ISLAMABAD: In a bid to counter rising inflation and alleviate the economic burden on citizens, the government has decided to reduce duty and taxes on the supply of edible oil.

(more…)Day: October 18, 2021

-

ITMinds, PPL sign deal for accounting services

KARACHI: Pakistan Petroleum Limited (PPL) & ITMinds Limited (ITMinds), a wholly owned subsidiary of Central Depository Company of Pakistan Limited (CDCPL), have signed an agreement enabling ITMinds to provide Back Office Accounting Services for PPL’s Retirement Funds.

This is a continuation of an earlier arrangement between ITMinds and PPL through which ITMinds had been successfully providing these BPO services to PPL, a statement said on Monday.

Through this arrangement, ITMinds will facilitate PPL for the accounting and administration of PPL’s Retirement Funds, including Pension, Provident and Gratuity funds, allowing PPL to focus on its investment decisions by leveraging ITMinds’ state of the art back office system and IT infrastructure while reaping the benefits of economies of scale.

Commenting on the occasion, Syed Rahat Hussain Naqvi, Senior Manager Finance-PPL, emphasized the importance of automation of back-office services for retirement funds for both process improvement as well as cost optimisation. He further appreciated how this arrangement with ITMinds in the last three years has helped to provide uninterrupted services, especially during the pandemic induced circumstances.

Also commenting on the occasion, Iqleem-uz-Zaman Khan, CEO – ITMinds, said that considering this is an era of specialization, ITMinds’ BPO services of fund accounting and administration enable companies to outsource their back office functions to a competent and reliable BPO partner while achieving efficiency, scalability and transparency of processes.

The event was also attended by, Shariq Jafrani CFO-CDC, Waqas Ashraf CFO- ITMinds, Muneer Hussain Manager Shared Services-PPL, M. Tarique Sheikh Senior Accountant-PPL and Salman Iqbal, Manager- ITMinds.

-

CGT rates on immovable property for Tax Year 2022

In a bid to streamline taxation procedures and ensure clarity for taxpayers, the Federal Board of Revenue (FBR) has released details regarding the tax rates on immovable property for the tax year 2022. The information is part of the Income Tax Ordinance, 2001, updated up to June 30, 2021, incorporating amendments introduced through the Finance Act, 2021.

(more…) -

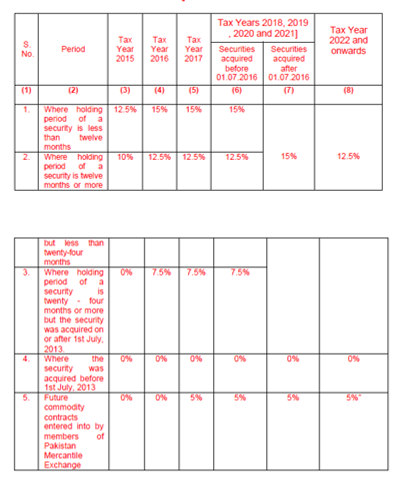

CGT rates on disposal of securities during Tax Year 2022

The tax rates on disposal of securities for tax year 2022 under the First Schedule of the Income Tax Ordinance, 2001.

The Federal Board of Revenue (FBR) issued the Income Tax Ordinance, 2001 updated up to June 30, 2021. The Ordinance incorporated amendments brought through Finance Act, 2021.

Following are the rates on disposal of securities:

The rate of tax to be paid under section 37A shall be as follows:—

TABLE I

Provided that the rate of tax on cash settled derivatives traded on the stock exchange shall be 5% for the tax years 2018 to 2020.

Provided that the rate for companies shall be as specified in Division II of Part I of First Schedule, in respective of debt securities;

Provided further that a mutual fund or a collective investment scheme or a REIT scheme shall deduct Capital Gains Tax at the rates as specified below, on redemption of securities as prescribed, namely:—

Category Rate Individual and association of persons 10% for stock funds 10% for other funds Company 10% for stock funds 25% for other funds Explanation.- For removal of doubt, it is clarified that, the provisions of this proviso shall be applicable only in case of a mutual fund or collective investment scheme or a REIT scheme.

-

KSE-100 index falls on uncertainty in IMF negotiations

KARACHI: The benchmark KSE-100 index of Pakistan Stock Exchange (PSX) fell by 192 points on Monday. The index declined owing to uncertainty in dialogues of the government authorities with the IMF.

The index closed at 44,629 points as against last Friday’s closing of 44,821 points.

Analysts at Arif Habib Limited said that the market took pressure from the negative news vibes due to delay in negotiating the resumption of IMF package.

Though, the Ministry of Finance highlighted that the negotiations are ongoing and underlying terms will be negotiated soon, the investors had not like the uncertainty.

Oil chain and banking stocks went positive earlier in the session that added a total of 169 points on the index, however, selling pressure eroded this gain and MoC brought the Index in negative territory.

Among scrips, HUMNL topped the volumes with 25.1 million shares, followed by WTL (20.8 million) and HASCOL (13.8 million).

Sectors contributing to the performance include Technology (-146 points), Cement (-47 points), Engineering (-27 points), Textile (-24 points) and Refinery (-18 points).

Volumes declined from 334.3 million shares to 248.3 million shares (-26 per cent DoD). Average traded value also declined by 25 per cent DoD to reach US$ 51 million as against US$ 68.2 million.

Stocks that contributed significantly to the volumes include HUMNL, WTL, HASCOL, UNITY and DSL, which formed 34 per cent of total volumes.

Stocks that contributed positively to the index include HBL (+48 points), MCB (+31 points), OGDC (+30 points), PPL (+29 points) and ENGRO (+27 points). Stocks that contributed negatively include TRG (-88 points), SYS (-47 points), BAHL (-42 points), FFC (-22 points) and UNITY (-17 points).

-

Foreign direct investment declines to $439M in 1QFY22

Pakistan has witnessed a four per cent decrease in foreign direct investment (FDI) during the first quarter (July – September) of the fiscal year 2021/2022 (Q1FY22), as per data released by the State Bank of Pakistan (SBP) on Monday.

(more…) -

KIBOR rates on October 18, 2021

KARACHI: State Bank of Pakistan (SBP) on Monday issued the following Karachi Interbank Offered Rates (KIBOR) on October 18, 2021.

Tenor BID OFFER 1 – Week 7.22 7.72 2 – Week 7.25 7.75 1 – Month 7.30 7.80 3 – Month 7.76 8.01 6 – Month 8.16 8.41 9 – Month 8.46 8.96 1 – Year 8.74 9.24 -

PKR derails to make record low at Rs172.78 to dollar

KARACHI: The Pak Rupee (PKR) derailed against dollar on Monday and fell to a new all-time low of Rs172.78 in the interbank foreign exchange market.

The rupee fell by Rs1.6 to end at Rs178.78 to a dollar from last Friday’s closing of Rs171.18 in the interbank foreign exchange market.

Currency experts said that the market was opened after two days holidays. Further a public holiday on October 19, 2021 put pressure on dollar demand.

They said that huge import bill during first quarter of the current fiscal year pushed up the dollar demand. The import bill of the country recorded an increase of 66.11 per cent during first quarter (July – September) 2021. The country has spent foreign exchange to the tune of $18.75 billion during first quarter of the current fiscal year as compared with $11.28 billion in the corresponding quarter of the last fiscal year.

The oil import bill is the major reason for the massive depreciation in the local currency. The oil import bill registered a phenomenal growth of 97 per cent to $4.59 billion during the first quarter of the current fiscal year as compared with $2.33 billion in the corresponding quarter of the last fiscal year.

-

SBP issues customers exchange rates for October 18, 2021

Karachi, October 18, 2021 – The State Bank of Pakistan (SBP) has released the latest exchange rates for various foreign currencies against the Pakistani Rupee (PKR) on Monday, October 18, 2021.

(more…)