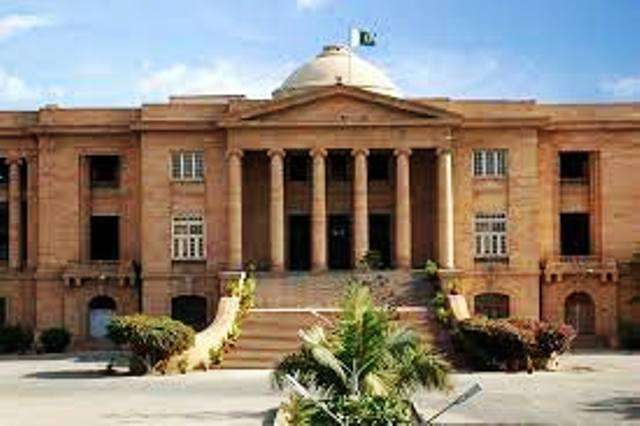

KARACHI, October 30, 2023 — In a significant development concerning income tax regulations in Pakistan, the Sindh High Court (SHC) has granted interim relief in a case related to deemed income under Section 7E of the Income Tax Ordinance, 2001.

The court’s decision has provided respite for taxpayers facing potential tax liabilities for Tax Year 2023.

The higher court granted a stay in response to a petition challenging Section 7E of the Income Tax Ordinance, 2001, which deals with taxation on a deemed income basis. The petitioner, represented by Abid Shahban, an Advocate of the Supreme Court, sought an urgent resolution of the case due to the imminent deadline for filing tax returns.

Section 7E was introduced under the Finance Act, 2022, making it applicable for Tax Year 2022 and beyond. According to this section, every resident individual is deemed to have derived income equivalent to five percent of the fair market value of capital assets situated in Pakistan. Exclusions to this provision are outlined in the law.

The SHC’s decision, as documented in the order sheet of C.P No. D-5127 of 2023, reads, “Subject to the payment of 50 percent liability under Section 7E of the Income Tax Ordinance, 2001, no coercive action be taken against the petitioner under Section 7E for the period from 01.07.2022 to 30.06.2023. In these terms, the instant petition stands disposed of.”

This interim relief allows taxpayers to pay 50 percent of their tax liability under Section 7E for the specified period to avoid any coercive action. Notably, the petitioner sought relief due to the approaching deadline for tax return filing and the similarity of relief provided by the Supreme Court of Pakistan in the previous year.

It is worth mentioning that in August, the Federal Board of Revenue (FBR) had implemented a judgment from the Lahore High Court (LHC) concerning Section 7E. As a result of this implementation, Section 7E was not applicable to cases falling within the jurisdiction of the LHC, irrespective of whether they were tax filers or non-filers.

However, the SHC’s stay order, as issued, required taxpayers to make a 50 percent payment of their liability by October 31. There is a discrepancy between the court’s order and the FBR’s online portal, which currently only allows for a full settlement of the tax liability and has not been adjusted to accept partial payments as stipulated by the court.

This situation creates a challenge for taxpayers who wish to avail themselves of the interim relief granted by the Sindh High Court and highlights the need for coordination and alignment between the legal system and the relevant tax authorities. As the October 31 deadline approaches, taxpayers are eagerly awaiting clarification and updates on how to fulfill the conditions of the interim relief.

Active Taxpayers List in Pakistan Reaches Record 4.98 Million