Karachi, July 3, 2023: The Federal Board of Revenue (FBR) has taken disciplinary action against a principal appraiser of Karachi Customs.

(more…)Tag: Federal Board of Revenue

The Federal Board of Revenue is Pakistan’s apex tax agency, overseeing tax collection and policies. Pakistan Revenue is committed to providing timely updates on the Federal Board of Revenue to its readers.

-

Pakistan Implements Additional Tax on Unexpected Income

Islamabad, June 29, 2023: Starting from July 1, 2023, Pakistan has introduced an additional tax on unexpected income, profit, and gains. The Federal Board of Revenue (FBR) has been granted the authority to collect this tax.

(more…) -

Threshold of Cash Salary Payment Increased to Rs32,000

Karachi, June 28, 2023: The Finance Act, 2023 has introduced a significant amendment to increase the threshold of cash salary payment to Rs32,000.

(more…) -

National Assembly Approves Budget 2023-24 with New Recommendations of Heavy Taxes

Islamabad, June 25, 2023: The National Assembly of Pakistan has given its approval to the budget for 2023-24, incorporating new recommendations for imposing significant taxes.

(more…) -

FBR Given 31% Higher Tax Collection Target for FY24

ISLAMABAD: The Federal Board of Revenue (FBR) has been tasked with a 31 percent higher tax collection target for the fiscal year 2023-24, surpassing the target set for the outgoing fiscal year.

(more…) -

FBR Offices to Observe Normal Working Hours During Eid Holidays

Islamabad, June 24, 2023: The Federal Board of Revenue (FBR) in Pakistan has announced that the field offices of Inland Revenue will maintain normal working hours during the upcoming Eid holidays.

(more…) -

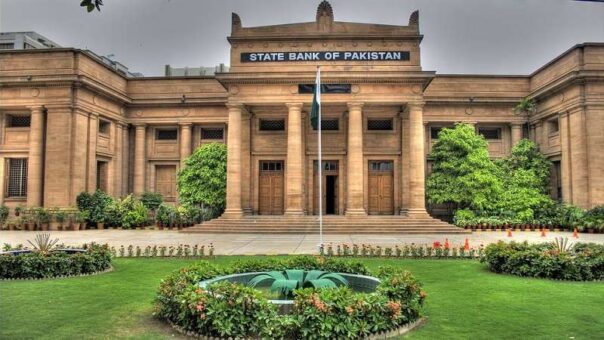

SBP Issues Special Instructions to Banks for Duty and Tax Collection

Karachi, June 24, 2023: The State Bank of Pakistan (SBP) has issued special instructions to banks in order to facilitate taxpayers during the upcoming holidays and ensure the smooth collection of duty and taxes.

(more…) -

FBR Intelligence Uncovers Massive Sales Tax Evasion by Battery Manufacturers

Karachi, June 24, 2023: The intelligence and investigation office of the Federal Board of Revenue (FBR) has uncovered a significant case of sales tax evasion by battery manufacturers.

(more…) -

IR Intelligence Launches Extensive Crackdown Against Fashion Designers for Tax Evasion

Karachi, June 23, 2023 – The Directorate of Intelligence and Investigation (Inland Revenue) – I&I IR, Karachi has intensified its efforts to combat the issuance of fake and flying sales tax invoices by the fashion designers.

(more…)