KARACHI: Filing of wealth statement is mandatory for making annual return form valid. Taxpayers are required to file asset declaration under Section 116 of Income Tax Ordinance, 2001.

Last date for filing income tax returns for tax year 2019 is October 31, 2019, which was already extended from September 30, 2019.

116. Wealth statement.— (1) The Commissioner may, by notice in writing, require any person being an individual to furnish, on the date specified in the notice, a statement (hereinafter referred to as the “wealth statement”) in the prescribed form and verified in the prescribed manner giving particulars of —

(a) the person’s total assets and liabilities as on the date or dates specified in such notice;

(b) the total assets and liabilities of the person’s spouse, minor children, and other dependents as on the date or dates specified in such notice;

(c) any assets transferred by the person to any other person during the period or periods specified in such notice and the consideration for the transfer;

(d) the total expenditures incurred by the person, and the person’s spouse, minor children, and other dependents during the period or periods specified in the notice and the details of such expenditures; and

(e) the reconciliation statement of wealth.

(2) Every resident taxpayer being an individual filing a return of income for any tax year shall furnish a wealth statement and wealth reconciliation statement for that year along with such return:

Provided that every member of an association of persons shall also furnish wealth statement and wealth reconciliation statement for the year along with return of income of the association.

Where a person, who has furnished a wealth statement, discovers any omission or wrong statement therein, he may, without prejudice to any liability incurred by him under any provision of this Ordinance, furnish a revised wealth statement along with the revised wealth reconciliation and the reasons for filing revised wealth statement, at any time before the receipt of notice under sub-section (9) of section 122, for the tax year to which it relates.

(4) Every person (other than a company or an association of persons) filing statement under sub-section (4) of section 115, falling under final tax regime (FTR) shall file a wealth statement along with reconciliation of wealth statement.

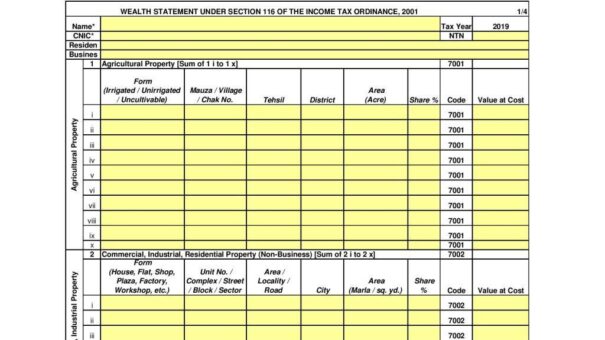

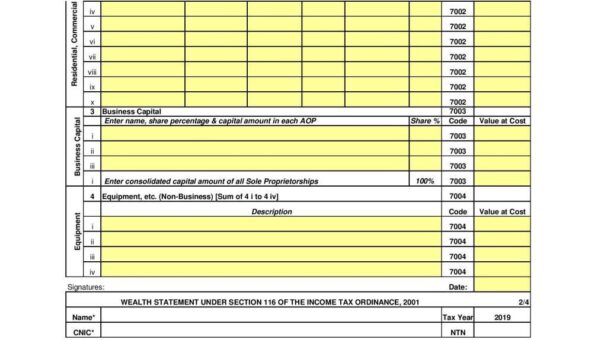

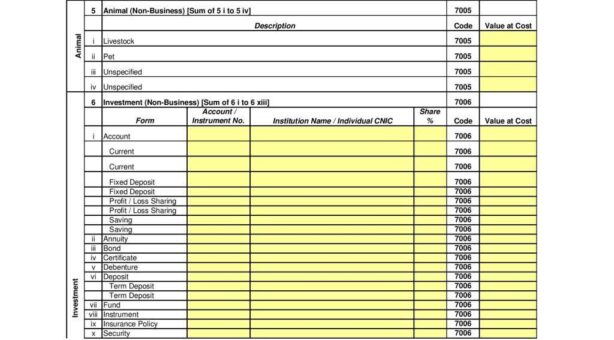

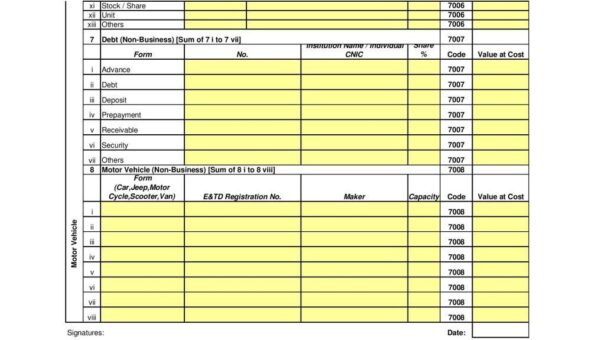

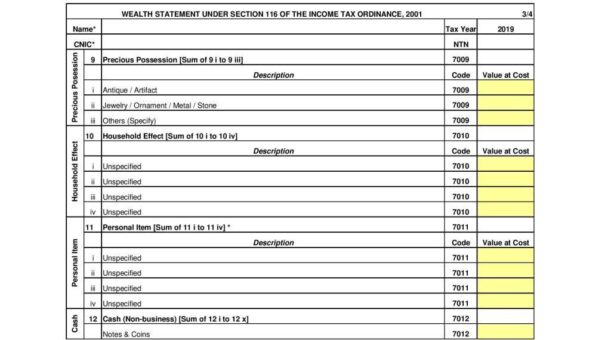

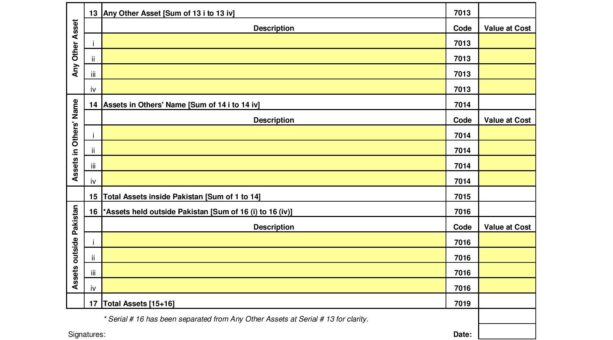

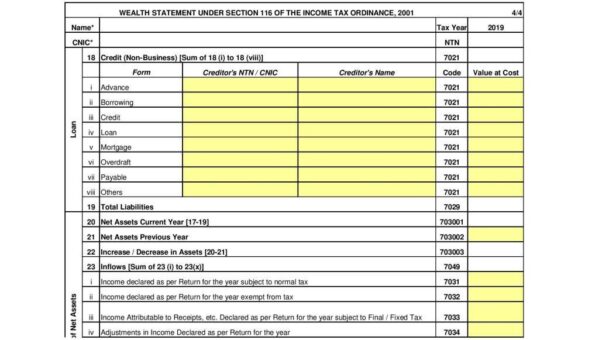

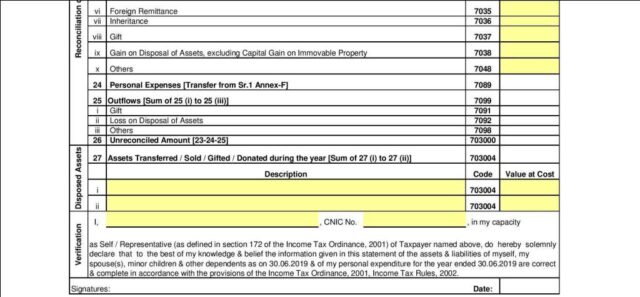

Following is the Form of Wealth Statement for Tax Year 2019 issued by Federal Board of Revenue (FBR):