Karachi, July 28, 2023 – The Federal Board of Revenue (FBR) fell short of its fiscal year 2022-23 tax collection target, as revealed by the finance ministry in a monthly report for July 2023.

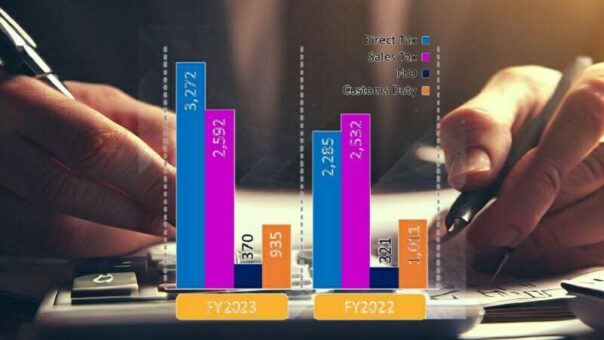

Despite posting a 16.6 percent growth in revenue collection, the FBR could only collect Rs 7.17 trillion as opposed to the assigned target of Rs 7.2 trillion.

READ MORE: FBR Strengthens Rules for Litigation and Prosecution in Pakistan Customs

During the preceding fiscal year, the FBR had collected Rs 6.15 trillion in revenue, making this year’s collection an improvement. However, the actual revenue target set for the FBR was even higher at Rs 7.47 trillion. Due to adverse economic conditions in the country, the target was revised downward to Rs 7.2 trillion. Despite this adjustment, the FBR was unable to meet the revised goal.

The failure to achieve the tax collection target comes as a significant challenge for the outgoing FBR chairman, Asim Ahmad, who is retiring from his position this week. During his last fiscal year as chairman, Ahmad was unable to deliver the desired results of revenue collection set by the government.

To bolster revenue collection during fiscal year 2022-23, the government implemented stringent measures, including introducing a mini-budget in February 2023. The finance supplementary bill 2023 presented during this period proposed several changes:

READ MORE: FBR Unveils IRIS 2.0: A Game-Changer for Efficient Tax Return Filing

1. An increase in the general sales tax rate from 17% to 18% on goods imported or locally sold, excluding those subject to sales tax at retail price (Third Schedule items). The relevant SRO came into effect from February 14, 2023.

2. An increase in the Federal Excise Duty (FED) on cigarettes, also applicable from February 14, 2023.

3. The Finance (Supplementary) Bill, 2023, also included proposals to: (i) Increase the general sales tax rate from 17% to 18% for Third Schedule items. (ii) Increase sales tax on locally produced coal and certain categories of imported mobile phones. (iii) Increase/impose FED on aerated waters from 13% to 20%, cement from Rs 1.5/kg to Rs 2/kg, and sugary drinks at 10%. (iv) Impose adjustable withholding income tax of 10% of the fair market value (FMV) on the sale/purchase of shares of unlisted companies. (v) Reintroduce advance income tax on functions and gatherings.

READ MORE: FBR Elaborates New Withholding Tax Regime for Motor Vehicles

The FBR, on the other hand, is arguing that the collection of Rs 7.17 trillion was achieved despite the slowdown in the economy and the downward revision of the GDP growth rate. Unprecedented compression in imports resulted in a decline in the import of high-duty items such as vehicles, home appliances, and various consumer goods like garments, fabrics, and footwear.

The finance ministry and FBR’s performance will likely undergo scrutiny in the wake of the unmet tax collection target. Economists and analysts will closely monitor the economic conditions and government policies to assess the impact on future revenue collection efforts and overall fiscal stability.

READ MORE: Your Guide to FBR’s Latest Tax Changes: Cash Withdrawal Tax Explained