KARACHI: The import of used electric vehicles has been proposed under ‘National Electric Policy’ for at least two years for giving time to local auto manufacturers to prepare development plans.

According to recently introduced ‘National Electric Policy’ it is proposed:

For the first two years i.e. 2019-2021 up to 3 years old ‘used’ all-electric vehicles will be allowed for import.

This time will give local auto manufacturers to prepare their EV development plans and will also help acclimatize local consumers with a lower upfront cost and will help in establishing charging infrastructure.

If locally manufactured EVs are available by 2021, then this import allowance can be withdrawn

However, if there are no locally manufactured EVs by year 2021 the decision to extend this allowance may be pondered upon.

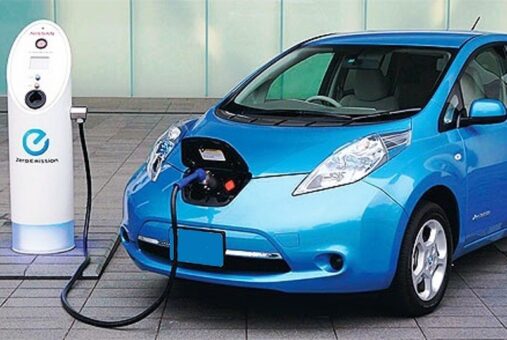

According to the policy the category of EVs include passenger and commercial cars, jeeps, SUVs, vans and small delivery vehicles of up to one ton cargo hauling i.e. Categories M1 and N1 of UNECE Vehicle Classification.

Although the car market has developed in Pakistan, there is virtually no EV penetration in the country.

Therefore, some aggressive steps are required to create an EV market and then reap its benefits.

The capital cost of electric cars is still high for masses and many countries provide tax breaks, incentives and trade-ins to encourage purchase of electric cars.

While the cost is high at this time, it is expected to go down steadily and by 2023-24 the cost of electric cars is projected to be at par with their Fossil Fuel Vehicle (FFV) counterparts.

For Pakistan to create an EV market some good incentives are needed to bring the cost of purchase of EVs down.

In view of the above the Government of Pakistan, in collaboration with relevant entities shall take the following measures:

1. All existing incentives of the Auto Development Policy 2016-2021 are to remain intact. However, government will give the following further incentives to jump start EV manufacturing in Pakistan only for local manufacturing units:

a. All EVs manufactured in Pakistan will be sold at less than one percent General Sales Tax (GST) for the next seven years to bring the purchase price of EVs down.

b. Pakistan manufactured EVs will be exempted from registration fees and annual token tax to encourage prospective buyers. Imported EV’s shall receive the same benefit for next 5 years.

2. EV specific parts and components, not being manufactured locally compliant to UNECE 1958 Agreement ‘WP.29’ standards as well as equivalent international standard applied by the United States, European Union and other major EV manufacturers, will be allowed import at one percent custom duty for the next two years until 2021.

3. Registration number plates of EVs will have a distinct color/design to create EV specific zones in high density areas and to introduce distinct incentives for EVs.

4. The State Bank of Pakistan may initially allow new EVs to be purchased under Green Banking Guidelines and may further evolve an incentive scheme push down the price of local EV manufacturing through a better financing scheme. Again this will encourage EV penetration in the country and will reduce upfront cost of EVs.