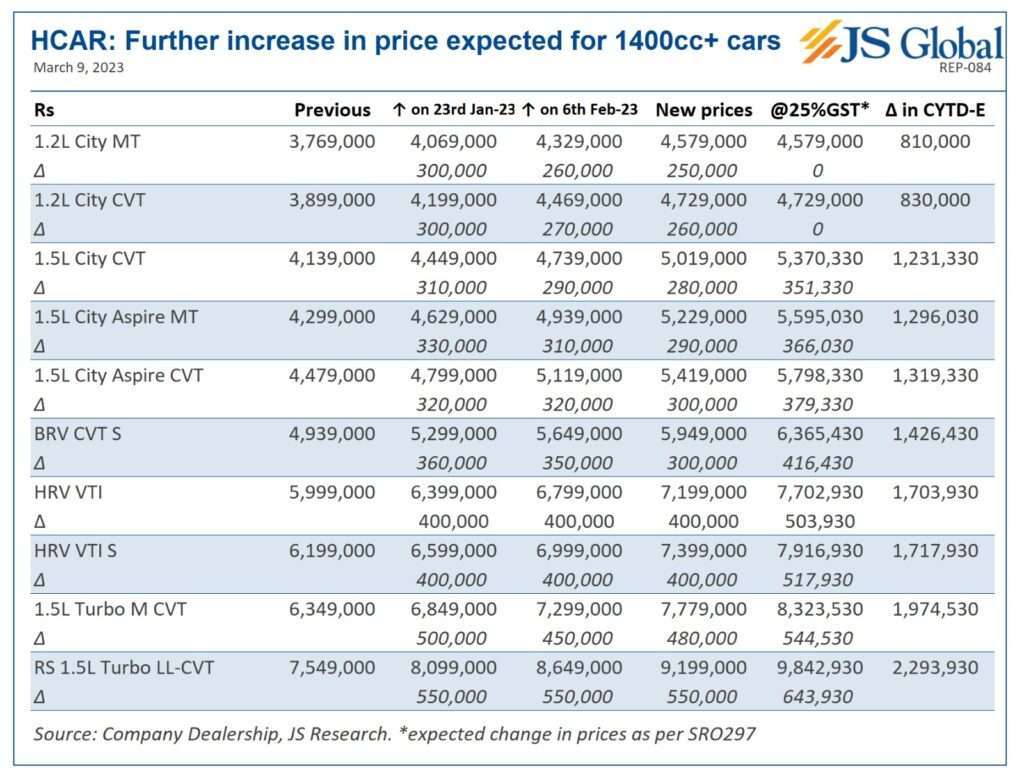

Experts estimated a massive hike in prices of cars with capacity of 1400CC and above after imposition of sales tax rate at 25 per cent.

The Federal Board of Revenue (FBR) notified SRO 297(I)/2023 on March 08, 2023, issuing the list of goods subjected to sales tax at 25 per cent sales tax.

The FBR issued the SRO following the approval of federal cabinet. The rates were proposed through the mini budget on February 15, 2023 and become part of the tax laws with the approval of Finance Supplementary Act, 2023 issued on February 23, 2023.

READ MORE: FBR issues list of luxury imported, local goods for imposing 25% sales tax

Analysts at JS Global said further increase in prices expected for 1400CC+ cars:

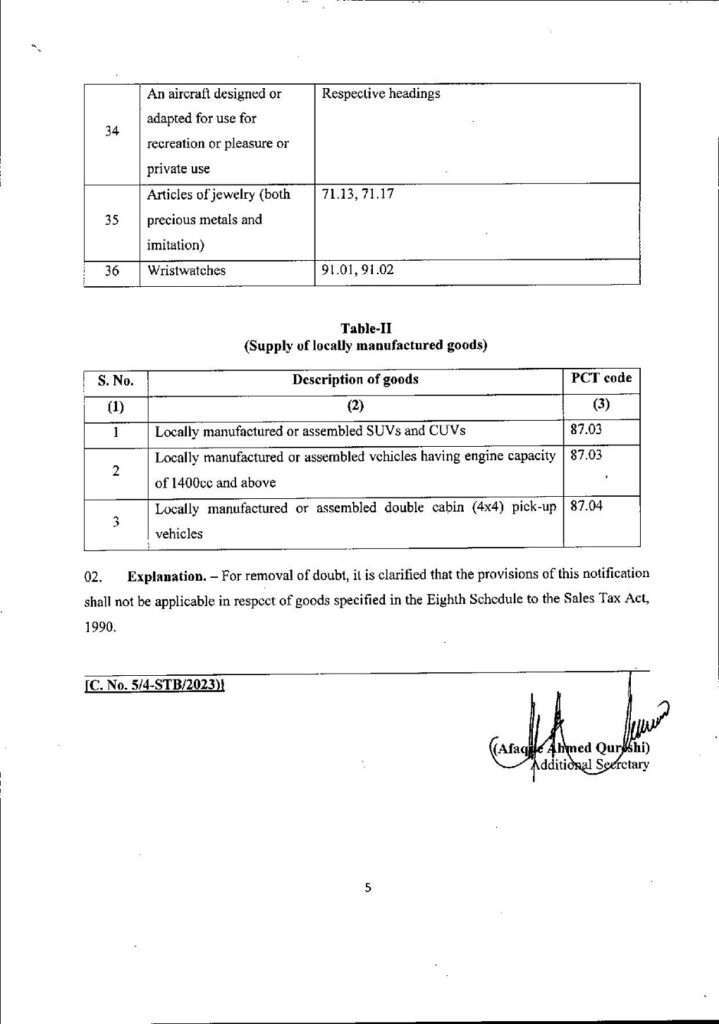

The FBR issued the details of locally manufactured cars on which sales tax at 25 per cent will be applied.

The revenue body also issued the following details of CBU imported vehicles for imposition of 25 per cent sales tax:

01. 8703.2113, -Mini Vans (CBU)

02. 8703.2119, Other

03. 8703.2193, – 4×4 vehicles (CBU)

04. 8703.2199, Other

05. 8703.2220, Vehicles of a cylinder capacity exceeding 1000cc but not exceeding 1300cc

06. 8703.2240, – Mini vans (CBU)

READ MORE: Pakistan slaps 25% sales tax on import of mobile phones valuing above $500

07. 8703.2290, other

08. 8703.2313, – Sport utility vehicles

09. 8703.2319, Other

10. 8703.2329, Other

11. 8703.2490, Other

12. 8703.3112, Other

13. 8703.3139, Other

14. 8703.3219, Other

15. 8703.3223, Sport utility vehicles (SUVs 4×4)

16. 8703.3229, Other

17. 8703.3390, Other

READ MORE: Pakistan’s external debt surges by 38% on massive PKR devaluation during one year

18. 8703.4019, Other

19. 8703.4032, Vehicles of a cylinder capacity exceeding 1000cc but not exceeding 1300cc

20. 8703.4039, Other

21. 8703.4049, Other

22. 8703.4069, Other

23. 8703.5019, Other

24. 8703.5029, Other

25. 8703.5049, Other

26. 8703.5059, Other

27. 8703.5069, Other

28. 8703.6029, Other

29. 8703.6032, – Vehicles of a cylinder capacity exceeding 1,000cc but not exceeding 1,300cc

30. 8703.6039, Other

31. 8703.6059, Other

32. 8703.6069, Other

33. 8703.7019, Other

34. 8703.2195, – Mini vans (CBU)

35. 8703.2260, Sport utility vehicles

36. 8703.2323, Sport utility vehicles (SUVs 4×4)

37. 8703.3129, – Other

38. 8703.3225, All terrain vehicles (4×4)

39. 8703.4029, – Other

40, 8703.4059, Other

41. 8703.5039, Other

42. 8703.6019, Other

43. 8703.6049, Other

READ MORE: Prices of diesel, petrol jump by 93.82% and 77.89% in latest inflation numbers

44. 8703.7029, Other

45. 8703.7039, Other

46. 8703.7049, Other

47. 8703.7059, Other

48. 8703.7069, Other

49. 8703.9000, Other