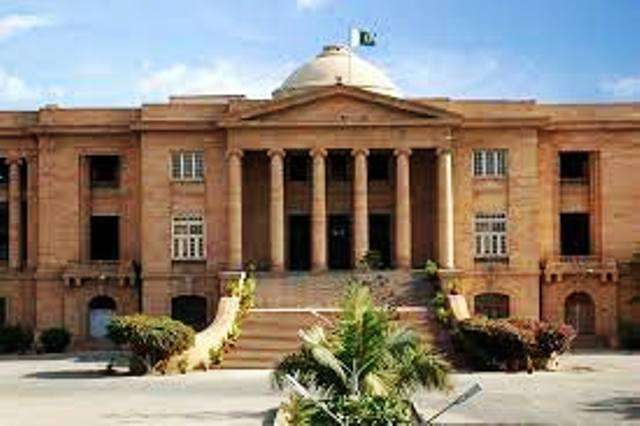

Sindh High Court Grants Interim Relief in Section 7E of Income Tax Ordinance

KARACHI, October 30, 2023 — In a significant development concerning income tax regulations in Pakistan, the Sindh High Court (SHC) has granted interim relief in a case related to deemed income under Section 7E of the Income Tax Ordinance, 2001.

(more…) -

FBR Initiates Penal Action Against Failure to Declare Business Bank Accounts

Karachi, September 17, 2023 – The Federal Board of Revenue (FBR) has taken punitive measures against individuals who have failed to declare their business bank accounts, as per recent reports.

(more…)