KARACHI: State Bank of Pakistan (SBP) on Sunday issued Rs75 commemorative banknote to celebrate 75th Independence Day.

Acting Governor State Bank of Pakistan (SBP) Dr. Murtaza Syed unveiled the Rs75 Commemorative Banknote to mark the 75 years of Pakistan’s Independence in a graceful ceremony held at the SBP Museum, Karachi on August 14, 2022.

He also inaugurated the Roshan Pension Plan (RPP) to augment the lifestyle banking under Roshan Digital Account (RDA) initiative for overseas Pakistanis.

READ MORE: SBP automates verification of refinance claims

Governor Dr. Murtaza Syed commenced the formal proceedings by hoisting the national flag in the presence of jubilant officers of the Bank and their families followed by playing of national anthem.

Dr. Murtaza Syed unveiled the design of Rs75 Commemorative Banknote. He noted that while issuance of coins and postage stamps is a regular and recurring feature to mark days of national importance, it is relatively rare that the SBP issues a commemorative banknote.

It is worth noting that the Rs75 Commemorative Banknote is the second such banknote to be issued by the SBP.

READ MORE: Interest rates on export, business loans enhanced to 10%

Earlier, the SBP issued the first and so far the only commemorative banknote in 1997 to mark the Golden Jubilee of Pakistan’s Independence. He also elaborated the features of the Banknote.

Paying tribute to the overseas Pakistanis for their relentless contributions towards the country, Governor (A) also inaugurated the Roshan Pension Plan (RPP) scheme, as a part of SBP’s resolve to augment the lifestyle banking under RDA initiative that is being added to the RDA product suite.

He said the overseas Pakistani’s can now avail the benefits of financial planning for their post-retirement life in Pakistan through RPP and enjoy exclusive pension plan.

READ MORE: Pakistan hikes key policy rate by 125 basis points to 15%

Soft launch of the product will start from August 15, 2022 with collaboration of RDA banks and Asset Management Companies.

Dwelling on the latest economic developments and challenges faced by the economy, Dr. Syed shared his thought-provoking views with the audience.

From the onset he separated on-ground facts from negative fake news making rounds on social media, which projected a doomsday scenario for Pakistan and advised citizens to not pay heed on such rumors.

He spoke on forthcoming IMF bailout package and Pakistan’s prospects amidst troubled economic scenario internationally.

READ MORE: PHMA cries foul on gas suspension to textile industry

The Governor brushed aside perception that Pakistan’s economy was in dire straits and said that economically weak and developing economies may undergo drastic challenges in next 12 months and Pakistan is no exception.

He reminded the audience that administrative infrastructure in countries like Pakistan is not very strong and resultantly, effects of price hike become more pronounced here.

He hoped the crucial IMF bailout program would provide reprieve to the country and Pakistan will not be vulnerable as compared to the countries that do not have the IMF program.

In the end, Dr. Syed inaugurated exhibition of rare photographs of Quaid e Azam in collaboration with Press Information Department (PID). Governor took keen interest in the photographs and appreciated the hard work of officials of PID and the SBP Museum.

Features of Rs75 Banknote:

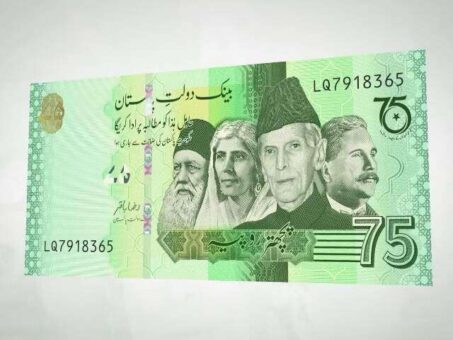

The Banknote is predominantly green, complemented by white shades and some yellowish tone to enrich its appeal.

The green color represents growth and development and derives inspiration from the Islamic identity of the country, whereas the white color emphasises the religious diversity of population.

The distinctive feature of this Banknote is multiple portraits on its front side. The personalities to grace the banknote are Quaid-i-Azam Muhammad Ali Jinnah, Sir Syed Ahmed Khan, Allama Muhammad Iqbal and Mohtarma Fatima Jinnah.

The Markhor and Deodar trees pictures on the reverse of the Banknote highlights our national commitment to address climate change and its repercussions.

Both Markhor and Deodar trees serve as symbols of the devastations wrought by these changes and call for urgent measures to combat and reverse environmental degradation.

Finance Department of the SBP bent over backwards for timely completion of this important project and I appreciate their efforts,’ said Dr. Syed.