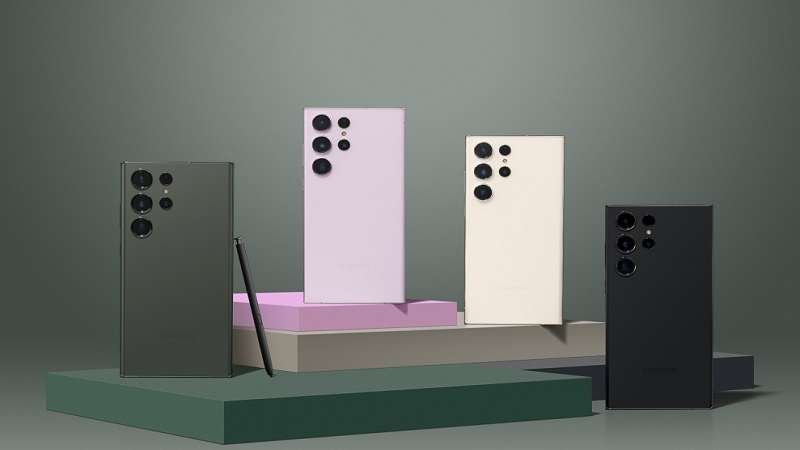

The Samsung Galaxy S23 Ultra has been released in Pakistan on February 02, 2023. The phone is available for purchase at a price of Rs560,000 for the variant with 512GB of internal memory and 12GB of RAM.

(more…)Category: IT & Telecom

Explore IT and Telecom stories with Pakistan Revenue, your go-to source for the latest updates on Pakistan’s technology and telecom sector. Stay ahead with real-time industry insights and economic developments.

-

Samsung unveils 98-Inch Neo QLED 8K TV

Samsung has unveiled its latest 98-inch Neo QLED 8K TV at CES 2023, catering to the growing demand for ultra-large TVs.

(more…) -

Careem introduces offline booking to counter internet outrage in Pakistan

In response to the widespread internet outage in Pakistan, Careem, the popular online cab service, has taken a proactive step by introducing an alternate method for booking rides. The company has implemented an offline booking system through three dedicated helplines, specifically for customers in Karachi.

(more…) -

Latest price of iPhone 14 Pro Max from May 12

The iPhone 14 Pro Max was released in Pakistan on September 29, 2022, with prices varying based on the chosen storage capacity.

(more…) -

Pakistan’s telecom sector faces billions in losses as internet suspension takes toll

Pakistan’s telecom sector has experienced a significant blow with financial losses amounting to Rs2.46 billion due to the suspension of broadband internet services over a three-day period.

(more…) -

Mobile phone banking faces major setbacks as Pakistan suspends internet services

Pakistan’s decision to shut down internet services in the country has had severe repercussions for the mobile phone banking sector, leading to substantial financial losses.

(more…) -

Internet blockage halts app-based car and ride-sharing services in Pakistan

In a bid to prevent potential protests following the arrest of former Prime Minister Imran Khan, the Pakistani government has implemented an internet blockage across the country. As a result, app-based car and ride-sharing services, including popular platforms such as Careem, Uber, in-Drive, and Bykea, are unable to provide services, a captain of app-based car services said on Thursday morning.

(more…) -

MediaTek unveils Dimensity 9200+ Chipset

MediaTek, a renowned semiconductor company, has announced the release of its highly anticipated Dimensity 9200+ chipset, an upgraded version of its predecessor.

(more…) -

P@SHA demands immediate resumption of Internet services

Muhammad Zohaib Khan, Chairman of Pakistan Software Houses Association (P@SHA), has strongly criticized the abrupt and unconsulted blockage of internet services in the country amid the ongoing political situation.

(more…) -

Telecom operators count losses as Internet shutdown takes a toll on Pakistan’s economy

In a dramatic turn of events, the arrest of former Prime Minister Imran Khan has plunged Pakistan into a state of turmoil, triggering massive protests across the nation.

(more…)