Islamabad, August 2, 2023 – The federal government has made a significant appointment by selecting Amjad Zubair Tiwana as the new Chairman of the Federal Board of Revenue (FBR), the apex tax agency in Pakistan. This decision was conveyed through an official notification issued by the Establishment Division.

(more…)Tag: Federal Board of Revenue

The Federal Board of Revenue is Pakistan’s apex tax agency, overseeing tax collection and policies. Pakistan Revenue is committed to providing timely updates on the Federal Board of Revenue to its readers.

-

New Tax Measures Boost Revenue: FBR Surpasses July Collection Target

Islamabad, August 1, 2023 – The Federal Board of Revenue (FBR) has achieved remarkable success by surpassing the revenue collection target for July 2023, thanks to the implementation of new tax measures that came into effect at the beginning of the month.

(more…) -

Return Filing Deadline Looms: File Your Income Tax Returns by September 30

Islamabad, August 1, 2023 – The Federal Board of Revenue (FBR) in Pakistan has officially announced the last date for filing income tax returns for the tax year 2023.

(more…) -

From Non-Filers to Active Taxpayers: Pakistan’s ATL Hits 4.26 Million High

Pakistan witnessed significant increase in Active Taxpayers with over 40,000 income tax returns filed in a single week, to high high of 4.26 million.

(more…) -

FBR Issues Updated Tax Law for Treatment of Black Money in Pakistan

Islamabad, July 31, 2023 – The Federal Board of Revenue (FBR) has recently released an updated tax law aimed at addressing the issue of black money and unexplained funds in Pakistan.

(more…) -

FBR Implements New Tax Rates on Sale and Purchase of Immovable Property

Karachi, July 29, 2023 – The Federal Board of Revenue (FBR) has recently put into effect new tax rates on the sales and purchase of immovable properties across the country.

(more…) -

Pakistan Announces 400% Increase in Tax on Payment through Debit/Credit Card

Karachi, July 29, 2023 – In a bid to curb the outflow of dollars and bolster its foreign exchange reserves, Pakistan has taken a significant step by announcing a whopping 400 percent increase in taxes on payments made through debit or credit cards.

(more…) -

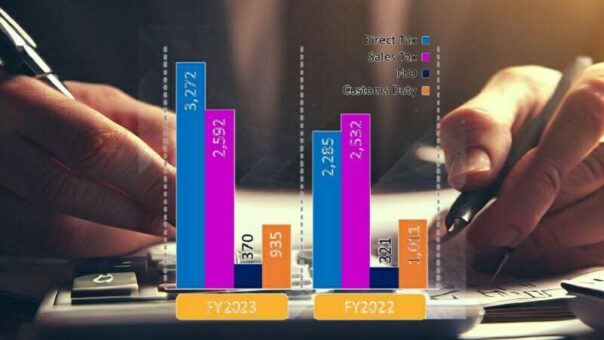

FBR’s Fiscal Fumble: Misses Rs 7.2 Trillion Tax Target for FY23

Karachi, July 28, 2023 – The Federal Board of Revenue (FBR) fell short of its fiscal year 2022-23 tax collection target, as revealed by the finance ministry in a monthly report for July 2023.

(more…) -

FBR Strengthens Rules for Litigation and Prosecution in Pakistan Customs

Islamabad, July 27, 2023 – The Federal Board of Revenue (FBR) in Pakistan has taken significant steps to enhance the process of litigation and prosecution in Pakistan Customs with the issuance of SRO 960 (I)/2023, notifying a draft amendment to the Customs Rules, 2001.

(more…) -

FBR Unveils IRIS 2.0: A Game-Changer for Efficient Tax Return Filing

Islamabad, July 27, 2023 – The Federal Board of Revenue (FBR) announced a major step forward in tax administration with the launch of IRIS 2.0, an upgraded version of the tax return filing system.

(more…)