ISLAMABAD: Duty free imports have jumped by 62.5 per cent on an annual basis, much higher growth comparing dutiable imports, Federal Board of Revenue (FBR) said in a report released recently.

(more…)Tag: duty free import

-

FBR issues rules for duty free import of minimum value goods

ISLAMABAD: Federal Board of Revenue (FBR) on Friday issued rules for duty free minimum value of goods imported through courier and postal service.

The FBR issued SRO 886(I)/2020 to notify draft amendment to Customs Rules, 2001.

Through the draft amendment the FBR issued ‘Deminimis rules for imported goods’, which shall apply to the goods imported through post service and air courier only.

“De minimis value’ means the value of goods up to five thousand rupees in terms of the provisions of Section 19C of the Customs Act, 1969.

The FBR said that for the purpose of application of the provisions of Section 19C of the Customs Act, 1969, the value mentioned on label of the postal good or the courier receipt shall be considered as the declared value.

Further, for conversion of invoice value into Pak Rupee, the postal or courier authorities shall take the official exchange rate of the previous day.

The postal or courier authorities shall submit a separate list of goods along with invoices and other documents, if any, wherein the declared value is up to five thousand rupees.

The customs authorities shall scrutinize the list and shall have the right to examine or detain any goods to verify the declared value or compliance to the requirement of any other law applicable thereon.

The postal or courier authorities shall submit a consolidated monthly e-statement of all such clearance along with copies of invoice of the imported goods cleared under the rules to the concerned customs authorities for re-conciliation of the record.

-

Duty free import increases by 17pc despite phasing out exemptions

KARACHI: Despite elimination of exemption and strengthening enforcement the duty free import surged by 17.1 percent during 2018/2019, according to official documents.

The FBR in its report released this month said that the duty free imports increased by 17.1 percent to Rs2,445 billion during fiscal year 2018/2019 as compared with Rs2,087 billion in the preceding fiscal year.

The documents revealed that goods under Chapter 27 of Customs Tariff were imported duty free worth Rs600 billion during fiscal year 2018/2019 as compared with Rs491 billion in the corresponding period of the preceding fiscal year.

The import of products including Mineral fuels, mineral oils and products under this chapter has increased by 22.3 percent during the period under review.

An amount of Rs317 billion has been allowed duty free for the import of boilers, machinery and mechanical during fiscal year 2018/2019, which is 12.5 percent higher than Rs282 billion in the same period of the preceding fiscal year.

The customs authorities granted duty free import of around Rs189 billion for the clearance of organic chemical during fiscal year 2018/2019 as compared with Rs144.85 billion in the preceding fiscal year, showing growth of 30.5 percent.

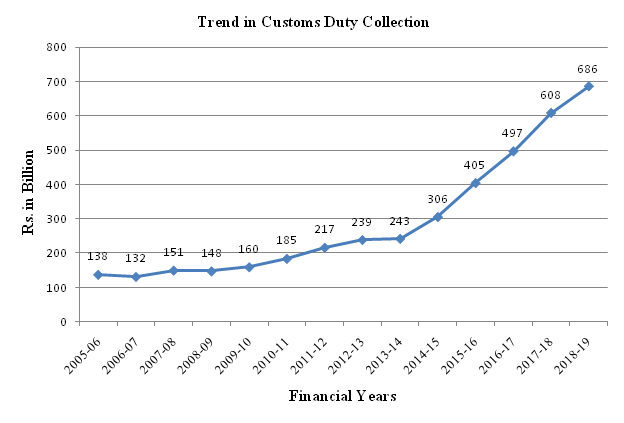

Despite lowering of tariff over the years, the customs duty is still one of the important sources of Federal Tax collection. The Dutiable Imports are the tax base for Customs Duty.

The collection of customs duty stood at around Rs686 billion and has contributed around 28.8 percent in the Indirect Taxes and 17.9 percent in total taxes during the F.Y.: 2018-2019.

It has increased by around 13 percent as compared to previous year.

The target of customs duty was Rs. 735 billion during FY: 2018-2019 which was missed by 6.7 percent.

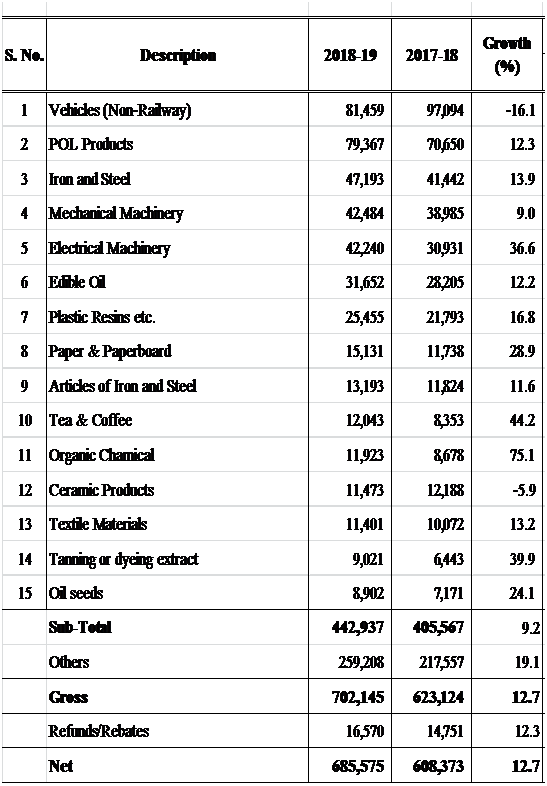

Source: FBR Out of 15 major revenue spinners, 13 items of imports recorded positive growth during FY: 2018-19 mainly due to increased Imports. On the other hand, only automobile (Ch:87) and ceramic products recorded negative growths.

The details of Customs Duty collection from major commodity groups (chapters) are presented in table below.

Source: FBR -

ECC allows duty free import of cotton

ISLAMABAD: The Economic Coordination Committee (ECC) of the Cabinet on Monday approved duty-free import of cotton.

The ECC took the decision at a meeting held here under the chairmanship of Advisor to Prime Minister on Finance and Revenue, Hafeez Shiekh in the chair.

The meeting also allowed cotton import through the Torkham border.

The ECC was informed that Cotton remained duty-free till the slab of zero percent was abolished in 2014-2015 and Custom Duty of 1 percent was imposed along with 5 percent Sales Tax.

Later on, 1 percent slab was increased to 2 percent and then 3 percent along with 2 percent additional customs duty to make it 5 percent.

Since 2017 the duties are withdrawn from January/February and re-imposed in July-August. It was also discussed that by January 01, 2010 the majority of the cotton would be lifted from the farmers.

Therefore, to further protect the farmers, the meeting allowed duty-free import of cotton with effect from January 15, 2020.

The ECC was also briefed that under Rule 28 of the Plant Quarantine Rules of 1967 / Plant Quarantine Act 1976, cotton is only allowed through sea route.

As trade with India is currently suspended by Pakistan, therefore, Afghanistan and the Central Asian states are the more viable economic sources for the import of cotton.

The ECC allowed import of cotton from Torkham Border subject to fulfillment of all sanitary and phytosanitary (SPS) conditions.

The ECC also desired that a comprehensive briefing may be given by the Ministry of National food Security and Research on matters pertaining to cotton production for next cotton season.

It may be noted that during first five months of current financial year, i.e. July-November 2019-20, the value-added readymade garments have increased by 35 percent, knitwear by 6 percent and bedwear by 14 percent in quantity terms as compared to the corresponding period of the previous year.

-

Overseas Pakistanis to be allowed bring duty-free hybrid vehicles

ISLAMABAD: In order to recognize the services of overseas Pakistanis, the government is considering to allow bringing duty-free hybrid vehicles into the country.

A statement said that the Ministry of Overseas Pakistan has proposed a major reward for Overseas Pakistanis in recognition of their services for the country and for their enduring convenience abroad.

The ministry is currently in the process of developing a list of major concessions and privileges to be given to Overseas Pakistanis for which all stakeholders and various departments have been requested to offer their concessional proposals.

It is for this reason; the Commerce Division has been requested to give their opinion on allowing Overseas Pakistanis, who remit one hundred thousand dollars to Pakistan in two years’ time, to bring one hybrid vehicle up to 3000cc without any duty.

The Commerce Division has proposed sending the same to the Ministry of Industry and Production/Engineering Development Board (EDB) to obtain their opinion.

The departments have been requested to submit their comments on the proposal as soon as possible so that the Ministry of Overseas Pakistanis can prepare this list within a stipulated time as advised by the Prime Minister’s office.

Special Assistant to the Prime Minister (SAPM) on Overseas Pakistanis and Human Resource Development (OPHRD) and Chairman National Tourism Coordination Board (NTCB) Syed Zulfiqar Bukhari, announced his full support for the move, reiterating that the project would not only reward overseas Pakistanis for contributing to the national treasury, but would also curtail Hundi and Hawala culture.

PM’s advisor Zulfi Bukhari is currently on a three-day tour to Doha, Qatar where he is meeting with Qatar Officials to promote tourism and investment in Pakistan.

-

Duty free import of plant, machinery allowed for industrial units

KARACHI: Federal Board of Revenue (FBR) has allowed duty free import of plant and machinery by industrial and manufacturing units.

The exemption has been allowed through Finance Supplementary (Second Amendment) Act, 2019 under Chapter 84 and 85 of Customs Act, 1969.

The FBR said that plant and machinery shall be allowed zero percent customs duty but it should be excluded consumer durable goods and office equipment as imported by Greenfield industries, intending to manufacture taxable goods, during their construction and installation period.

The exemption of customs duty is available on fulfillment of following conditions, namely:

(a) the importer is registered under the Sales Tax Act on or after the first day of July, 2019

(b) the industry is not established by splitting up or reconstruction or reconstruction of an undertaking already in existence or by transfer of machinery or plant from another industrial undertaking in Pakistan.

(c) exemption certificate issued by the commissioner Inland Revenue having jurisdiction; and

(d) The goods shall not be sold or otherwise disposed of without prior approval of the FBR and the payment of customs duties and taxes leviable at the time of import.