KARACHI: Overseas Investors Chamber of Commerce and Industry (OICCI) has recommended the tax authorities to simplify issuance of exemption certificate in order to facilitate taxpayers.

It its proposals for budget 2022/2023, the OICCI suggested the Federal Board of Revenue (FBR) to simplify the procedure of exemption certificate issuance.

READ MORE: OICCI suggests revamping withholding tax regime

It said delays in processing of exemptions certificates by department and un-necessary requirements to obtain exemption certificates under various sections of Ordinance results in hardship and refundable build ups due to tax deduction at source.

The OICCI recommended that the requirement to obtain exemption certificates for Companies having exempt income shall be dispensed with. For example, retirement funds, companies in tax holidays etc.

READ MORE: FBR proposed to reduce minimum tax rate to 0.25%

Companies that have discharged their full year tax liability in advance under section 148 / 153 of Income Tax Ordinance, 2001 shall also be issued exemption certificates under other provisions of Ordinance (for example Section 151, 233 etc.).

Furthermore, in respect of filer and compliant taxpayers 15 days limit for auto-issuance of exemption certificate as presently in case of Section 153 of the Ordinance, should be extended to other sections.

The OICCI also demanded restoration of exemption against withholding of income tax under section 148 of Income Tax Ordinance, 2001.

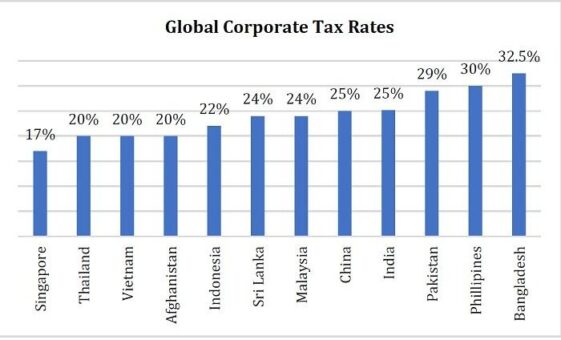

READ MORE: Foreign investors seek reduction in corporate tax rate

It recommended that exemption against withholding tax u/s 148 of the Ordinance be restored as previously available through clause 72B of the part I of the Second Schedule. Moreover, the criteria for obtaining 148 exemptions should be based on discharge of advance tax liability as per section 147 of the Income Tax Ordinance, 2001.

Adjustability of advance Tax Under section 148(7) available to industrial undertaking shall also be extended to service sector. It is recommended to amend the section in following manner:

READ MORE: Tax rates key element to attract foreign direct investment

“The tax required to be collected under this section shall be minimum tax on the income of the importer arising from the imports subject to sub-section (1) and this sub-section shall not apply in the case of import of goods on which tax is required to be collected under this section for internal consumption in the business”.

Section 48(1) of the Ordinance should allow automatic issuance of exemption certificate in line with Section 153.