Islamabad, June 26, 2023 – The National Assembly of Pakistan has passed the budget for the fiscal year 2023-24, introducing new tax rates for salary income.

(more…)Tag: salary tax card

-

FBR notifies statutory tax rates for salaried persons

The Federal Board of Revenue (FBR) has notified the statutory rates of income tax for salaried persons during Tax Year 2023.

In order to implement the rate of tax for salaried persons, the FBR issued Income Tax Ordinance, 2001 updated up to June 30, 2022. The following table is enacted for the taxation of salaried taxpayers for the Tax Year 2023:

READ MORE: FBR slaps additional customs duty at 35% on motor vehicles

Taxable Income Rate of Tax Up to Rs600,000 0% Rs600,001 –1,200,000 2.5% of amount exceeding Rs600,000 Rs1,200,001 –2,400,000 Rs15,000 + 12.5% of amount exceeding Rs1,200,000 Rs2,400,001 –3,600,000 Rs165,000 + 20% of amount exceeding Rs2,400,000 Rs3,600,001 –6,000,000 Rs405,000 + 25% of amount exceeding Rs3,600,000 Rs6,000,001 –12,000,000 Rs1,005,000 + 32.5% of amount exceeding Rs6,000,000 Amount exceeding Rs12,000,000 Rs2,955,000 + 35% of amount exceeding Rs12,000,000 The rate of tax in the table above are applicable where the income of an individual chargeable under the head ‘salary’ exceeds seventy-five per cent of his/her taxable income.

It is pertinent to mention that Finance Minister Dr. Miftah Ismail on floor of the House while presenting the federal budget 2022/2023 announced massive relief for salaried persons.

According to the budget speech of the finance minister, the basic threshold of taxable salary is proposed to be enhanced to Rs1.2 million from the Rs600,000 for salaried individuals.

READ MORE: Tax exemption granted to donations for PM flood relief fund

“This would pass tens of billions of rupees benefit to salaried people. This will generate a positive economic cycle whereby this money would get transferred to the businesses as the disposable income of salaried people increases therefore ultimately, the government will benefit through the thriving of the business, the creation of more jobs, and tax revenues in the future,” according to the budget speech.

However, the government withdrew the proposal and revived the exempt income to Rs600,000 while approving the Finance Act, 2022 from the National Assembly.

READ MORE: Pakistan raises Regulatory Duty to 100 % on motor vehicle import

Haider Ali Patel, former president of Karachi Tax Bar Association (KTBA) in a recent presentation on the Finance Act, 2022 stated that the revised rates in respect of salaried taxpayers had been enacted with the change in maximum rate of tax from 32.5 per cent to 35 per cent.

He stated that the enacted tax rates have taken away the proposed tax relief sought to be provided to the individuals belonging to lower salaried class.

READ MORE: Pakistan amends laws to tax retailers

“On the other hand, the tax incidence has been increased considerably for the individuals belonging to higher salary brackets,” he added.

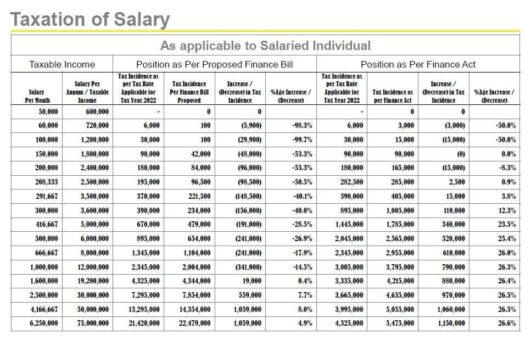

Patel presented the following table provides the increase / decrease in the tax incidence of salaries taxpayers from tax liability of the tax year 2022 to tax year 2023 and also the tax liability calculated as per the proposed Finance Bill, 2023:

-

Pakistan reduces salary tax slabs to 7 in budget 2022/23

ISLAMABAD: Pakistan has reduced the number of tax slabs for salaried persons through Finance Bill 2022 in the budget 2022/2023.

According to the Finance Bill, 2022 the government announced the reduction of salary tax slabs as well as incentive in tax payment for persons falling in the income range of Rs600,000 to Rs1.2 million.

READ MORE: Massive cut in subsidies to curtail current expenditures

Pakistan on June 10, 2022 presented its federal budget for the fiscal year 2022/2023. The budget carried several relief and taxation measures.

Finance Minister Miftah Ismail during his budget speech announced that the basic exemption for salaried persons has been increased to Rs1.2 million from Rs600,000.

READ MORE: Petroleum levy to generate Rs750 billion

As per income tax laws, the exempt income is not required to file income tax return and declaration of assets.

However, the Finance Bill, 2022 has clearly mentioned that the basic exemption from income tax for salaried persons is remained Rs600,000. However, persons falling in the income range of Rs600,000 and Rs1.2 million are required to pay a token amount of Rs100 as income tax on annual basis.

READ MORE: FBR assigned tax collection target of Rs7 trillion in 2022/2023

Therefore, it will be mandatory for persons falling under this income range to file income tax returns and declaration of assets. Besides, they will also be selected for audit.

Apart from this important amendment, the Finance Bill, 2022 also proposed to reduce the salary income slabs for the purpose of tax collection.

READ MORE: Budget 2022/2023: Salient features of customs duty act

Following are proposed and existing income slabs and tax rates:

Salary income slabs and tax rates proposed through Finance Bill, 2022:

S# Taxable Income Rate of Tax (1) (2) (3) 1. Where taxable income does not exceed Rs. 600,000 0 2. Where taxable income exceeds Rs. 600,000 but does not exceed Rs. 1,200,000 Rs. 100 3. Where taxable income exceeds Rs. 1,200,000 but does not exceed Rs. 2,400,000 7% of the amount exceeding Rs. 1,200,000 4. Where taxable income exceeds Rs. 2,400,000 but does not exceed Rs. 3,600,000 Rs. 84,000 + 12.5% of the amount exceeding Rs. 2,400,000 5. Where taxable income exceeds Rs. 3,600,000 but does not exceed Rs. 6,000,000 Rs. 234,000 + 17.5% of the amount exceeding Rs. 3,600,000 6. Where taxable income exceeds Rs. 6,000,000 but does not exceed Rs. 12,000,000 Rs. 654,000 + 22.5% of the amount exceeding Rs. 6,000,000 7. Where taxable income exceeds Rs. 12,000,000 Rs. 2,004,000 + 32.5% of the amount exceeding Rs. 12,000,000.” Following are the rates of tax for salaried persons during tax year 2022 (July 01, 2021 – June 30, 2022):

(2) Where the income of an individual chargeable under the head “salary” exceeds seventy-five per cent of his taxable income, the rates of tax to be applied shall be as set out in the following table, namely:—

1. Where taxable income does not exceed: Rs. 600,000 0%

2. Where taxable income exceeds Rs. 600,000 but does not exceed Rs. 1,200,000: 5% of the amount exceeding Rs. 600,000

3. Where taxable income exceeds Rs. 1,200,000 but does not exceed Rs. 1,800,000: Rs. 30,000 plus 10% of the amount exceeding Rs. 1,200,000

4. Where taxable income exceeds Rs. 1,800,000 but does not exceed Rs. 2,500,000: Rs. 90,000 plus 15% of the amount exceeding Rs. 1,800,000

5. Where taxable income exceeds Rs.2,500,000 but does not exceed Rs. 3,500,000: Rs. 195,000 plus 17.5% of the amount exceeding Rs. 2,500,000

6. Where taxable income exceeds Rs. 3,500,000 but does not exceed Rs. 5,000,000: Rs. 370,000 plus 20% of the amount exceeding Rs. 3,500,000

7. Where taxable income exceeds Rs. 5,000,000 but does not exceeds Rs. 8,000,000: Rs. 670,000 plus 22.5% of the amount exceeding Rs. 5,000,000

8. Where taxable income exceeds Rs. 8,000,000 but does not exceeds Rs. 12,000,000: Rs. 1,345,000 plus 25% of the amount exceeding Rs. 8,000,000

9. Where taxable income exceeds Rs. 12,000,000 but does not exceeds Rs. 30,000,000: Rs. 2,345,000 plus 27.5% of the amount exceeding Rs. 12,000,000

10. Where taxable income exceeds Rs. 30,000,000 but does not exceeds Rs. 50,000,000: Rs. 7,295,000 plus 30% of the amount exceeding Rs. 30,000,000

11. Where taxable income exceeds Rs. 50,000,000 but does not exceeds Rs. 75,000,000: Rs. 13,295,000 plus 32.5% of the amount exceeding Rs. 50,000,000

12. Where taxable income exceeds Rs. 75,000,000 Rs. 21,420,000 plus 35% of the amount exceeding Rs. 75,000,000]

-

Tax slabs for salaried person for tax year 2020/2021

KARACHI: Following are the tax slabs for salaried persons to be applicable during tax year 2021 (2020/2021).

1. Where taxable income does not exceed Rs. 600,000: the tax rate shall be zero percent

2. Where taxable income exceeds Rs. 600,000 but does not exceed Rs. 1,200,000: the tax rate shall be 5 percent of the amount exceeding Rs. 600,000

3. Where taxable income exceeds Rs. 1,200,000 but does not exceed Rs. 1,800,000: the tax rate shall be Rs. 30,000 plus 10 percent of the amount exceeding Rs. 1,200,000

4. Where taxable income exceeds Rs. 1,800,000 but does not exceed Rs. 2,500,000: the tax rate shall be Rs. 90,000 plus 15 percent of the amount exceeding Rs. 1,800,000

5. Where taxable income exceeds Rs.2,500,000 but does not exceed Rs. 3,500,000: the tax rate shall be Rs. 195,000 plus 17.5 percent of the amount exceeding Rs. 2,500,000

6. Where taxable income exceeds Rs. 3,500,000 but does not exceed Rs. 5,000,000: the tax rate shall be Rs. 370,000 plus 20 percent of the amount exceeding Rs. 3,500,000

7. Where taxable income exceeds Rs. 5,000,000 but does not exceeds Rs. 8,000,000: the tax rate shall be Rs. 670,000 plus 22.5 percent of the amount exceeding Rs. 5,000,000

8. Where taxable income exceeds Rs. 8,000,000 but does not exceeds Rs. 12,000,000: the tax rate shall be Rs. 1,345,000 plus 25 percent of the amount exceeding Rs. 8,000,000

9. Where taxable income exceeds Rs. 12,000,000 but does not exceeds Rs. 30,000,000: the tax rate shall be Rs. 2,345,000 plus 27.5 percent of the amount exceeding Rs. 12,000,000

10. Where taxable income exceeds Rs. 30,000,000 but does not exceeds Rs. 50,000,000: the tax rate shall be Rs. 7,295,000 plus 30 percent of the amount exceeding Rs. 30,000,000

11. Where taxable income exceeds Rs. 50,000,000 but does not exceeds Rs. 75,000,000: the tax rate shall be Rs. 13,295,000 plus 32.5 percent of the amount exceeding Rs. 50,000,000

12. Where taxable income exceeds Rs. 75,000,000: the tax rate shall be Rs. 21,420,000 plus 35 percent of the amount exceeding Rs. 75,000,000

-

FBR issues salary tax card for Tax Year 2020

KARACHI: Federal Board of Revenue (FBR) has issued salary tax card for tax year 2020 after incorporating changes brought through Finance Act, 2019 to Income Tax Ordinance, 2001.

The FBR issued Income Tax Ordinance, 2001 updated till June 30, 2019 under which tax rates for salary persons would be applicable from July 01, 2019 to June 30, 2020

The FBR said that there the income of an individual chargeable under the head “salary” exceeds seventy-five per cent of his taxable income, the rates of tax to be applied shall be as set out in the following table, namely:

S. No. Taxable income Rate of tax (1) (2) (3) 1. Where taxable income does not exceed Rs. 600,000 0% 2. Where taxable income exceeds Rs. 600,000 but does not exceed Rs. 1,200,000 5% of the amount exceeding Rs. 600,000 3. Where taxable income exceeds Rs. 1,200,000 but does not exceed Rs. 1,800,000 Rs. 30,000 plus 10% of the amount exceeding Rs. 1,200,000 4. Where taxable income exceeds Rs. 1,800,000 but does not exceed Rs. 2,500,000 Rs. 90,000 plus 15% of the amount exceeding Rs. 1,800,000 5. Where taxable income exceeds Rs.2,500,000 but does not exceed Rs. 3,500,000 Rs. 195,000 plus 17.5% of the amount exceeding Rs. 2,500,000 6. Where taxable income exceeds Rs. 3,500,000 but does not exceed Rs. 5,000,000 Rs. 370,000 plus 20% of the amount exceeding Rs. 3,500,000 7. Where taxable income exceeds Rs. 5,000,000 but does not exceeds Rs. 8,000,000 Rs. 670,000 plus 22.5% of the amount exceeding Rs. 5,000,000 8. Where taxable income exceeds Rs. 8,000,000 but does not exceeds Rs. 12,000,000 Rs. 1,345,000 plus 25% of the amount exceeding Rs. 8,000,000 9. Where taxable income exceeds Rs. 12,000,000 but does not exceeds Rs. 30,000,000 Rs. 2,345,000 plus 27.5% of the amount exceeding Rs. 12,000,000 10. Where taxable income exceeds Rs. 30,000,000 but does not exceeds Rs. 50,000,000 Rs. 7,295,000 plus 30% of the amount exceeding Rs. 30,000,000 11. Where taxable income exceeds Rs. 50,000,000 but does not exceeds Rs. 75,000,000 Rs. 13,295,000 plus 32.5% of the amount exceeding Rs. 50,000,000 12. Where taxable income exceeds Rs. 75,000,000 Rs. 21,420,000 plus 35% of the amount exceeding Rs. 75,000,000] -

Finance Act 2019: Tax slabs for salary income

ISLAMABAD: The Parliament has approved the Finance Bill 2019 to implement rate of income tax on salary income.

The statutory exempt income has been enhanced to Rs600,000 for tax year 2020 through Finance Act, 2019.

S.No Taxable Income Rate of Tax (1) (2) (3) 1. Where taxable income does not exceed Rs. 600,000 0% 2. Where taxable income exceeds Rs. 600,000 but does not exceed Rs. 1,200,000 5% of the amount exceeding Rs. 600,000 3. Where taxable income exceeds Rs. 1,200,000 but does not exceed Rs. 1,800,000 Rs. 30,000 plus 10% of the amount exceeding Rs. 1,200,000 4. Where taxable income exceeds Rs. 1,800,000 but does not exceed Rs. 2,500,000 Rs. 90,000 plus 15% of the amount exceeding Rs. 1,800,000 5. Where taxable income exceeds Rs. 2,500,000 but does not exceed Rs. 3,500,000 Rs. 195,000 plus 17.5% of the amount exceeding Rs. 2,500,000 6. Where taxable income exceeds Rs. 3,500,000 but does not exceed Rs. 5,000,000 Rs. 370,000 plus 20% of the amount exceeding Rs. 3,500,000 7. Where taxable income exceeds Rs. 5,000,000 but does not exceed Rs. 8,000,000 Rs. 670,000 plus 22.5% of the amount exceeding Rs. 5,000,000 8. Where taxable income exceeds Rs. 8,000,000 but does not exceed Rs. 12,000,000 Rs. 1,345,000 plus 25% of the amount exceeding Rs. 8,000,000 9. Where taxable income exceeds Rs. 12,000,000 but does not exceed Rs.30,000,000 Rs. 2,345,000 plus 27.5% of the amount exceeding Rs. 12,000,000 10. Where taxable income exceeds Rs. 30,000,000 but does not exceed Rs.50,000,000 Rs. 7,295,000 plus 30% of the amount exceeding Rs. 30,000,000 11. Where taxable income exceeds Rs. 50,000,000 but does not exceed Rs.75,000,000 Rs. 13,295,000 plus 32.5% of the amount exceeding Rs. 50,000,000 12. Where taxable income exceeds Rs.75,000,000 Rs. 21,420,000 plus 35% of the amount exceeding Rs. 75,000,000″; The tax slabs should be applicable on a person’s where the income of an individual chargeable under the head “salary” exceeds seventy-five per cent of his taxable income.