Karachi, September 16, 2024 – Pakistan’s textile exports have witnessed a significant growth of 5.37% during the first two months (July–August) of the current fiscal year 2024-25, according to data released by the Pakistan Bureau of Statistics (PBS) on Monday. The country’s textile exports reached $2.92 billion during this period, up from $2.77 billion in the corresponding months of the previous fiscal year.

(more…)Category: Trade & Industry

This section covers news on trade and industry. Pakistan Revenue is committed to providing the latest updates on business trends.

-

Site Association Demands Single-Digit Interest Rate

Karachi, September 13, 2024 – The Site Association of Industry (SAI) has urged the State Bank of Pakistan (SBP) to lower interest rates to a single digit, calling for a more aggressive approach to stimulate economic growth.

(more…) -

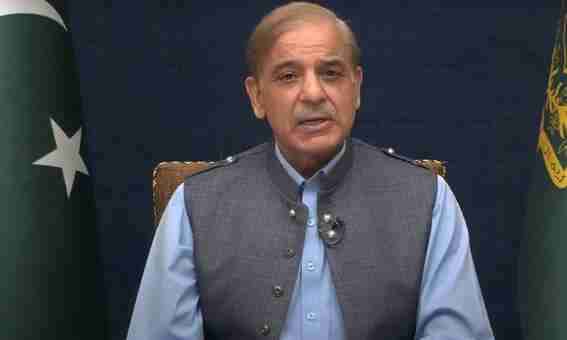

PM Shehbaz Directs Measures to Boost SMEs Profitability

Islamabad, September 13, 2024 – Prime Minister Shehbaz Sharif has called for immediate measures to enhance the profitability of small and medium enterprises (SMEs), emphasizing their pivotal role in driving national economic growth.

(more…) -

Business Community Terms 2% Rate Cut Too Little

Karachi, September 12, 2024 – The business community in Pakistan has voiced its disappointment over the State Bank of Pakistan’s (SBP) decision to cut the key policy rate by 2%, terming it insufficient given the current economic conditions.

(more…) -

MTO Karachi Urges ABAD to Pay FED on Properties

Karachi, September 11, 2024 – The Medium Taxpayers Office (MTO) Karachi has called upon members of the Association of Builders and Developers (ABAD) to comply with the newly implemented Federal Excise Duty (FED) on immovable properties.

(more…) -

Indonesia Ready to Negotiate Free Trade Agreement with Pakistan

Islamabad, September 11, 2024: In a significant move towards strengthening bilateral economic ties, Indonesia has expressed its readiness to negotiate a Free Trade Agreement (FTA) with Pakistan. Rahmat Hindiarta Kusuma, the Charge d’Affaires of the Indonesian Embassy, conveyed this during his visit to the Islamabad Chamber of Commerce and Industry (ICCI) on Wednesday.

(more…) -

KATI Demands Urgent Cut in Interest Rates

Karachi, September 6, 2024 – The Korangi Association of Trade and Industry (KATI) on Friday issued an urgent call for a reduction in interest rates, citing the recent drop in inflation. KATI President Johar Qandhari emphasized the need for a 4% cut in interest rates to align with the current inflation rate, which stands at 9%.

(more…) -

National Foods Sees 26.35% Profit Decline Despite Strong Sales

Karachi, September 6, 2024 – National Foods Limited on Friday reported a significant 26.35% decline in net profit for the fiscal year ended June 30, 2024, despite robust sales growth.

(more…) -

PBF Calls on Traders to Boost Economy with Tax Compliance

Karachi – The Pakistan Business Forum (PBF) has called on traders and shopkeepers across the country to fulfill their tax obligations, emphasizing the importance of increased tax collection for long-term economic stability.

(more…) -

FPCCI Announces Launch of Modern Digital Media Channel

Karachi, September 5, 2024 – The Federation of Pakistan Chambers of Commerce and Industry (FPCCI) announced the launch of a modern digital media platform aimed at addressing key economic, social, and societal issues.

(more…)