According to official data, investment in registered prize bonds in Pakistan has declined to Rs 56.84 billion by the end of February 2023, compared with Rs 56.90 billion a year ago.

(more…)Tag: Prize Bonds

-

FBR issues tax rate on prize bonds, winning for TY2023

Federal Board of Revenue (FBR) has issued tax rates to be collected on winning of prize bonds and raffle or lottery during tax year 2023.

(more…) -

SBP makes important announcement for withdrawn prize bonds

KARACHI: State Bank of Pakistan (SBP) on Wednesday made important announcement related to withdrawn prize bonds.

(more…) -

Prize bonds worth Rs6.27 billion still unclaimed despite last opportunity

KARACHI: Bearer prize bonds worth Rs6.27 billion are still unclaimed despite the government has granted a last opportunity to investors to document the same.

(more…) -

SBP reminds last date for encashment of bearer prize bonds by June 30

State Bank of Pakistan (SBP) on Wednesday reminded the general public about the last date for encashment of bearer prize bonds.

(more…) -

Redemption date for bearer prize bonds is June 30: SBP

KARACHI: State Bank of Pakistan (SBP) on Monday said redemption date for bearer prize bonds has been extended up to June 30, 2022.

(more…) -

Last date to redeem bearer prize bonds extended: SBP

KARACHI: The State Bank of Pakistan (SBP) on Tuesday said that the last date to redeem bearer prize bonds has been extended considering the hardship of bond holders.

(more…) -

Final chance to encash bearer prize bonds: SBP

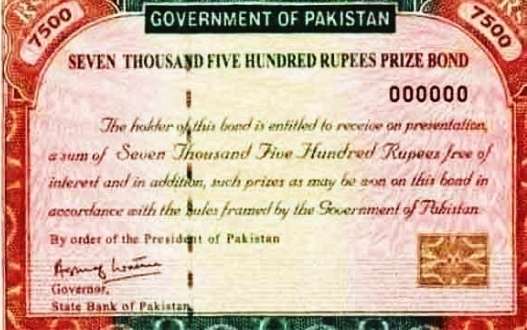

KARACHI: The final chance has been given to public to exchange or encash bearer prize bonds with various denominations by June 30, 2023.

The State Bank of Pakistan (SBP) in a statement on Wednesday said that the federal government had given another opportunity to the public to get the withdrawn prize bonds of Rs.7500, 15,000, 25,000 and Rs. 40,000 redeemed/encashed by June 30, 2023.

READ MORE: Pakistan-issued prize bonds expire on June 30, 2022

Earlier, the government had fixed deadline of June 30, 2022, for redemption/encashment of these prize bonds, however, considering that some of the prize bond holders could not get their bonds redeemed a final opportunity has been given for encashment of prize bonds till June 30, 2023.

READ MORE: SBP directs banks to accept bearer prize bonds

The investors of aforesaid prize bonds have following options of encashment or exchange: Encashment at Face Value; Conversion to Premium Prize Bonds of Rs. 25,000 and/or Rs. 40,000 (Registered); Replacement with Special Savings Certificates (SSC) or Defense Savings Certificates (DSC).

READ MORE: Prize bond (bearer) holders given 3 months to document

The prize bonds can be redeemed from SBP Banking Services Corporation office and branches of commercial banks across the country till 30th June 2023. The SBP has issued necessary instructions to commercial banks to accept requests from general public for encashment or exchange of the prize bonds till the extended date.

READ MORE: History of Prize Bonds in Pakistan

The members of general public holding these are encouraged to avail this final opportunity and get their prize bonds redeemed before June 30, 2023. These prize bonds shall not be en-cashable or exchangeable after the expiry of the extended deadline, thereby rendering them worthless.

-

Last date extended for exchanging bearer prize bonds to June 30, 2023

ISLAMABAD: The federal government on Tuesday announced to extend the last date for exchanging / converting the bearer prize bonds up to June 30, 2023.

The bearer prize bonds with denominations of Rs40,000/-, Rs25,000/-, Rs15,000/ and Rs7,500 were expired on June 30, 2022. However, there is huge amount unclaimed against these bearer bonds and people complained for not providing sufficient time for exchanging the bonds.

READ MORE: Pakistan-issued prize bonds expire on June 30, 2022

The finance division through various notifications notified the date extension up to June 30, 2023 for the bearer prize bonds.

The finance ministry launched the withdrawal of the unregistered prize bonds in a phased manner. The federal government on June 24, 2019, announced to discontinue the circulation of Rs40,000 denomination national prize bonds. Similarly, on December 10, 2020, the government announced to discontinue the circulation of Rs25,000 denomination prize bonds. In April 2021, the finance ministry announced that national prize bonds of denominations Rs7,500 and Rs15,000 shall not be sold.

READ MORE: SBP directs banks to accept bearer prize bonds

Since June 2019 the government repeatedly extended the date for exchanging the bearer bonds. Previously, the last date for exchanging the unregistered bonds was December 31, 2021.

The government is aiming to document the bearer bonds so the exchanging the unregistered bond with cash has been prohibited. The ministry of finance issued various procedure to convert the bond without exchanging with the cash.

READ MORE: Prize bond (bearer) holders given 3 months to document

The bonds can be converted to premium prize bonds (registered) of denomination of Rs25,000 and Rs40,000 (subject to the adjustment of differential amount) through 16 field offices of State Bank of Pakistan (SBP) Banking Services Corporation (BSC), and branches of six commercial banks i.e. National Bank of Pakistan, Habib Bank Limited, United Bank Limited, MCB Bank Limited, Allied Bank Limited, and Bank Alfalah Limited.

READ MORE: History of Prize Bonds in Pakistan

The bonds can be replaced with Special Saving Certificates/Defence Saving Certificates through the 16 field offices of SBP Banking Services Corporation, authorized commercial banks, and the National Savings Center.

The bonds will only be encashed by transferring the proceeds to the bonds holder’s bank account through the 16 field offices of SBP BSC as well as the authorized commercial bank branches and to the Saving Accounts at National Savings Centers.

-

FBR notifies tax rates on prize bond, lottery winning during 2022-2023

Federal Board of Revenue (FBR) has notified rates of withholding tax on wining prize bonds and winnings raffle or lottery during 2022-2023.

The FBR issued the withholding tax card for tax year 2023 (July 01, 2022 to June 30, 2023) after amending the Income Tax Ordinance, 2001 through changes brought through Finance Act, 2022.

READ MORE: Tax rates for rental income from immovable property during 2022-2023

Following is the text of Section 156 related to tax on prizes and winnings:

156. Prizes and winnings.—(1) Every person paying prize on a prize bond, or winnings from a raffle, lottery, prize on winning a quiz, prize offered by companies for promotion of sale, or cross-word puzzle shall deduct tax from the gross amount paid at the rate specified in Division VI of Part III of the First Schedule.

READ MORE: FBR notifies withholding tax rates for exports during 2022-2023

(2) Where a prize, referred to in sub-section (1), is not in cash, the person while giving the prize shall collect tax on the fair market value of the prize.

(3) The tax deductible under sub-section (1) or collected under sub-section (2) shall be final tax on the income from prizes or winnings referred to in the said sub-sections.

The rate of withholding tax on prizes and winnings under Section 156:

READ MORE: Tax rates on payments for goods, services during 2022-2023

— The rate of withholding tax for prize bond or cross word puzzle is 15 per cent for persons on Active Taxpayers List (ATL) and 30 per cent for person not on the ATL.

— The rate of withholding tax for raffle, lottery, quiz, prize and sale promotion by a company is 20 per cent for person on the ATL and 40 per cent for person not on the ATL.

READ MORE: Tax rates on payments to non-residents during 2022-2023

READ MORE: Up to 70% income tax imposed on dividends for year 2022-2023

READ MORE: FBR updates salary tax card for year 2022-2023

READ MORE: FBR issues withholding tax rates on imports for tax year 2022-2023

READ MORE: Tax rates on profit from bank deposits during year 2022/2023