The Pakistan Telecommunication Authority (PTA) has intensified its nationwide crackdown against illegal SIM issuance, conducting a major enforcement operation on a Ufone franchisee in Peshawar.

(more…)Tag: Ufone

-

Ufone 4G extends free calls to flood-affected communities

Islamabad, August 17, 2025 – In response to the devastating impact of flash floods across Khyber Pakhtunkhwa (KP), Ufone 4G has announced a special initiative to provide free calls for subscribers in the worst-hit districts.

(more…) -

Ufone Ranked No. 1 in PTA QoS Coverage

Islamabad, January 24, 2025 – Ufone has secured the top position in network coverage based on the Quality of Service (QoS) survey conducted by the Pakistan Telecommunication Authority (PTA).

(more…) -

ONIC Appoints Symmetry Group for Digital Presence in Pakistan

Karachi, December 11, 2024 – ONIC (Digital Technology Managed Service Pvt. Limited) has chosen Symmetry Group as its partner to revolutionize its digital presence in Pakistan. This strategic collaboration aims to strengthen ONIC’s position as a cutting-edge digital telco brand.

(more…) -

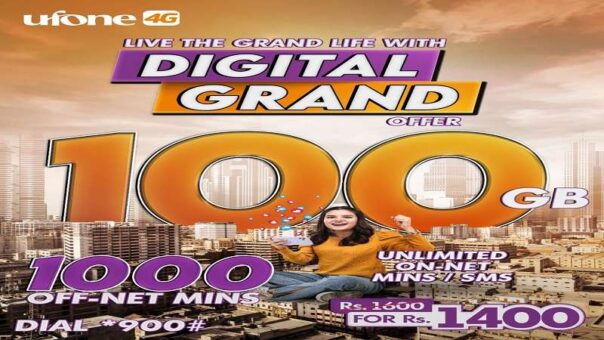

Ufone 4G Revolutionizes Connectivity with Digital Grand

Ufone 4G, the leading telecommunications provider in Pakistan, has unveiled its latest offering: the Digital Grand Offer. This groundbreaking offer redefines connectivity, providing exceptional advantages to our esteemed customers.

(more…) -

USF Awards Rs6.78 Billion Contract to Ufone for Providing High-Speed Mobile Broadband

Islamabad, July 13, 2023 – The Universal Service Fund (USF) has awarded a contract worth approximately Rs6.78 billion to Ufone for providing High-Speed Mobile Broadband services in the Sibbi district of Balochistan province and Motorway M-8.

(more…) -

Ufone increases rates amid rising inflation

KARACHI: Ufone, Pakistan’s largest phone service provider, has increased tariff for its various packages.

In a message sent by the cellular service provider to its customers said: “… to maintain quality of services during ongoing rise in inflation, there will be changes in some of our offers.”

READ MORE: Ufone 4G ranked top voice and data network

The rates of following packages have been increased:

UPower 100, which was of Rs.100 has been increased to Rs.120 with change in resources of addition 1000 SMS in All in One (Option 1) Variant which will be effective from June 28, 2022.

Super Card Plus, which was of Rs.649 has been increased to Rs.699 which will be effective from June 29, 2022. The resources are same as previous.

READ MORE: Ufone signs Rs21 billion agreement for 4G spectrum

Super Card Gold, which was of Rs.999 has been increased to Rs.1099 with change of resources of addition 100 Off-Net minutes and 2GB Main volume and 2 GB Social Volume (1 GB FB and 1 GB WA) which will be effective from June 29, 2022.

-

Meezan Bank provides bill discounting facility for Huawei

KARACHI: Meezan Bank has successfully instituted an Islamic alternate to Inland Bill Discounting Facility for Huawei Technologies Pakistan (Pvt.) Limited – a first-of-its-kind transaction in Islamic banking industry, developed as a Shariah-compliant alternate to local bill discounting facility.

READ MORE: Meezan Bank lends Rs1 billion under youth scheme

The first drawdown under the facility was made against a deferred payment inland Letter of Credit (LC) opened by Pak Telecom Mobile Limited (Ufone) in favour of Huawei. The transaction has been developed by the Bank under the supervision and guidance of Dr. Muhammad Imran Ashraf Usmani – Vice Chairman Shariah Board, Meezan Bank, after a series of deliberations and persistent efforts.

READ MORE: Meezan Bank announces 26% growth in annual profit

On this occasion, Abdullah Ahmed – Group Head, Corporate & Institutional Banking, Meezan Bank stated: “Meezan Bank is pleased to offer yet another milestone solution for the Islamic banking industry i.e., a Shariah-compliant alternative to discounting of long tenor inland bills with provision of variable profit rates. We are hopeful that this solution will serve as a precedent for unique transactions pertaining to trade within telecom industry.”

READ MORE: Meezan Bank, Suzuki Motors sign MoU for car financing

Ahmed Ali Siddiqui – Group Head, Shariah Compliance, Meezan Bank, stated, “This endeavour of Meezan Bank displays its capability to develop out-of-the-box, innovative and Shariah-compliant solutions and reinforces its position as the leading Islamic bank of the country. We hope this solution will open a new chapter in facilitating trade among businesses and industries in a Shariah-compliant way and bring more businesses and trade into fold of Islamic banking.”

READ MORE: Meezan Bank starts Islamic financing scheme for SMEs