According to official data, investment in registered prize bonds in Pakistan has declined to Rs 56.84 billion by the end of February 2023, compared with Rs 56.90 billion a year ago.

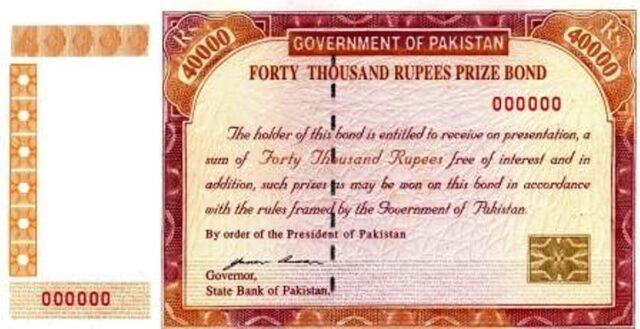

The decline in investment was particularly noticeable in the denomination of Rs 40,000 prize bonds, which fell to Rs 34.43 billion, compared with Rs 34.71 billion a year earlier.

READ MORE: Pakistan increases profit rates on saving schemes

However, investment in denomination of Rs 25,000 prize bonds increased to Rs 22.40 billion by February 2023, compared with Rs 22.19 billion a year earlier.

The decline in investment in prize bonds can be attributed to the government’s efforts to bring unrecorded money into the formal economy in compliance with the conditions of the Financial Action Task Force (FATF).

READ MORE: Dar chairs meeting to review implementation of Riba free system in Pakistan

The government withdrew bearer prize bonds of high denominations and introduced registered prize bonds to document investments made through the Central Directorate of National Savings (CDNS).

The recent increase in the benchmark policy rate by the State Bank of Pakistan (SBP) to a record high of 21% has made banking deposits more attractive than investment in other sectors, including prize bonds.

The government has also discontinued the circulation of national prize bonds with denominations of Rs 7,500/-, Rs 15,000/-, Rs 25,000/-, and Rs 40,000/-. The bonds can be converted to premium prize bonds (registered) of denominations of Rs 25,000 and Rs 40,000, or replaced with Special Saving Certificates/Defense Saving Certificates through authorized commercial banks and the National Savings Center.

READ MORE: State Bank asked to provide details of borrowing at zero interest

The government’s aim is to document all investments made through CDNS, including identifying the source of income for investment in national savings.

Pakistan’s undocumented economy has long been a challenge for the government, with estimates suggesting that it makes up a significant portion of the country’s gross domestic product (GDP). This informal economy includes activities that are not registered with the government and therefore are not subject to taxes or regulations.

The government has taken various measures to address this issue, such as introducing tax amnesty schemes, launching a crackdown on tax evaders, and encouraging people to register their businesses.

The efforts to document the economy have been driven in part by the need to meet the requirements of international organizations such as the Financial Action Task Force (FATF), which has repeatedly expressed concern over Pakistan’s lack of progress in combating money laundering and terrorism financing.

READ MORE: Pakistan supports use of Chinese RMB as global currency

The government has also introduced several measures to encourage the use of digital payments, which can help to bring more transactions into the formal economy. For example, the State Bank of Pakistan has launched a program to promote the use of mobile banking and digital payments, and the government has announced plans to offer tax incentives to businesses that adopt digital payment methods.

Despite these efforts, the informal economy in Pakistan remains a significant challenge, and it continues to pose a barrier to economic growth and development. The government will need to continue to take steps to document the economy and encourage businesses and individuals to register their activities and pay taxes in order to fully address this issue.